Question

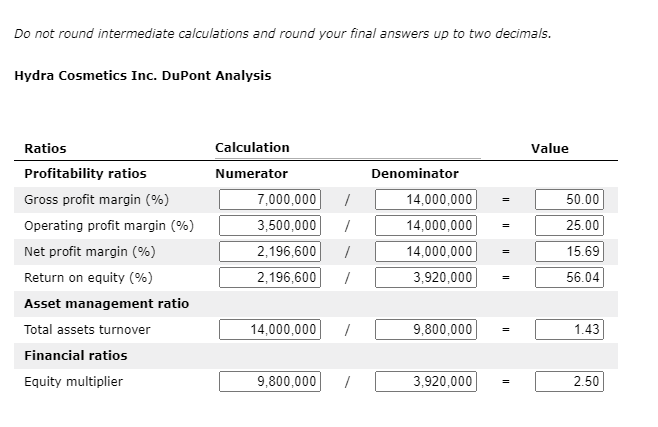

If I remember correctly, the DuPont equation breaks down our ROE into three component ratios: ____________ ( net profit margin / operating profit margin ),

If I remember correctly, the DuPont equation breaks down our ROE into three component ratios: ____________ (net profit margin / operating profit margin), the total asset turnover ratio, and ____________. (equity multiplier / debt ratio)

And, according to my understanding of the DuPont equation and its calculation of ROE, the three ratios provide insights into the companys ___________ (use of debt versus equity financing / shareholder and dividend management), effectiveness in using the companys assets, and ____________. ( management of its revenues and depreciation methods / control over its expenses)

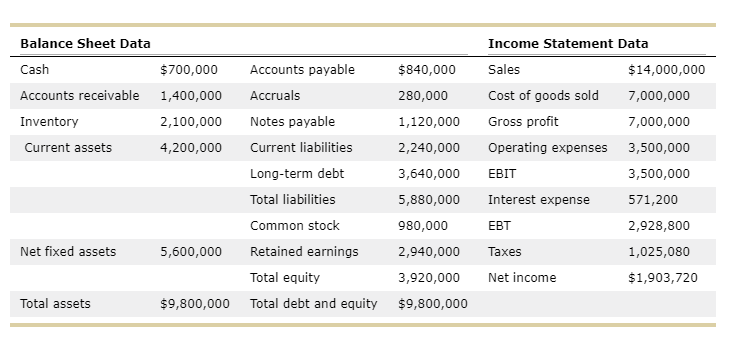

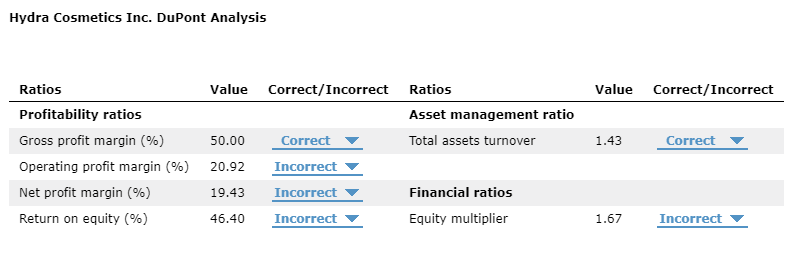

Check the box to the side of the calculated value if the calculation is correct and leave it unchecked if the calculation is incorrect.

Can you please confirm whether my answers are correct for parts 2 and 3? For part 1, the bolded phrases are the options available. Thank you

Can you please confirm whether my answers are correct for parts 2 and 3? For part 1, the bolded phrases are the options available. Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started