If I could just get some help double-checking the journal entries and some help with the adjusting entries and bank reconciliations, that would be great. Thanks in advance.

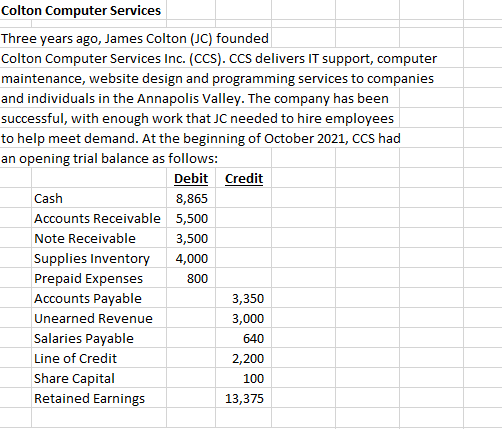

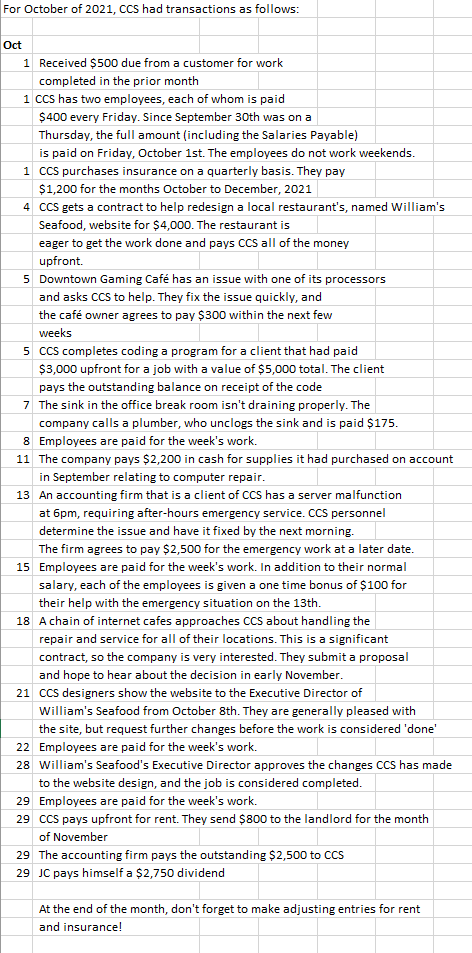

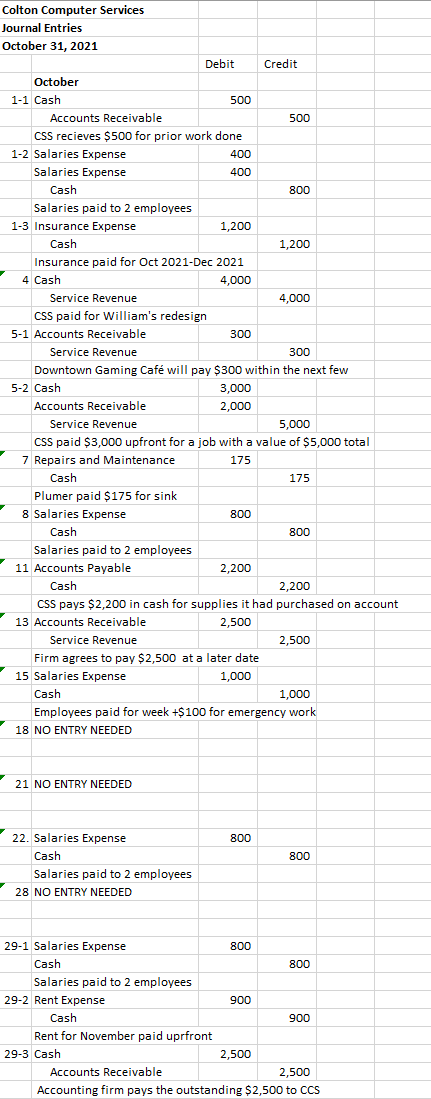

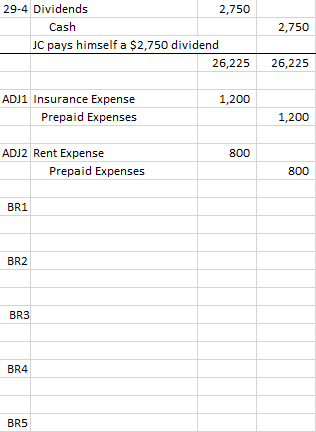

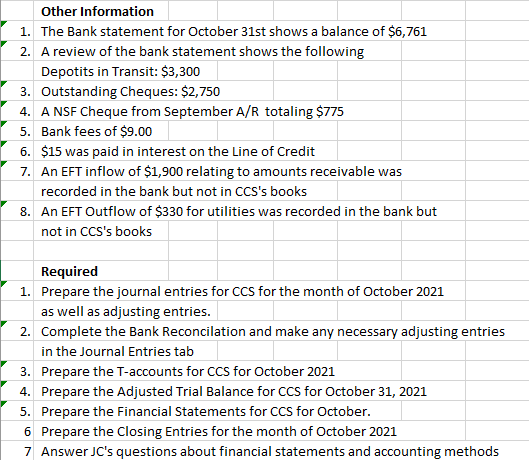

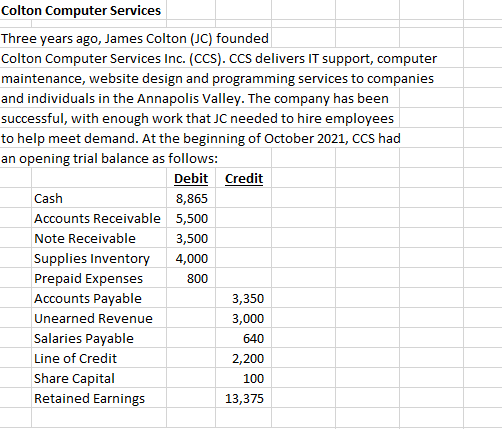

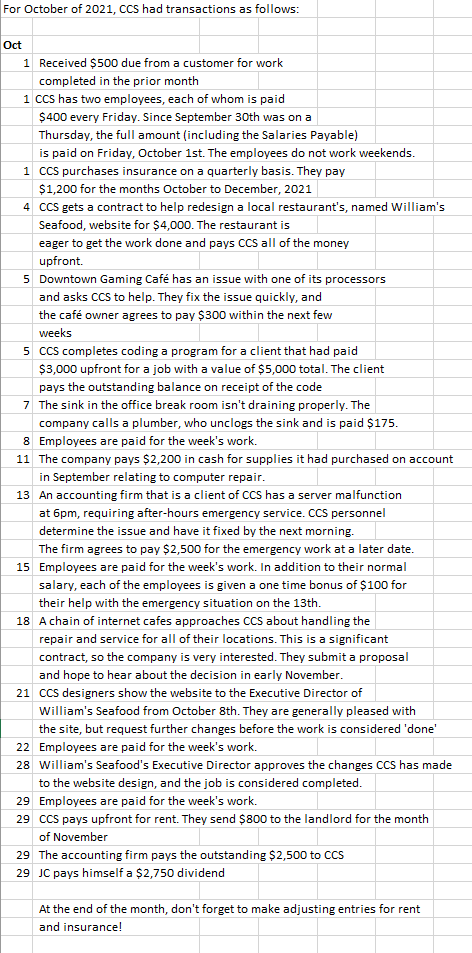

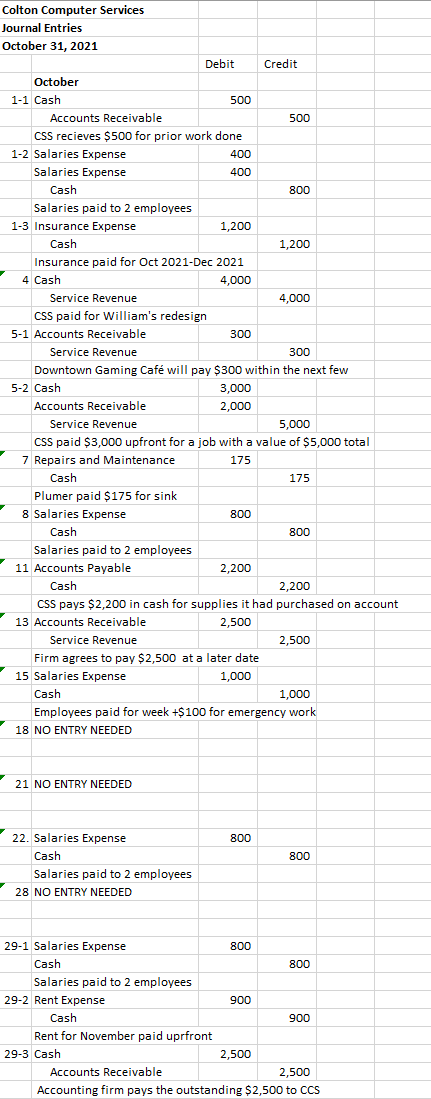

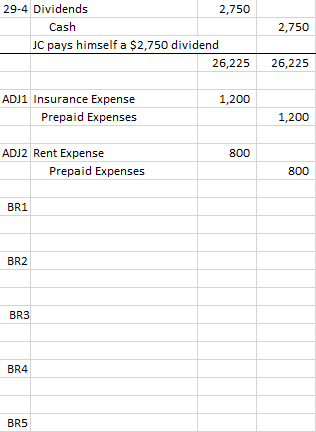

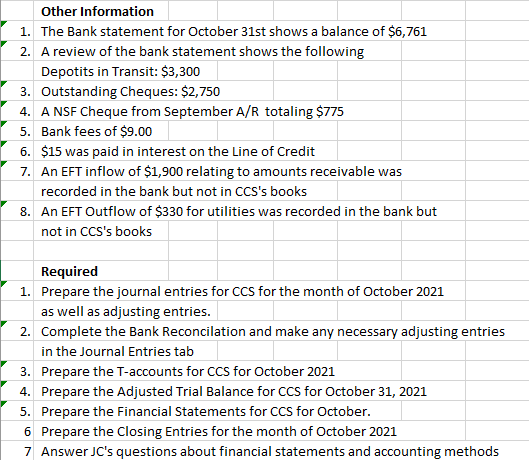

Colton Computer Services Three years ago, James Colton (JC) founded Colton Computer Services Inc. (CCS). CCS delivers IT support, computer maintenance, website design and programming services to companies and individuals in the Annapolis Valley. The company has been successful, with enough work that JC needed to hire employees to help meet demand. At the beginning of October 2021, CCS had an opening trial balance as follows: \begin{tabular}{|l|r|r|} \hline & Debit & Credit \\ \hline Cash & 8,865 & \\ \hline Accounts Receivable & 5,500 & \\ \hline Note Receivable & 3,500 & \\ \hline Supplies Inventory & 4,000 & \\ \hline Prepaid Expenses & 800 & \\ \hline Accounts Payable & & 3,350 \\ \hline Unearned Revenue & & 3,000 \\ \hline Salaries Payable & & 640 \\ \hline Line of Credit & & 2,200 \\ \hline Share Capital & & 100 \\ \hline Retained Earnings & & 13,375 \\ \hline & & \\ \hline \end{tabular} For October of 2021 , CCS had transactions as follows: Oct 1 Received $500 due from a customer for work completed in the prior month 1 CCS has two employees, each of whom is paid $400 every Friday. Since September 30th was on a Thursday, the full amount (including the Salaries Payable) is paid on Friday, October 1st. The employees do not work weekends. 1 CCS purchases insurance on a quarterly basis. They pay $1,200 for the months October to December, 2021 4 CCS gets a contract to help redesign a local restaurant's, named William's Seafood, website for $4,000. The restaurant is eager to get the work done and pays CCS all of the money upfront. 5 Downtown Gaming Caf has an issue with one of its processors and asks cCS to help. They fix the issue quickly, and the caf owner agrees to pay $300 within the next few weeks 5 CCS completes coding a program for a client that had paid $3,000 upfront for a job with a value of $5,000 total. The client pays the outstanding balance on receipt of the code 7 The sink in the office break room isn't draining properly. The company calls a plumber, who unclogs the sink and is paid \$175. 8 Employees are paid for the week's work. 11 The company pays $2,200 in cash for supplies it had purchased on account in September relating to computer repair. 13 An accounting firm that is a client of CCS has a server malfunction at 6pm, requiring after-hours emergency service. CCS personnel determine the issue and have it fixed by the next morning. The firm agrees to pay $2,500 for the emergency work at a later date. 15 Employees are paid for the week's work. In addition to their normal salary, each of the employees is given a one time bonus of $100 for their help with the emergency situation on the 13th. 18 A chain of internet cafes approaches CCS about handling the repair and service for all of their locations. This is a significant contract, so the company is very interested. They submit a proposal and hope to hear about the decision in early November. 21 CCS designers show the website to the Executive Director of William's Seafood from October 8th. They are generally pleased with the site, but request further changes before the work is considered 'done' 22 Employees are paid for the week's work. 28 William's Seafood's Executive Director approves the changes CCS has made to the website design, and the job is considered completed. 29 Employees are paid for the week's work. 29 CCS pays upfront for rent. They send $800 to the landlord for the month of November 29 The accounting firm pays the outstanding $2,500 to CCS 29 JC pays himself a $2,750 dividend At the end of the month, don't forget to make adjusting entries for rent and insurance! Colton Computer Services Journal Entries October 31, 2021 \begin{tabular}{|l|l|r|r|} \hline & & Debit & Credit \\ \hline & October & & \\ \hline 11 & Cash & 500 & \\ \hline & Accounts Receivable & & 500 \\ \hline & CSS recieves $500 for prior work done & \\ \hline 12 & Salaries Expense & 400 & \\ \hline & Salaries Expense & 400 & \\ \hline & Cash & & 800 \\ \hline & Salaries paid to 2 employees & & \\ \hline 13 & Insurance Expense & 1,200 & \\ \hline & Cash & & 1,200 \\ \hline & Insurance paid for Oct 2021-Dec 2021 & \\ \hline 4 & Cash & 4,000 & \\ \hline & Service Revenue & & 4,000 \\ \hline & CSS paid for William's redesign \\ \hline 51 & Accounts Receivable & \\ \hline & Service Revenue & 300 & \\ \hline \end{tabular} Downtown Gaming Caf will pay $300 within the next few CSS pays $2,200 in cash for supplies it had purchased on account \begin{tabular}{l|l|r|r|} 13 & Accounts Receivable & 2,500 & \\ \hline Service Revenue & & 2,500 \\ \hline & Firm agrees to pay $2,500 at a later date \\ \hline 15 & Salaries Expense & 1,000 & \\ \hline & Cash & & 1,000 \\ \hline \end{tabular} Employees paid for week +$100 for emergency work 18 NO ENTRY NEEDED 21 NO ENTRY NEEDED \begin{tabular}{|l|l|r|r|} \hline 22. Salaries Expense & 800 & \\ \hline & Cash \\ \hline & Salaries paid to 2 employees & & \\ \hline 28 & NO ENTRY NEEDED & & \\ \hline & & & \\ \hline & & & \\ \hline 291 & Salaries Expense & & \\ \hline & Cash & & 800 \\ \hline & Salaries paid to 2 employees & & \\ \hline 292 & Rent Expense & 900 & \\ \hline & Cash & & 900 \\ \hline & Rent for November paid uprfront & \\ \hline 293 & Cash & 2,500 & \\ \hline & Accounts Receivable & & 2,500 \\ \hline \end{tabular} Accounting firm pays the outstanding $2,500 to CCS \begin{tabular}{|c|r|r|} \hline 294 Dividends & 2,750 & \\ \hline Cash & & 2,750 \\ \hline \end{tabular} JC pays himself a $2,750 dividend \begin{tabular}{|l|r|r|r|} \hline & & 26,225 & 26,225 \\ \hline ADJ1 & & & \\ \hline & Preparance Expense & 1,200 & \\ \hline & & & 1,200 \\ \hline ADJ2 & Rent Expense & & \\ \hline & Prepaid Expenses & & \\ \hline & & & 800 \\ \hline BR1 & & & \\ \hline & & & \\ \hline BR2 & & & \\ \hline & & & \\ \hline BR3 & & & \\ \hline & & & \\ \hline & & & \\ \hline BR4 & & & \\ \hline & & & \\ \hline \end{tabular} Other Information 1. The Bank statement for October 31st shows a balance of $6,761 2. A review of the bank statement shows the following Depotits in Transit: $3,300 3. Outstanding Cheques: $2,750 4. A NSF Cheque from September A/R totaling $775 5. Bank fees of $9.00 6. \$15 was paid in interest on the Line of Credit 7. An EFT inflow of $1,900 relating to amounts receivable was recorded in the bank but not in CCS's books 8. An EFT Outflow of $330 for utilities was recorded in the bank but not in CCS's books Required 1. Prepare the journal entries for CCS for the month of October 2021 as well as adjusting entries. 2. Complete the Bank Reconcilation and make any necessary adjusting entries in the Journal Entries tab 3. Prepare the T-accounts for CCS for October 2021 4. Prepare the Adjusted Trial Balance for CCS for October 31, 2021 5. Prepare the Financial Statements for CCS for October. 6 Prepare the Closing Entries for the month of October 2021 7 Answer JC s questions about financial statements and accounting methods Colton Computer Services Three years ago, James Colton (JC) founded Colton Computer Services Inc. (CCS). CCS delivers IT support, computer maintenance, website design and programming services to companies and individuals in the Annapolis Valley. The company has been successful, with enough work that JC needed to hire employees to help meet demand. At the beginning of October 2021, CCS had an opening trial balance as follows: \begin{tabular}{|l|r|r|} \hline & Debit & Credit \\ \hline Cash & 8,865 & \\ \hline Accounts Receivable & 5,500 & \\ \hline Note Receivable & 3,500 & \\ \hline Supplies Inventory & 4,000 & \\ \hline Prepaid Expenses & 800 & \\ \hline Accounts Payable & & 3,350 \\ \hline Unearned Revenue & & 3,000 \\ \hline Salaries Payable & & 640 \\ \hline Line of Credit & & 2,200 \\ \hline Share Capital & & 100 \\ \hline Retained Earnings & & 13,375 \\ \hline & & \\ \hline \end{tabular} For October of 2021 , CCS had transactions as follows: Oct 1 Received $500 due from a customer for work completed in the prior month 1 CCS has two employees, each of whom is paid $400 every Friday. Since September 30th was on a Thursday, the full amount (including the Salaries Payable) is paid on Friday, October 1st. The employees do not work weekends. 1 CCS purchases insurance on a quarterly basis. They pay $1,200 for the months October to December, 2021 4 CCS gets a contract to help redesign a local restaurant's, named William's Seafood, website for $4,000. The restaurant is eager to get the work done and pays CCS all of the money upfront. 5 Downtown Gaming Caf has an issue with one of its processors and asks cCS to help. They fix the issue quickly, and the caf owner agrees to pay $300 within the next few weeks 5 CCS completes coding a program for a client that had paid $3,000 upfront for a job with a value of $5,000 total. The client pays the outstanding balance on receipt of the code 7 The sink in the office break room isn't draining properly. The company calls a plumber, who unclogs the sink and is paid \$175. 8 Employees are paid for the week's work. 11 The company pays $2,200 in cash for supplies it had purchased on account in September relating to computer repair. 13 An accounting firm that is a client of CCS has a server malfunction at 6pm, requiring after-hours emergency service. CCS personnel determine the issue and have it fixed by the next morning. The firm agrees to pay $2,500 for the emergency work at a later date. 15 Employees are paid for the week's work. In addition to their normal salary, each of the employees is given a one time bonus of $100 for their help with the emergency situation on the 13th. 18 A chain of internet cafes approaches CCS about handling the repair and service for all of their locations. This is a significant contract, so the company is very interested. They submit a proposal and hope to hear about the decision in early November. 21 CCS designers show the website to the Executive Director of William's Seafood from October 8th. They are generally pleased with the site, but request further changes before the work is considered 'done' 22 Employees are paid for the week's work. 28 William's Seafood's Executive Director approves the changes CCS has made to the website design, and the job is considered completed. 29 Employees are paid for the week's work. 29 CCS pays upfront for rent. They send $800 to the landlord for the month of November 29 The accounting firm pays the outstanding $2,500 to CCS 29 JC pays himself a $2,750 dividend At the end of the month, don't forget to make adjusting entries for rent and insurance! Colton Computer Services Journal Entries October 31, 2021 \begin{tabular}{|l|l|r|r|} \hline & & Debit & Credit \\ \hline & October & & \\ \hline 11 & Cash & 500 & \\ \hline & Accounts Receivable & & 500 \\ \hline & CSS recieves $500 for prior work done & \\ \hline 12 & Salaries Expense & 400 & \\ \hline & Salaries Expense & 400 & \\ \hline & Cash & & 800 \\ \hline & Salaries paid to 2 employees & & \\ \hline 13 & Insurance Expense & 1,200 & \\ \hline & Cash & & 1,200 \\ \hline & Insurance paid for Oct 2021-Dec 2021 & \\ \hline 4 & Cash & 4,000 & \\ \hline & Service Revenue & & 4,000 \\ \hline & CSS paid for William's redesign \\ \hline 51 & Accounts Receivable & \\ \hline & Service Revenue & 300 & \\ \hline \end{tabular} Downtown Gaming Caf will pay $300 within the next few CSS pays $2,200 in cash for supplies it had purchased on account \begin{tabular}{l|l|r|r|} 13 & Accounts Receivable & 2,500 & \\ \hline Service Revenue & & 2,500 \\ \hline & Firm agrees to pay $2,500 at a later date \\ \hline 15 & Salaries Expense & 1,000 & \\ \hline & Cash & & 1,000 \\ \hline \end{tabular} Employees paid for week +$100 for emergency work 18 NO ENTRY NEEDED 21 NO ENTRY NEEDED \begin{tabular}{|l|l|r|r|} \hline 22. Salaries Expense & 800 & \\ \hline & Cash \\ \hline & Salaries paid to 2 employees & & \\ \hline 28 & NO ENTRY NEEDED & & \\ \hline & & & \\ \hline & & & \\ \hline 291 & Salaries Expense & & \\ \hline & Cash & & 800 \\ \hline & Salaries paid to 2 employees & & \\ \hline 292 & Rent Expense & 900 & \\ \hline & Cash & & 900 \\ \hline & Rent for November paid uprfront & \\ \hline 293 & Cash & 2,500 & \\ \hline & Accounts Receivable & & 2,500 \\ \hline \end{tabular} Accounting firm pays the outstanding $2,500 to CCS \begin{tabular}{|c|r|r|} \hline 294 Dividends & 2,750 & \\ \hline Cash & & 2,750 \\ \hline \end{tabular} JC pays himself a $2,750 dividend \begin{tabular}{|l|r|r|r|} \hline & & 26,225 & 26,225 \\ \hline ADJ1 & & & \\ \hline & Preparance Expense & 1,200 & \\ \hline & & & 1,200 \\ \hline ADJ2 & Rent Expense & & \\ \hline & Prepaid Expenses & & \\ \hline & & & 800 \\ \hline BR1 & & & \\ \hline & & & \\ \hline BR2 & & & \\ \hline & & & \\ \hline BR3 & & & \\ \hline & & & \\ \hline & & & \\ \hline BR4 & & & \\ \hline & & & \\ \hline \end{tabular} Other Information 1. The Bank statement for October 31st shows a balance of $6,761 2. A review of the bank statement shows the following Depotits in Transit: $3,300 3. Outstanding Cheques: $2,750 4. A NSF Cheque from September A/R totaling $775 5. Bank fees of $9.00 6. \$15 was paid in interest on the Line of Credit 7. An EFT inflow of $1,900 relating to amounts receivable was recorded in the bank but not in CCS's books 8. An EFT Outflow of $330 for utilities was recorded in the bank but not in CCS's books Required 1. Prepare the journal entries for CCS for the month of October 2021 as well as adjusting entries. 2. Complete the Bank Reconcilation and make any necessary adjusting entries in the Journal Entries tab 3. Prepare the T-accounts for CCS for October 2021 4. Prepare the Adjusted Trial Balance for CCS for October 31, 2021 5. Prepare the Financial Statements for CCS for October. 6 Prepare the Closing Entries for the month of October 2021 7 Answer JC s questions about financial statements and accounting methods