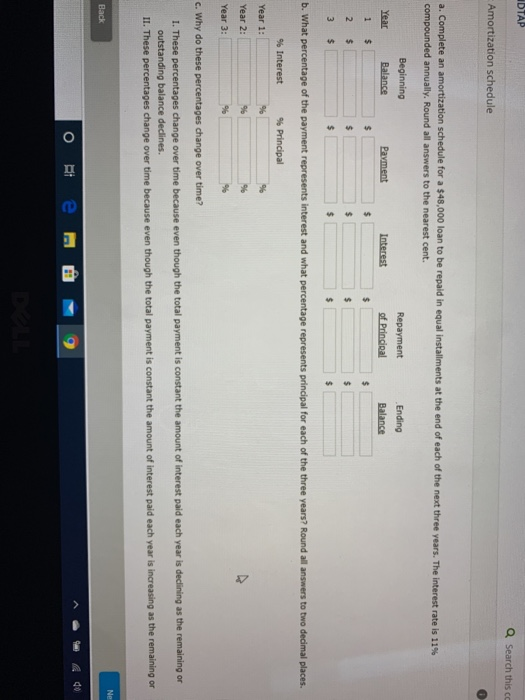

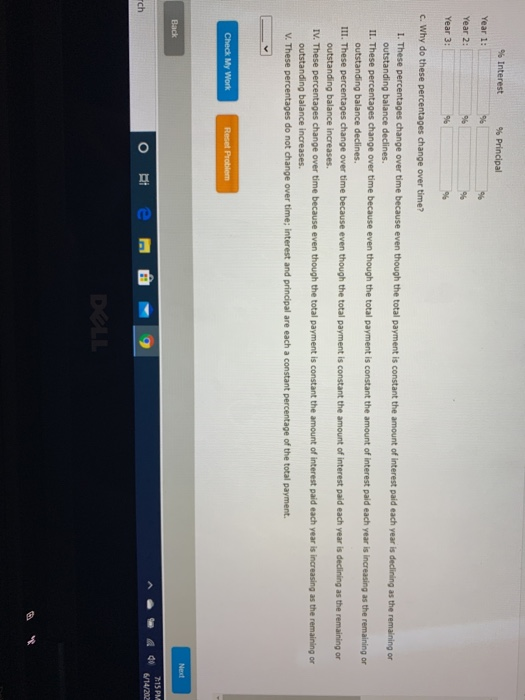

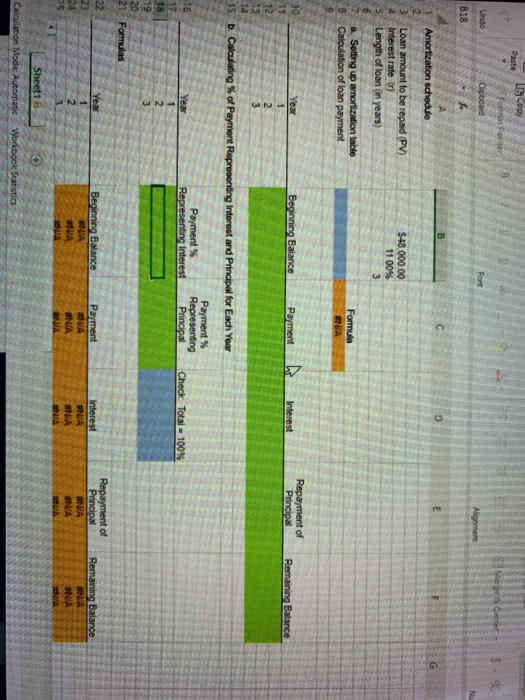

IDTAP Q Search this ca Amortization schedule a. Complete an amortization schedule for a $48,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 11% compounded annually. Round all answers to the nearest cent. Beginning Balance Repayment of Principal Year Ending Balance Payment Interest 1 $ $ $ $ $ 2 $ $ $ $ $ 3 $ $ $ $ $ b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places. % Principal % Interest Year 1: % % Year 2: 96 9 Year 3: % % c. Why do these percentages change over time? 1. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance declines. II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or Ne Back O RA e E Interest % Principal Year 1: 96 Year 2: 96 % Year 3: %6 96 c. Why do these percentages change over time? 1. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance declines. II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance declines. III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance increases. IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance increases. V. These percentages do not change over time; interest and principal are each a constant percentage of the total payment. Check My Work Reset Problem Next Back 7:15 PM 6/14/202 e Tch E Lo Copy Paste FD vege & Content Cipboard Font Undo B18 Alignment N D E G Amortization schedule Loan amount to be repaid (PV) Interest rate Length of loan in years) $48000.00 11 00% 3 a. Setting up amortization table Calculation of loan payment Formula ANA Year Payment Interest Repayment of Principal Remaining Balance 10 Beginning Balance 11 1 2 13 3 14 15. b. Calculating % of Payment Representing Interest and Principal for Each Year Payment % Payment % Representing 16 Representing Interest Principal 17 18 2 3 20 21 Formulas Yes Check Total 100% 1 19 22 23 24 Year 1 2 3 Beginning Balance ANA #N/A Payment #NA #N/A Interest #N/A #NA INA Repayment of Principal ANA ANA Remaining Balance #N/A #NA ENIA Sheet1 + Calculation Mode: Automatic Workbook Statistics