Answered step by step

Verified Expert Solution

Question

1 Approved Answer

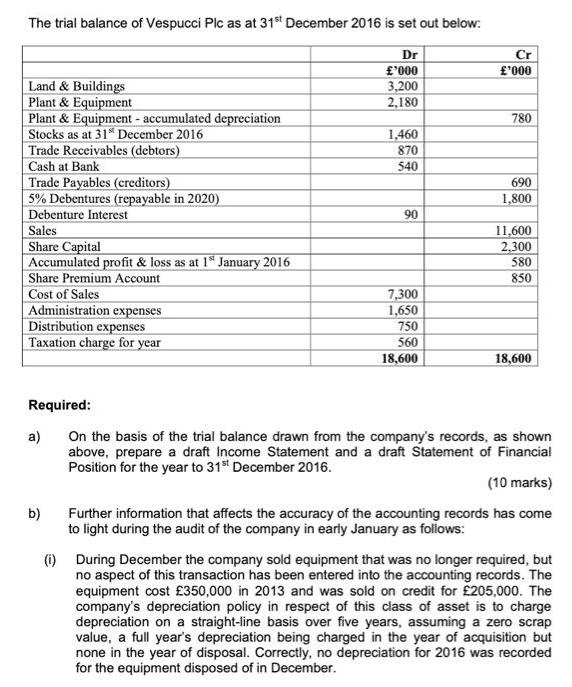

The trial balance of Vespucci Plc as at 31 December 2016 is set out below: Dr Cr '000 '000 3,200 2,180 Land & Buildings

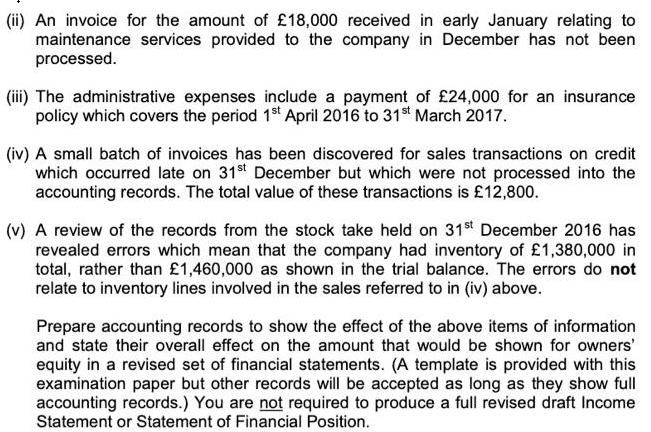

The trial balance of Vespucci Plc as at 31 December 2016 is set out below: Dr Cr '000 '000 3,200 2,180 Land & Buildings Plant& Equipment Plant & Equipment - accumulated depreciation Stocks as at 31* December 2016 Trade Receivables (debtors) Cash at Bank Trade Payables (creditors) 5% Debentures (repayable in 2020) Debenture Interest Sales Share Capital Accumulated profit & loss as at 1 January 2016 Share Premium Account Cost of Sales Administration expenses Distribution expenses Taxation charge for year 780 1,460 870 540 690 1,800 90 11,600 2,300 580 850 7,300 1,650 750 560 18,600 18,600 Required: a) On the basis of the trial balance drawn from the company's records, as shown above, prepare a draft Income Statement and a draft Statement of Financial Position for the year to 31* December 2016. (10 marks) b) Further information that affects the accuracy of the accounting records has come to light during the audit of the company in early January as folows: (1) During December the company sold equipment that was no longer required, but no aspect of this transaction has been entered into the accounting records. The equipment cost 350,000 in 2013 and was sold on credit for 205,000. The company's depreciation policy in respect of this class of asset is to charge depreciation on a straight-line basis over five years, assuming a zero scrap value, a full year's depreciation being charged in the year of acquisition but none in the year of disposal. Correctly, no depreciation for 2016 was recorded for the equipment disposed of in December. (ii) An invoice for the amount of 18,000 received in early January relating to maintenance services provided to the company in December has not been processed. (ii) The administrative expenses include a payment of 24,000 for an insurance policy which covers the period 1 t April 2016 to 31 March 2017. (iv) A small batch of invoices has been discovered for sales transactions on credit which occurred late on 31st December but which were not processed into the accounting records. The total value of these transactions is 12,800. (v) A review of the records from the stock take held on 31st December 2016 has revealed errors which mean that the company had inventory of 1,380,000 in total, rather than 1,460,000 as shown in the trial balance. The errors do not relate to inventory lines involved in the sales referred to in (iv) above. Prepare accounting records to show the effect of the above items of information and state their overall effect on the amount that would be shown for owners' equity in a revised set of financial statements. (A template is provided with this examination paper but other records will be accepted as long as they show full accounting records.) You are not required to produce a full revised draft Income Statement or Statement of Financial Position.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Vespucci Plc Income Statement for the year ended 31122016 Particulars Sales Revenue Less Cost of S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started