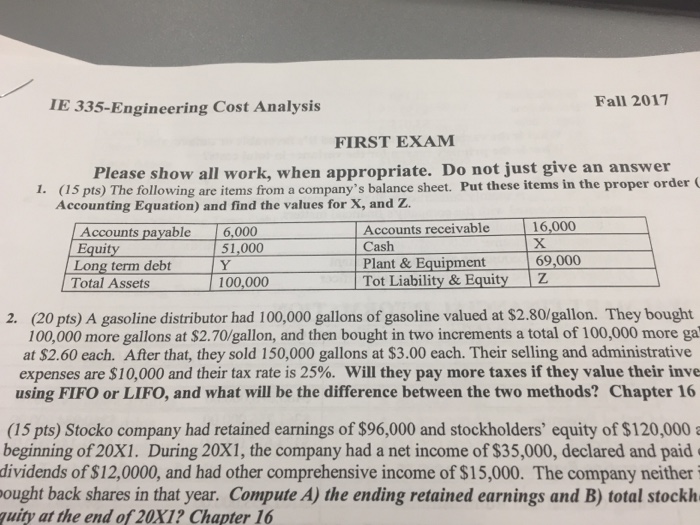

IE 335-Engineering Cost Analysis Fall 2017 FIRST EXAM Please show all work, when appropriate. Do not just give an answer 1. (15 pts) The following are items from a company's balance sheet. Put these items in the proper order Accounting Equation) and find the values for X, and Z 6,000 16,000 Accounts payable Equity Long term debt Total Assets Accounts receivable Cash Plant & Equipment Tot Liability & Equity Z 51,000 69,000 100,000 2. (20 pts) A gasoline distributor had 100,000 gallons of gasoline valued at $2.80/gallon. They bought 100,000 more gallons at $2.70/gallon, and then bought in two increments a total of 100,000 more ga at $2.60 each. After that, they sold 150,000 gallons at $3.00 each. Their selling and administrative expenses are $10,000 and their tax rate is 25%, will they pay more taxes if they value their inve using FIFO or LIFO, and what will be the difference between the two methods? Chapter 16 (15 pts) Stocko company had retained earnings of $96,000 and stockholders' equity of S120,000 beginning of 20X1. During 20X1, the company had a net income of $35,000, declared and paid dividends of $12,0000, and had other comprehensive income of $15,000. The company neither ought back shares in that year. Compute A) the ending retained earnings and B) total stockh uity at the end of 20X1? Chapter 16 IE 335-Engineering Cost Analysis Fall 2017 FIRST EXAM Please show all work, when appropriate. Do not just give an answer 1. (15 pts) The following are items from a company's balance sheet. Put these items in the proper order Accounting Equation) and find the values for X, and Z 6,000 16,000 Accounts payable Equity Long term debt Total Assets Accounts receivable Cash Plant & Equipment Tot Liability & Equity Z 51,000 69,000 100,000 2. (20 pts) A gasoline distributor had 100,000 gallons of gasoline valued at $2.80/gallon. They bought 100,000 more gallons at $2.70/gallon, and then bought in two increments a total of 100,000 more ga at $2.60 each. After that, they sold 150,000 gallons at $3.00 each. Their selling and administrative expenses are $10,000 and their tax rate is 25%, will they pay more taxes if they value their inve using FIFO or LIFO, and what will be the difference between the two methods? Chapter 16 (15 pts) Stocko company had retained earnings of $96,000 and stockholders' equity of S120,000 beginning of 20X1. During 20X1, the company had a net income of $35,000, declared and paid dividends of $12,0000, and had other comprehensive income of $15,000. The company neither ought back shares in that year. Compute A) the ending retained earnings and B) total stockh uity at the end of 20X1? Chapter 16