Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if answered I will make sure to leave a like :) Lydex Company Comparative Income Statement and Reconciliation begin{tabular}{lrr} Sales (all on account) & This

if answered I will make sure to leave a like :)

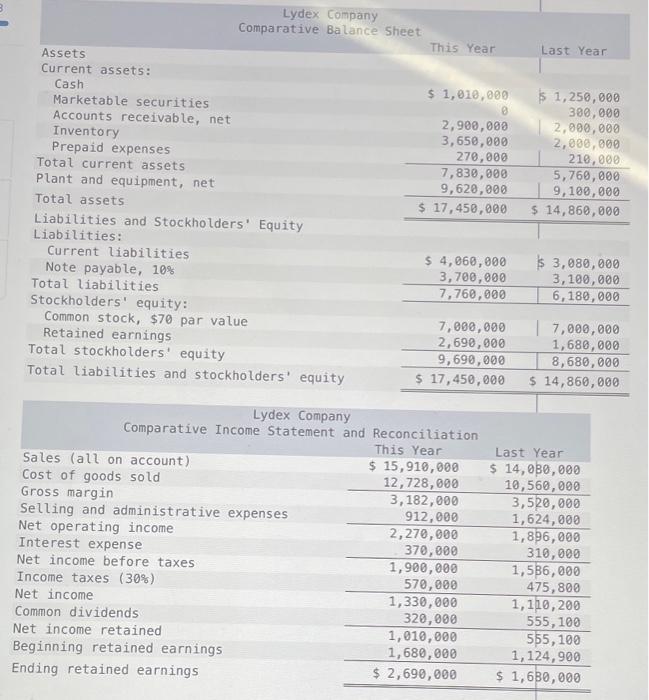

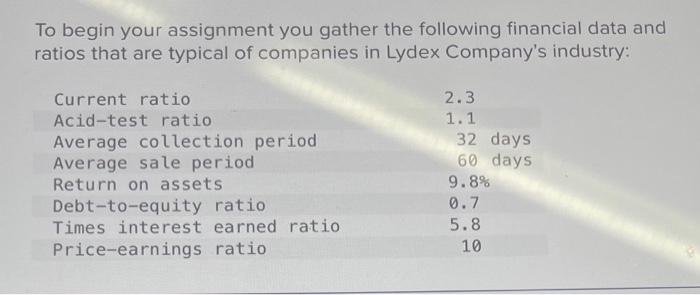

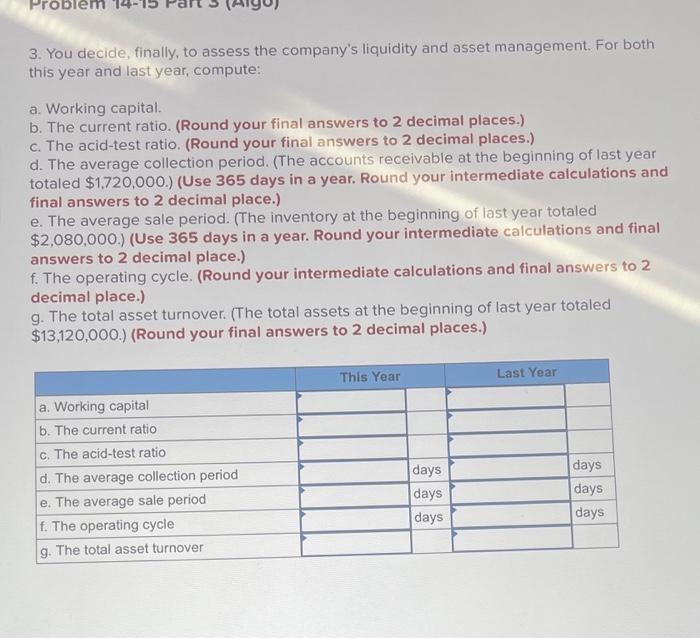

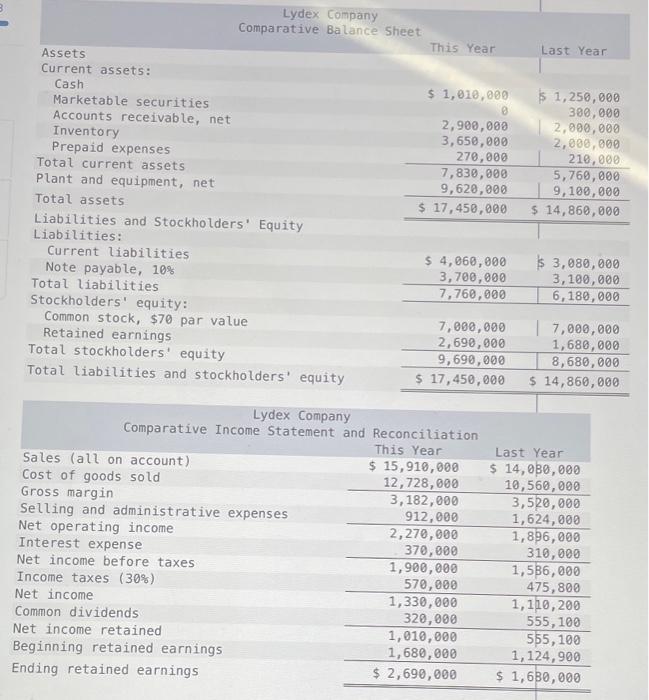

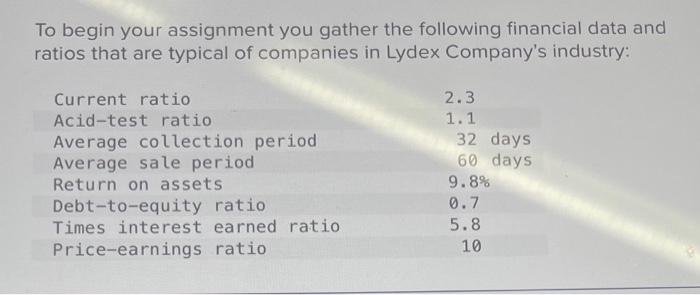

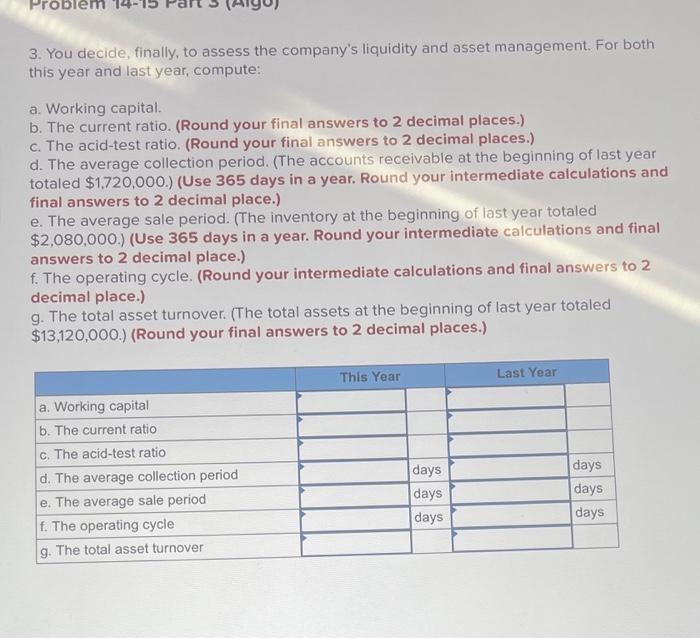

Lydex Company Comparative Income Statement and Reconciliation \begin{tabular}{lrr} Sales (all on account) & This Year & Last Year \\ Cost of goods sold & $15,910,000 & $14,080,000 \\ Gross margin & 12,728,000 & 10,560,000 \\ Selling and administrative expenses & 3,182,000 & 3,520,000 \\ Net operating income & 912,000 & 1,624,000 \\ Interest expense & 2,270,000 & 1,896,000 \\ Net income before taxes & 370,000 & 310,000 \\ Income taxes (30\%) & 1,900,000 & 1,536,000 \\ Net income & 570,000 & 475,800 \\ Common dividends & 1,330,000 & 1,110,200 \\ Net income retained & 320,000 & 555,100 \\ Beginning retained earnings & 1,010,000 & 555,100 \\ Ending retained earnings & 1,680,000 & 1,124,900 \\ \hline \end{tabular} To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Company's industry: 3. You decide, finally, to assess the company's liquidity and asset management. For both this year and last year, compute: a. Working capital. b. The current ratio. (Round your final answers to 2 decimal places.) c. The acid-test ratio. (Round your final answers to 2 decimal places.) d. The average collection period. (The accounts receivable at the beginning of last year totaled $1,720,000.) (Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal place.) e. The average sale period. (The inventory at the beginning of last year totaled $2,080,000 ) (Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal place.) f. The operating cycle. (Round your intermediate calculations and final answers to 2 decimal place.) g. The total asset turnover. (The total assets at the beginning of last year totaled $13,120,000.) (Round your final answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started