If anyone could help, it would be greatly appreciated. Thank you!

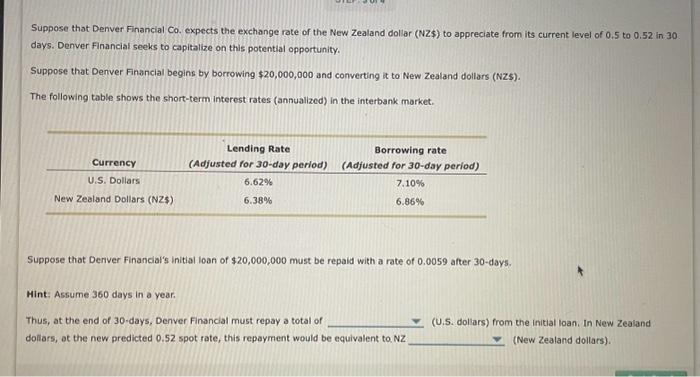

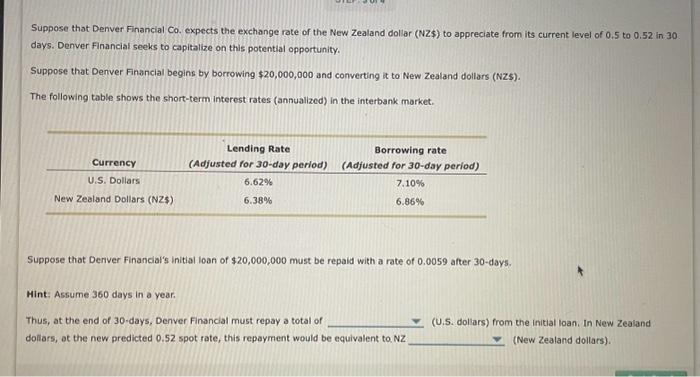

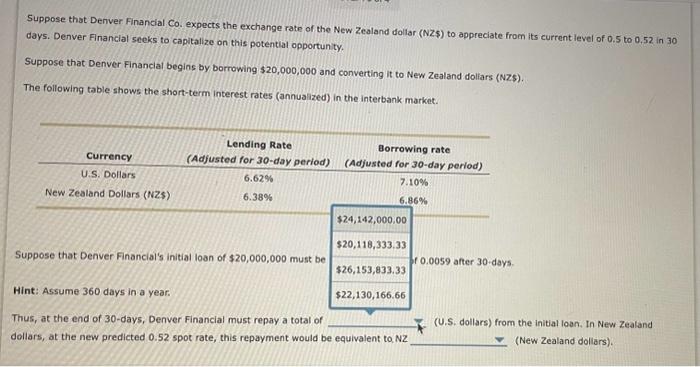

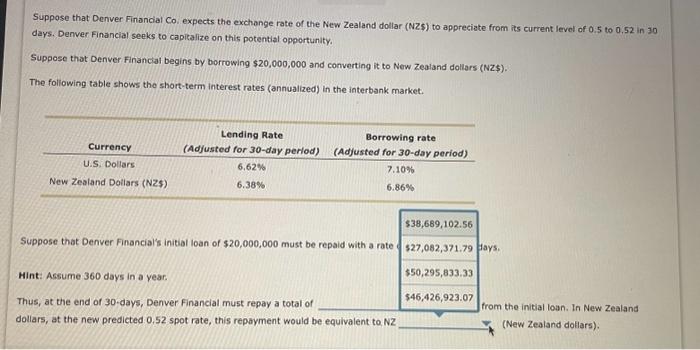

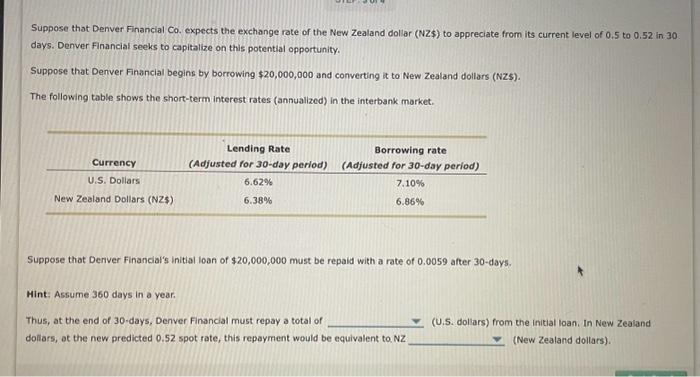

Suppose that Denver Financial Co. expects the exchange rate of the New Zealand dollar (NZ\$) to appreciate from its current level of 0.5 to 0.52 in 30 days. Denver Financial seeks to capitalize on this potential opportunity. Suppose that Denver Financial begins by borrowing $20,000,000 and converting it to New Zealand dollars (Nz\$). The following table shows the short-term interest rates (annualized) in the interbank market. Suppose that Denver Financial's initial loan of $20,000,000 must be repaid with a rate of 0,0059 after 30 -days. Hint: Assume 360 days in a year. Thus, at the end of 30 -days, Denver Financial must repay a total of (U.S. dollars) from the Initial loan. In New Zealand dollars, ot the new predicted 0.52 spot rate, this repayment would be equivalent to NZ (New Zealand dollars). Suppose that Denver Financial Co. expects the exchange rate of the New Zealand dollar (NZ\$) to appreciate froen its current level of 0.5 to 0.52 in 30 days. Denver Financial sceks to capitalize on this potential opportunity. Suppose that Denver Financlal begins by borrowing $20,000,000 and converting it to New Zealand doliars (NZ\$). The following table shows the short-term interest rates (annualized) in the interbank market. Thus, at the end of 30-days, Denver Financial must repay a total of (U.S. dollars) from the initial loan, In New Zealand dollars, at the new predicted 0.52 spot rate, this repayment would be equivalent to. NZ (New Zealand dollars). Suppose that Denver Finandial Co, expects the exchange rate of the New Zealand dollar (NZ\$) to appreciate from its current level of 0.5 to 0,52 in 30 days. Denver Financial seeks to capitalize on this potential opportunity. Suppose that Denver Financial begins by borrowing $20,000,000 and converting it to New Zealand dollars (NZ\$). The following table shows tho short-term interest rates (annualized) in the interbank market. \begin{tabular}{l|l|} Suppose that Denver Financial's initial loan of $20,000,000 must be repaid with a rate & $38,689,102.56 \\ \hline Hint: Assume 360 days in a year. & $50,295,833.33 \\ \hline Thus, at the end of 30 -days, Denver Financial must repay a total of & $46,426,923.07 \\ \hline \end{tabular} dollars, at the new predicted 0,52 spot rate, this repayment would be equivalent to NZ, (New Zealand dollars). Suppose that Denver Financial Co. expects the exchange rate of the New Zealand dollar (NZ\$) to appreciate from its current level of 0.5 to 0.52 in 30 days. Denver Financial seeks to capitalize on this potential opportunity. Suppose that Denver Financial begins by borrowing $20,000,000 and converting it to New Zealand dollars (Nz\$). The following table shows the short-term interest rates (annualized) in the interbank market. Suppose that Denver Financial's initial loan of $20,000,000 must be repaid with a rate of 0,0059 after 30 -days. Hint: Assume 360 days in a year. Thus, at the end of 30 -days, Denver Financial must repay a total of (U.S. dollars) from the Initial loan. In New Zealand dollars, ot the new predicted 0.52 spot rate, this repayment would be equivalent to NZ (New Zealand dollars). Suppose that Denver Financial Co. expects the exchange rate of the New Zealand dollar (NZ\$) to appreciate froen its current level of 0.5 to 0.52 in 30 days. Denver Financial sceks to capitalize on this potential opportunity. Suppose that Denver Financlal begins by borrowing $20,000,000 and converting it to New Zealand doliars (NZ\$). The following table shows the short-term interest rates (annualized) in the interbank market. Thus, at the end of 30-days, Denver Financial must repay a total of (U.S. dollars) from the initial loan, In New Zealand dollars, at the new predicted 0.52 spot rate, this repayment would be equivalent to. NZ (New Zealand dollars). Suppose that Denver Finandial Co, expects the exchange rate of the New Zealand dollar (NZ\$) to appreciate from its current level of 0.5 to 0,52 in 30 days. Denver Financial seeks to capitalize on this potential opportunity. Suppose that Denver Financial begins by borrowing $20,000,000 and converting it to New Zealand dollars (NZ\$). The following table shows tho short-term interest rates (annualized) in the interbank market. \begin{tabular}{l|l|} Suppose that Denver Financial's initial loan of $20,000,000 must be repaid with a rate & $38,689,102.56 \\ \hline Hint: Assume 360 days in a year. & $50,295,833.33 \\ \hline Thus, at the end of 30 -days, Denver Financial must repay a total of & $46,426,923.07 \\ \hline \end{tabular} dollars, at the new predicted 0,52 spot rate, this repayment would be equivalent to NZ, (New Zealand dollars)