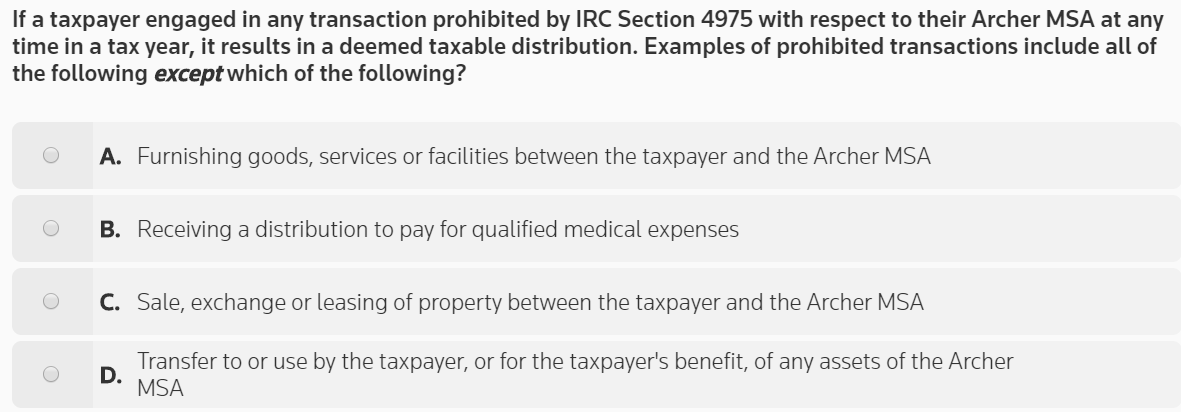

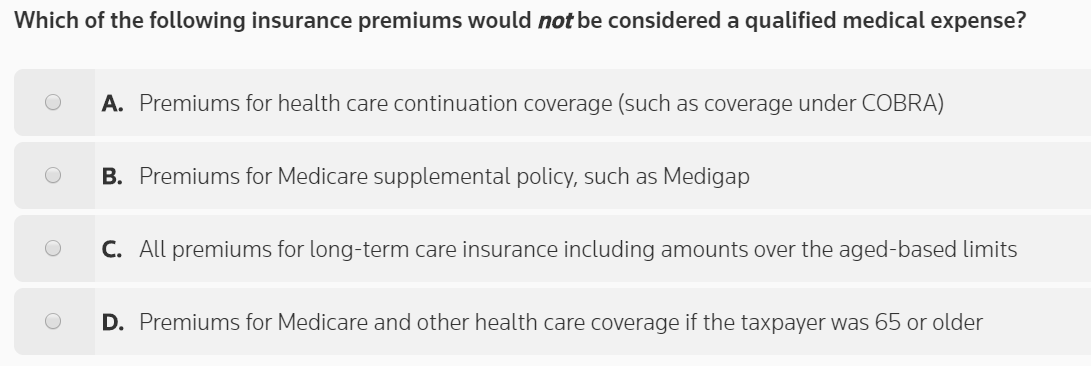

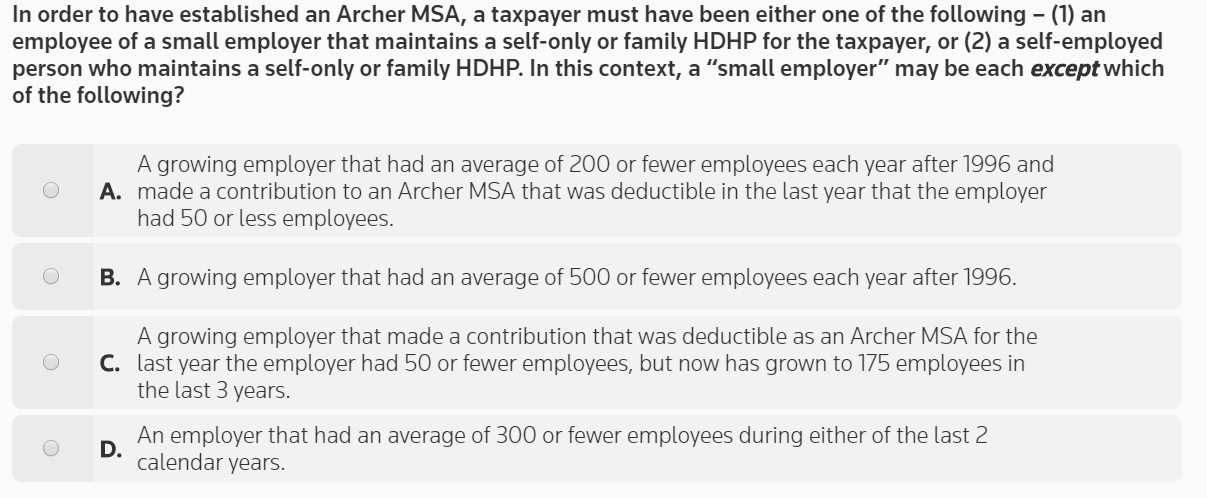

If a taxpayer engaged in any transaction prohibited by IRC Section 4975 with respect to their Archer MSA at any time in a tax year, it results in a deemed taxable distribution. Examples of prohibited transactions include all of the following except which of the following? A. Furnishing goods, services or facilities between the taxpayer and the Archer MSA o B. Receiving a distribution to pay for qualified medical expenses O C. Sale, exchange or leasing of property between the taxpayer and the Archer MSA Transfer to or use by the taxpayer, or for the taxpayer's benefit, of any assets of the Archer MSA Which of the following insurance premiums would not be considered a qualified medical expense? O A. Premiums for health care continuation coverage (such as coverage under COBRA) O B. Premiums for Medicare supplemental policy, such as Medigap O C. All premiums for long-term care insurance including amounts over the aged-based limits D. Premiums for Medicare and other health care coverage if the taxpayer was 65 or older In order to have established an Archer MSA, a taxpayer must have been either one of the following - (1) an employee of a small employer that maintains a self-only or family HDHP for the taxpayer, or (2) a self-employed person who maintains a self-only or family HDHP. In this context, a "small employer" may be each except which of the following? O A growing employer that had an average of 200 or fewer employees each year after 1996 and A. made a contribution to an Archer MSA that was deductible in the last year that the employer had 50 or less employees. o B. A growing employer that had an average of 500 or fewer employees each year after 1996. A A growing employer that made a contribution that was deductible as an Archer MSA for the C. last year the employer had 50 or fewer employees, but now has grown to 175 employees in the last 3 years. O An employer that had an average of 300 or fewer employees during either of the last 2 D. calendar years. Under the last-month rule, a taxpayer is an eligible individual for the entire year, if they are an eligible individual on the first day of the last month of the taxpayer's tax year. If the taxpayer is a calendar year taxpayer, the taxpayer is considered an eligible individual for the entire year if they were eligible on what date? o A. December 1 o B. December 31 o C. January 1 O D. July 1 All the following are correct for HRAs except which of the following? A. A self-employed person is eligible for an HRA. An HRA may be offered by an employer to an employee with other health plans including FSAs. O C. Reimbursements may be tax free if the taxpayer pays qualified medical expenses. O D. Unused amounts in an HRA can be carried forward for reimbursements in later years. Which of the following statements is incorrect for health FSAs? O A. A taxpayer can withdraw funds from the FSA account to pay for amounts covered under A. another health plan. o B. A taxpayer can withdraw funds from the FSA account to pay qualified medical expenses. O C. A taxpayer does not need to be in any other health care plan to participate in an FSA. O Once a taxpayer stops working for their employer or if they retire or lose FSA eligibility, the D. FSA is no longer available. A taxpayer has excess contributions if the contributions to an Archer MSA for the year are greater than the appropriate limits. All of the following are correct with regard to excess contributions except for which of the following? o A. An excise tax applies to each year the excess contribution stays in the account. O B . Excess contributions are deductible. O C. Excess contributions are subject to a 6% excise tax. o Excess contributions made by the taxpayer's employer are included in the taxpayer's gross D. income. If a taxpayer engaged in any transaction prohibited by IRC Section 4975 with respect to their Archer MSA at any time in a tax year, it results in a deemed taxable distribution. Examples of prohibited transactions include all of the following except which of the following? A. Furnishing goods, services or facilities between the taxpayer and the Archer MSA o B. Receiving a distribution to pay for qualified medical expenses O C. Sale, exchange or leasing of property between the taxpayer and the Archer MSA Transfer to or use by the taxpayer, or for the taxpayer's benefit, of any assets of the Archer MSA Which of the following insurance premiums would not be considered a qualified medical expense? O A. Premiums for health care continuation coverage (such as coverage under COBRA) O B. Premiums for Medicare supplemental policy, such as Medigap O C. All premiums for long-term care insurance including amounts over the aged-based limits D. Premiums for Medicare and other health care coverage if the taxpayer was 65 or older In order to have established an Archer MSA, a taxpayer must have been either one of the following - (1) an employee of a small employer that maintains a self-only or family HDHP for the taxpayer, or (2) a self-employed person who maintains a self-only or family HDHP. In this context, a "small employer" may be each except which of the following? O A growing employer that had an average of 200 or fewer employees each year after 1996 and A. made a contribution to an Archer MSA that was deductible in the last year that the employer had 50 or less employees. o B. A growing employer that had an average of 500 or fewer employees each year after 1996. A A growing employer that made a contribution that was deductible as an Archer MSA for the C. last year the employer had 50 or fewer employees, but now has grown to 175 employees in the last 3 years. O An employer that had an average of 300 or fewer employees during either of the last 2 D. calendar years. Under the last-month rule, a taxpayer is an eligible individual for the entire year, if they are an eligible individual on the first day of the last month of the taxpayer's tax year. If the taxpayer is a calendar year taxpayer, the taxpayer is considered an eligible individual for the entire year if they were eligible on what date? o A. December 1 o B. December 31 o C. January 1 O D. July 1 All the following are correct for HRAs except which of the following? A. A self-employed person is eligible for an HRA. An HRA may be offered by an employer to an employee with other health plans including FSAs. O C. Reimbursements may be tax free if the taxpayer pays qualified medical expenses. O D. Unused amounts in an HRA can be carried forward for reimbursements in later years. Which of the following statements is incorrect for health FSAs? O A. A taxpayer can withdraw funds from the FSA account to pay for amounts covered under A. another health plan. o B. A taxpayer can withdraw funds from the FSA account to pay qualified medical expenses. O C. A taxpayer does not need to be in any other health care plan to participate in an FSA. O Once a taxpayer stops working for their employer or if they retire or lose FSA eligibility, the D. FSA is no longer available. A taxpayer has excess contributions if the contributions to an Archer MSA for the year are greater than the appropriate limits. All of the following are correct with regard to excess contributions except for which of the following? o A. An excise tax applies to each year the excess contribution stays in the account. O B . Excess contributions are deductible. O C. Excess contributions are subject to a 6% excise tax. o Excess contributions made by the taxpayer's employer are included in the taxpayer's gross D. income