Answered step by step

Verified Expert Solution

Question

1 Approved Answer

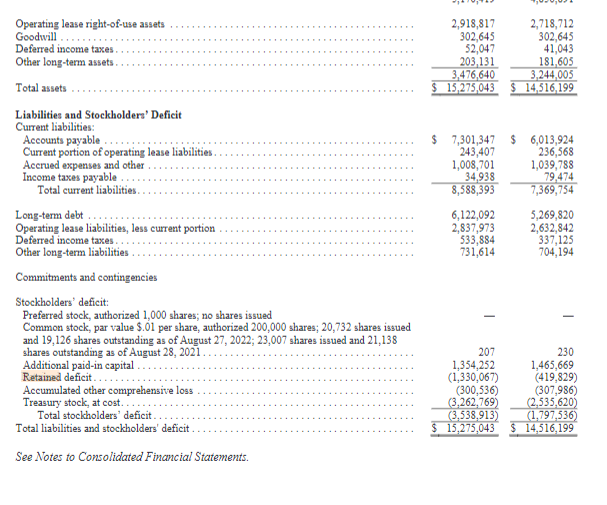

If autozone's retained earnings and shareholder's equity was negative in 2 0 2 2 and 2 0 2 1 does that mean that autozone' has

If autozone's retained earnings and shareholder's equity was negative in and does that mean that autozone' has been experiencing poor financial performance?

Operating lease right-of-use assets Goodwill Deferred income taxes.. Other long-term assets. Total assets Liabilities and Stockholders' Deficit Current liabilities: Accounts payable Current portion of operating lease liabilities. Accrued expenses and other. Income taxes payable. Total current liabilities. Long-term debt Operating lease liabilities, less current portion Deferred income taxes. Other long-term liabilities. 2,918,817 302,645 2,718,712 302,645 52,047 41,043 203,131 3,476,640 181,605 3,244,005 $ 15,275,043 $ 14,516,199 $ 7,301,347 $ 6,013,924 243,407 1,008,701 236,568 1,039,788 34,938 79,474 8,588,393 7,369,754 6,122,092 5,269,820 2,837,973 2,632,842 533,884 337,125 731,614 704,194 Commitments and contingencies Stockholders' deficit: Preferred stock, authorized 1,000 shares; no shares issued Common stock, par value $.01 per share, authorized 200,000 shares; 20,732 shares issued and 19,126 shares outstanding as of August 27, 2022; 23,007 shares issued and 21,138 shares outstanding as of August 28, 2021. Additional paid-in capital.. Retained deficit... Accumulated other comprehensive loss Treasury stock, at cost. Total stockholders' deficit. Total liabilities and stockholders' deficit. See Notes to Consolidated Financial Statements. 207 230 1,465,669 (419,829) 1,354,252 (1,330,067) (300,536) (3,262,769) (3,538,913) $ 15,275,043 (307,986) (2,535,620) (1,797,536) $ 14,516,199

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started