Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If image is hard to read, right click it and click Open image in new tab. It should be more clear. Thank you Edit: From

If image is hard to read, right click it and click Open image in new tab. It should be more clear. Thank you

Edit: From our expert: Connect with me at myhomeworkhelp89 on g mail for accounting questions. I will send excel file with full workings for as low as US $ 3.

No. Get off chegg

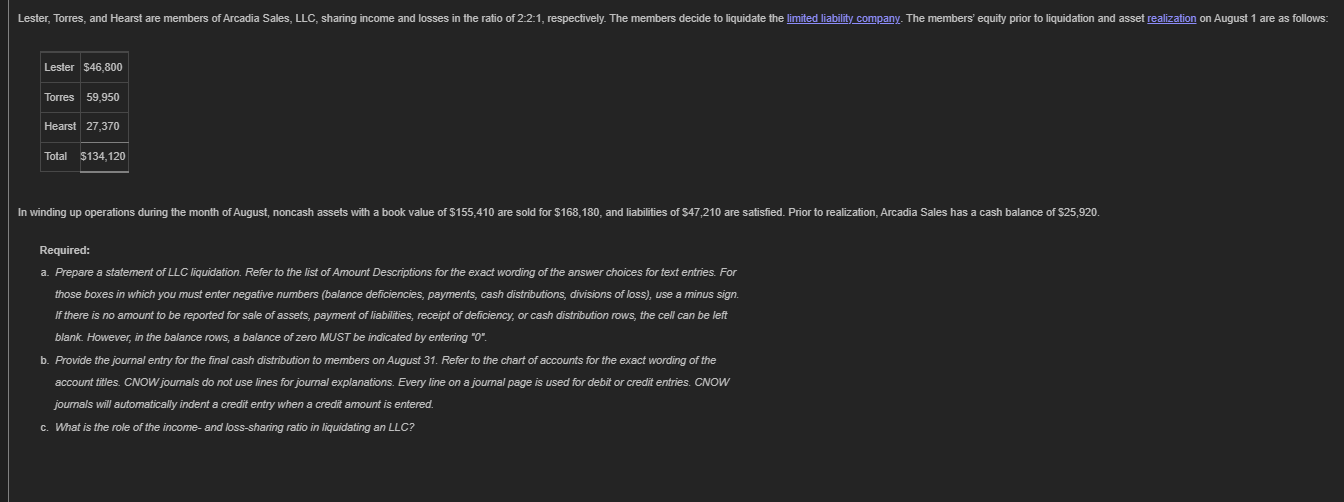

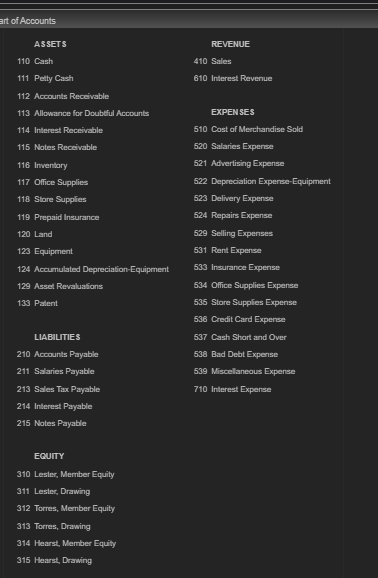

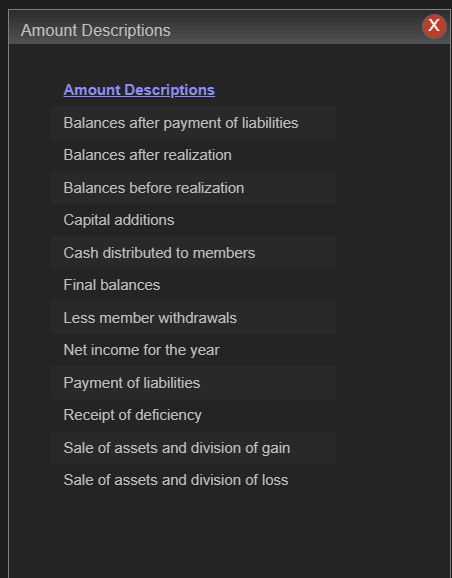

Amount Descriptions Amount Descriptions Balances after payment of liabilities Balances after realization Balances before realization Capital additions Cash distributed to members Final balances Less member withdrawals Net income for the year Payment of liabilities Receipt of deficiency Sale of assets and division of gain Sale of assets and division of loss b. Provide the journal entry for the final cash distribution to members on August 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. of Accounts Assets 110 Cash 111 Petty Cash 112 Accounts Reccivable 113 Allowance for Doubtful Accounts 114 Interest Receivable 115 Nates Reccivable 116 Inventary 117 Office Supplies 118 Store Supplies 119 Prepaid Insurance 120 Land 123 Equipment 124 Accumulsted Depreciation-Equipment 129 Assed Revaluations 133 Pastent LIABIUTIES 210 Accounts Payable 211 Salaries Payable 213 Ssles Tax Payable 214 Interest Payable 215 Nates Payable EQUTY 310 Lester, Member Equity 311 Lester, Drawing 312 Torres, Mermber Equity 313 Torres, Drawing 314 Hearst, Mennber Equily 315 Hearst, Drawing REVENUE 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Merchandise Sold 520 Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Equipment 523 Delivery Expense 524 Repsirs Expense 529 Selling Expenses 531 Rent Expense 533 Insurance Expense 534 Office Supplies Expense 535 Store Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense Required: a. Prepare a statement of LLC liquidation. Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency, or cash distribution rows, the cell can be left blank. However, in the balance rows, a balance of zero MUST be indicated by entering " 0 ". b. Provide the journal entry for the final cash distribution to members on August 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. c. What is the role of the income- and loss-shaning ratio in liquidating an LLC? Amount Descriptions Amount Descriptions Balances after payment of liabilities Balances after realization Balances before realization Capital additions Cash distributed to members Final balances Less member withdrawals Net income for the year Payment of liabilities Receipt of deficiency Sale of assets and division of gain Sale of assets and division of loss b. Provide the journal entry for the final cash distribution to members on August 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. of Accounts Assets 110 Cash 111 Petty Cash 112 Accounts Reccivable 113 Allowance for Doubtful Accounts 114 Interest Receivable 115 Nates Reccivable 116 Inventary 117 Office Supplies 118 Store Supplies 119 Prepaid Insurance 120 Land 123 Equipment 124 Accumulsted Depreciation-Equipment 129 Assed Revaluations 133 Pastent LIABIUTIES 210 Accounts Payable 211 Salaries Payable 213 Ssles Tax Payable 214 Interest Payable 215 Nates Payable EQUTY 310 Lester, Member Equity 311 Lester, Drawing 312 Torres, Mermber Equity 313 Torres, Drawing 314 Hearst, Mennber Equily 315 Hearst, Drawing REVENUE 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Merchandise Sold 520 Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Equipment 523 Delivery Expense 524 Repsirs Expense 529 Selling Expenses 531 Rent Expense 533 Insurance Expense 534 Office Supplies Expense 535 Store Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense Required: a. Prepare a statement of LLC liquidation. Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency, or cash distribution rows, the cell can be left blank. However, in the balance rows, a balance of zero MUST be indicated by entering " 0 ". b. Provide the journal entry for the final cash distribution to members on August 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. c. What is the role of the income- and loss-shaning ratio in liquidating an LLCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started