Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If all could be done that would be nice but if not thatll be okay :) thanks! Information given in word problem format: The Peg

If all could be done that would be nice but if not thatll be okay :) thanks!

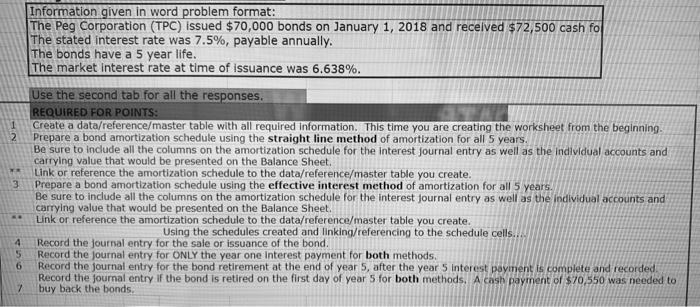

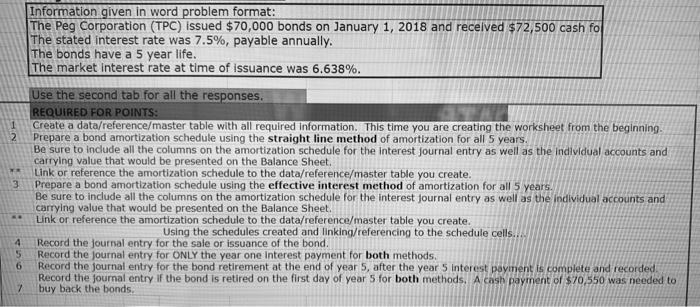

Information given in word problem format: The Peg Corporation (TPC) issued $70,000 bonds on January 1, 2018 and received $72,500 cash fo The stated interest rate was 7.5%, payable annually. The bonds have a 5 year life. The market interest rate at time of issuance was 6.638%. Use the second tab for all the responses. REQUIRED FOR POINTS: Create a data/reference/master table with all required information. This time you are creating the worksheet from the beginning. 2 Prepare a bond amortization schedule using the straight line method of amortization for all 5 years. Be sure to include all the columns on the amortization schedule for the interest journal entry as well as the individual accounts and carrying value that would be presented on the Balance Sheet. Link or reference the amortization schedule to the data/reference/master table you create. Prepare a bond amortization schedule using the effective interest method of amortization for all 5 years. Be sure to include all the columns on the amortization schedule for the interest Journal entry as well as the individual accounts and carrying value that would be presented on the Balance Sheet Link or reference the amortization schedule to the data/reference/master table you create. Using the schedules created and linking/referencing to the schedule cells. 4 Record the journal entry for the sale or issuance of the bond. 5 Record the Journal entry for ONLY the year one Interest payment for both methods Record the journal entry for the bond retirement at the end of year 5, after the year 5 interest payment is complete and recorded. Record the journal entry of the bond is retired on the first day of years for both methods. A cash payment of $70,550 was needed to buy back the bonds, 3 6 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started