Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IF ANYONE COULD SHOW ME HOW TO DO THIS PROBLEM STEP-BY-STEP AND BY HAND (NO EXCEL!) THAT WOULD BE ABSOLUTELY GREAT! IF ANYONE COULD SHOW

IF ANYONE COULD SHOW ME HOW TO DO THIS PROBLEM STEP-BY-STEP AND BY HAND (NO EXCEL!) THAT WOULD BE ABSOLUTELY GREAT!

IF ANYONE COULD SHOW ME HOW TO DO THIS PROBLEM STEP-BY-STEP AND BY HAND (NO EXCEL!) THAT WOULD BE ABSOLUTELY GREAT!

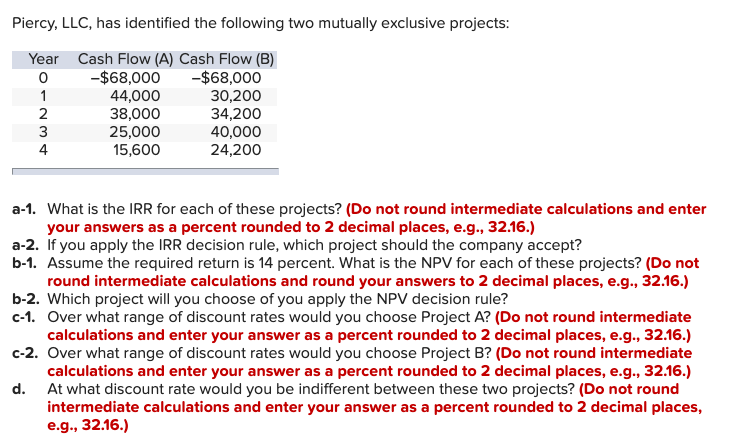

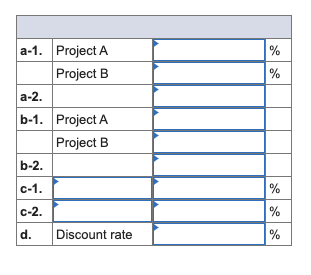

Piercy, LLC, has identified the following two mutually exclusive projects: a-1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. If you apply the IRR decision rule, which project should the company accept? b-1. Assume the required return is 14 percent. What is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. Which project will you choose of you apply the NPV decision rule? c-1. Over what range of discount rates would you choose Project A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Over what range of discount rates would you choose Project B? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) d. At what discount rate would you be indifferent between these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{} & & % \\ \hline a-1. & Project A & & % \\ \hline & Project B & & \\ \hline a-2. & & & \\ \hline b-1. & Project A & & \\ \hline & Project B & & % \\ \hline b-2. & & & % \\ \hline c-1. & & % \\ \hline c-2. & & & \\ \hline d. & Discount rate & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started