Answered step by step

Verified Expert Solution

Question

1 Approved Answer

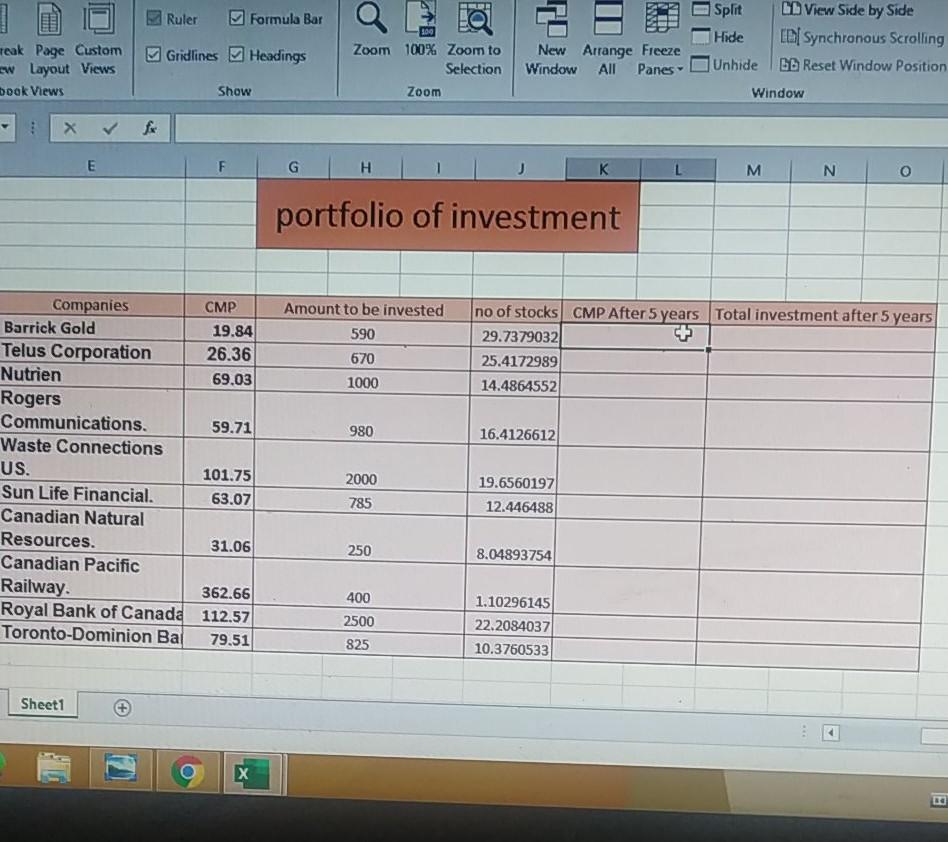

if current market price of company xyz is 19.84 CAD, than what will be the cmp after 5 years? if i am making such portfolio

if current market price of company xyz is 19.84 CAD, than what will be the cmp after 5 years?

if i am making such portfolio nd now i want to know the price after 5 years. so how could i do thatm

Split Ruler Formula Bar 300 Hide CD View Side by Side I Synchronous Scrolling CD Reset Window Position Gridlines Headings reak Page Custom w Layout Views book Views Zoom 100% Zoom to Selection Zoom New Arrange Freeze Window Panes All Unhide Show Window E F G H K M N portfolio of investment Amount to be invested 590 no of stocks CMP After 5 years Total investment after 5 years 29.7379032 25.4172989 14.4864552 670 1000 980 16.4126612 Companies CMP Barrick Gold 19.84 Telus Corporation 26.36 Nutrien 69.03 Rogers Communications. 59.71 Waste Connections US. 101.75 Sun Life Financial. 63.07 Canadian Natural Resources. 31.06 Canadian Pacific Railway. 362.66 Royal Bank of Canada 112.57 Toronto-Dominion Ba 79.51 2000 785 19.6560197 12.446488 250 8.04893754 400 2500 825 1.10296145 22.2084037 10.3760533 Sheet1 Split Ruler Formula Bar 300 Hide CD View Side by Side I Synchronous Scrolling CD Reset Window Position Gridlines Headings reak Page Custom w Layout Views book Views Zoom 100% Zoom to Selection Zoom New Arrange Freeze Window Panes All Unhide Show Window E F G H K M N portfolio of investment Amount to be invested 590 no of stocks CMP After 5 years Total investment after 5 years 29.7379032 25.4172989 14.4864552 670 1000 980 16.4126612 Companies CMP Barrick Gold 19.84 Telus Corporation 26.36 Nutrien 69.03 Rogers Communications. 59.71 Waste Connections US. 101.75 Sun Life Financial. 63.07 Canadian Natural Resources. 31.06 Canadian Pacific Railway. 362.66 Royal Bank of Canada 112.57 Toronto-Dominion Ba 79.51 2000 785 19.6560197 12.446488 250 8.04893754 400 2500 825 1.10296145 22.2084037 10.3760533 Sheet1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started