Question

If a customer wishes to buy a 91-day call option, the market-maker ?lls this order by selling a call option. To be speci?c, suppose that

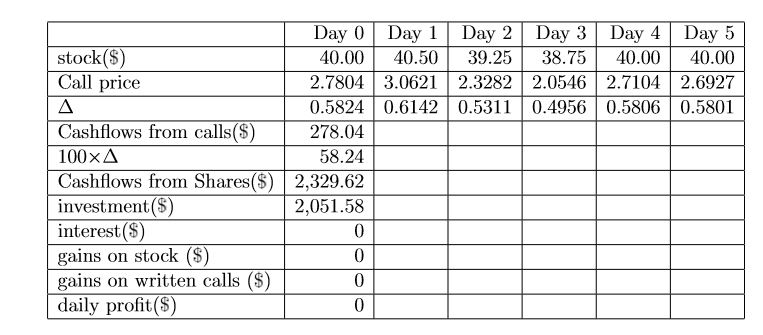

If a customer wishes to buy a 91-day call option, the market-maker ?lls this order by selling a call option. To be speci?c, suppose that S = $40, K = $40, ? = 0.30, r = 0.08 (continuously compounded), and dividend yield = 0. We will let T denote the expiration time of the option and t the present, so time to expiration is T ?t. Let T ?t = 91/365.

Daily pro?t calculation over 5 days for a market-maker who deltahedges a written option on 100 shares. To hedge this position, the market-maker can buy delta shares to delta-hedge the position. We now will consider the risk of a delta-hedged position by assuming that the market-maker delta-hedges and marks-to-market daily. Fill the blanks for Day 1 to Day 5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started