Question: If an analyst uses the constant dividend growth model to value a stock, which of the following is certain to cause the analyst to increase

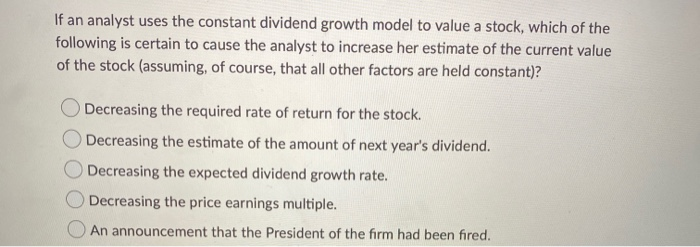

If an analyst uses the constant dividend growth model to value a stock, which of the following is certain to cause the analyst to increase her estimate of the current value of the stock (assuming, of course, that all other factors are held constant)? Decreasing the required rate of return for the stock. Decreasing the estimate of the amount of next year's dividend. Decreasing the expected dividend growth rate. Decreasing the price earnings multiple. An announcement that the President of the firm had been fired

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock