Question

If beta measures the sensitivity of a stock's returns to the market's overall returns, then the average beta is 1.0. And to be practical, some

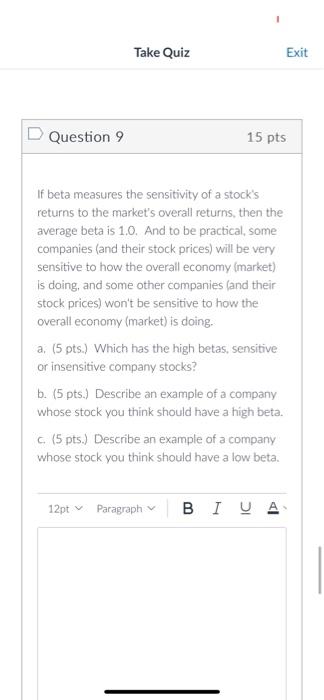

If beta measures the sensitivity of a stock's returns to the market's overall returns, then the average beta is 1.0. And to be practical, some companies (and their stock prices) will be very sensitive to how the overall economy (market) is doing, and some other companies (and their stock prices) won't be sensitive to how the overall economy (market) is doing.

a. (5 pts.) Which has the high betas, sensitive or insensitive company stocks?

b. (5 pts.) Describe an example of a company whose stock you think should have a high beta.

c. (5 pts.) Describe an example of a company whose stock you think should have a low beta.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started