Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If 10 year US Treasury Bonds are currently priced in the market at a 3.50% Yield to Maturity, would the company's equivalent maturity debt be

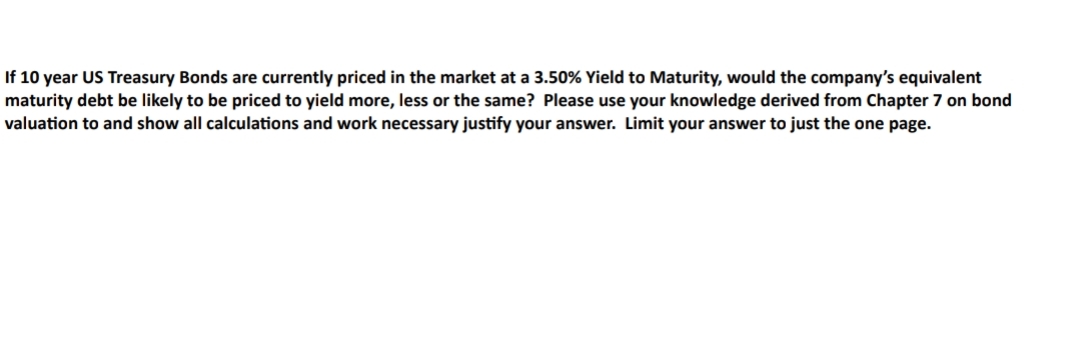

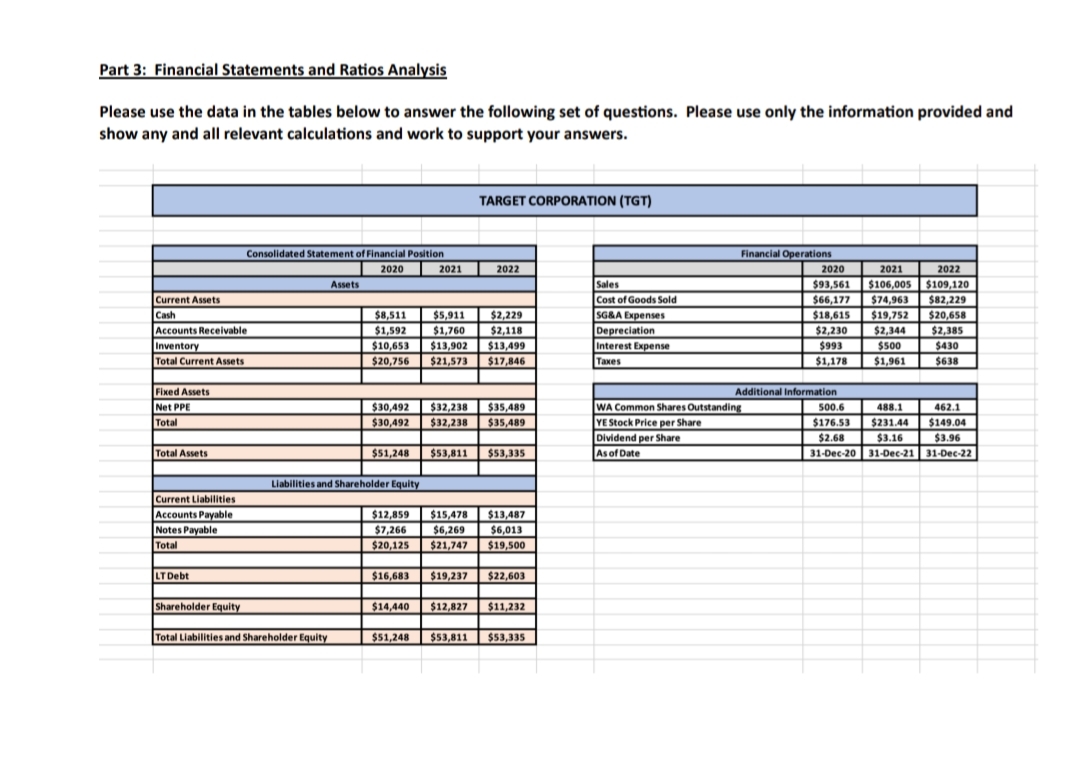

If 10 year US Treasury Bonds are currently priced in the market at a 3.50% Yield to Maturity, would the company's equivalent maturity debt be likely to be priced to yield more, less or the same? Please use your knowledge derived from Chapter 7 on bond valuation to and show all calculations and work necessary justify your answer. Limit your answer to just the one page. Part 3: Financial Statements and Ratios Analysis Please use the data in the tables below to answer the following set of questions. Please use only the information provided and show any and all relevant calculations and work to support your answers

If 10 year US Treasury Bonds are currently priced in the market at a 3.50% Yield to Maturity, would the company's equivalent maturity debt be likely to be priced to yield more, less or the same? Please use your knowledge derived from Chapter 7 on bond valuation to and show all calculations and work necessary justify your answer. Limit your answer to just the one page. Part 3: Financial Statements and Ratios Analysis Please use the data in the tables below to answer the following set of questions. Please use only the information provided and show any and all relevant calculations and work to support your answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started