What is the break-even sales in units? If Barnwell brothers is subject to an effective income tax rate of 40%, how many units would Barnwell

If Barnwell brothers is subject to an effective income tax rate of 40%, how many units would Barnwell brothers have to sale to earn an after-tax profit of $90,000?

If fixed costs increase $31,500 with no other cost or revenue factors changing, what is the break-even sales in units?

How would these calculations affect decision making for managers at Barnwell Brothers? Why?

What recommendations would you suggest for reducing costs at Barnwell Brothers?

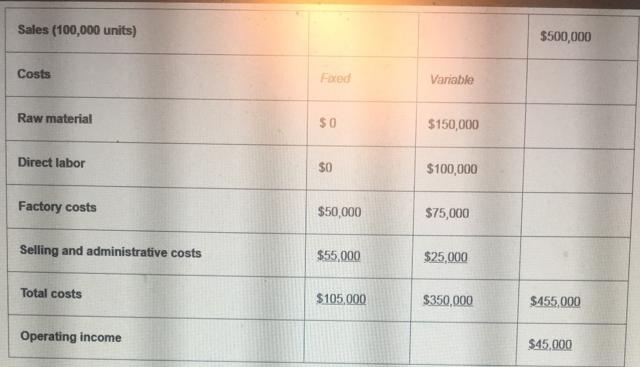

Sales (100,000 units) $500,000 Costs Fxed Variable Raw material $0 $150,000 Direct labor S0 $100,000 Factory costs $50,000 $75,000 Selling and administrative costs $55,000 $25,000 Total costs $105,000 $350,000 $455,000 Operating income $45,000

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Break Even Sales in Units Sales 500000 Less Variable cost 350000 Contribution 150000 LessFixed Cost ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started