Answered step by step

Verified Expert Solution

Question

1 Approved Answer

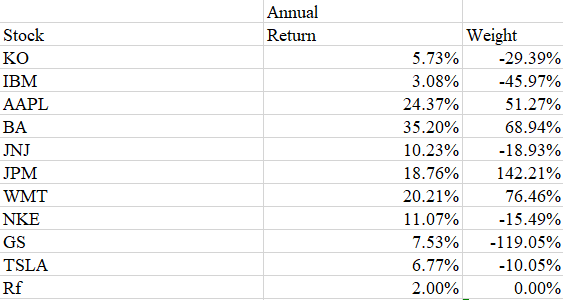

if I got optimal portfolio weight like this which means we can take short position. how to calculate the portfolio reture with capm?and how to

if I got optimal portfolio weight like this which means we can take short position. how to calculate the portfolio reture with capm?and how to compute portfolio beta value if we if have negative weighted value(assume we already have single beta value for each stock)? please help!

Annual Return Stock KO IBM AAPL JNJ JPM WMT NKE GS TSLA Rf 5.73% 3.08% 24.37% 35.20% 10.23% 18.76% 20.21% 11.07% 7.53% 6.77% 2.00% Weight -29.39% -45.97% 51.27% 68.94% -18.93% 142.21% 76.46% -15.49% -119.05% -10.05% 0.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started