Question

If a company's beta is greater than one and it calculates its cost of equity based on the classical CAPM instead of the tax-adjusted CAPM,

If a company's beta is greater than one and it calculates its cost of equity based on the classical CAPM instead of the tax-adjusted CAPM, is it more likely to reject acceptable projects or accept projects that should be rejected? Why?

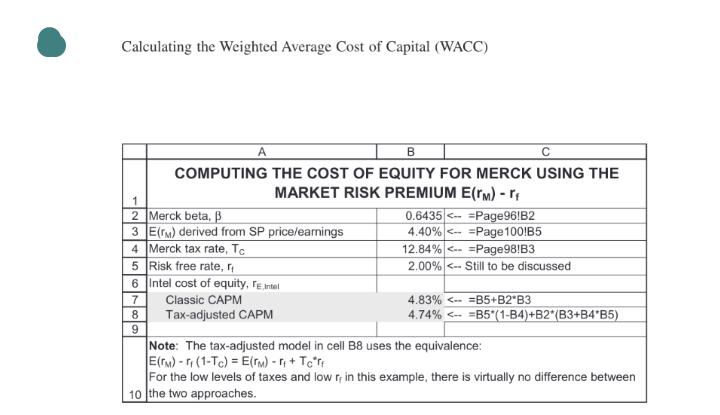

Calculating the Weighted Average Cost of Capital (WACC) B COMPUTING THE COST OF EQUITY FOR MERCK USING THE MARKET RISK PREMIUM E(rm) - rt Page96!B2 Page 100!B5 12.84% < Page98!B3 2.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F Brigham, Phillip R Daves

14th Edition

0357516664, 978-0357516669

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App