Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If Jack and Jill agree that their respective capital should be $460000 calculate the amount of their goodwill.show calculation and write the answers. Jack and

If Jack and Jill agree that their respective capital should be $460000 calculate the amount of their goodwill.show calculation and write the answers.

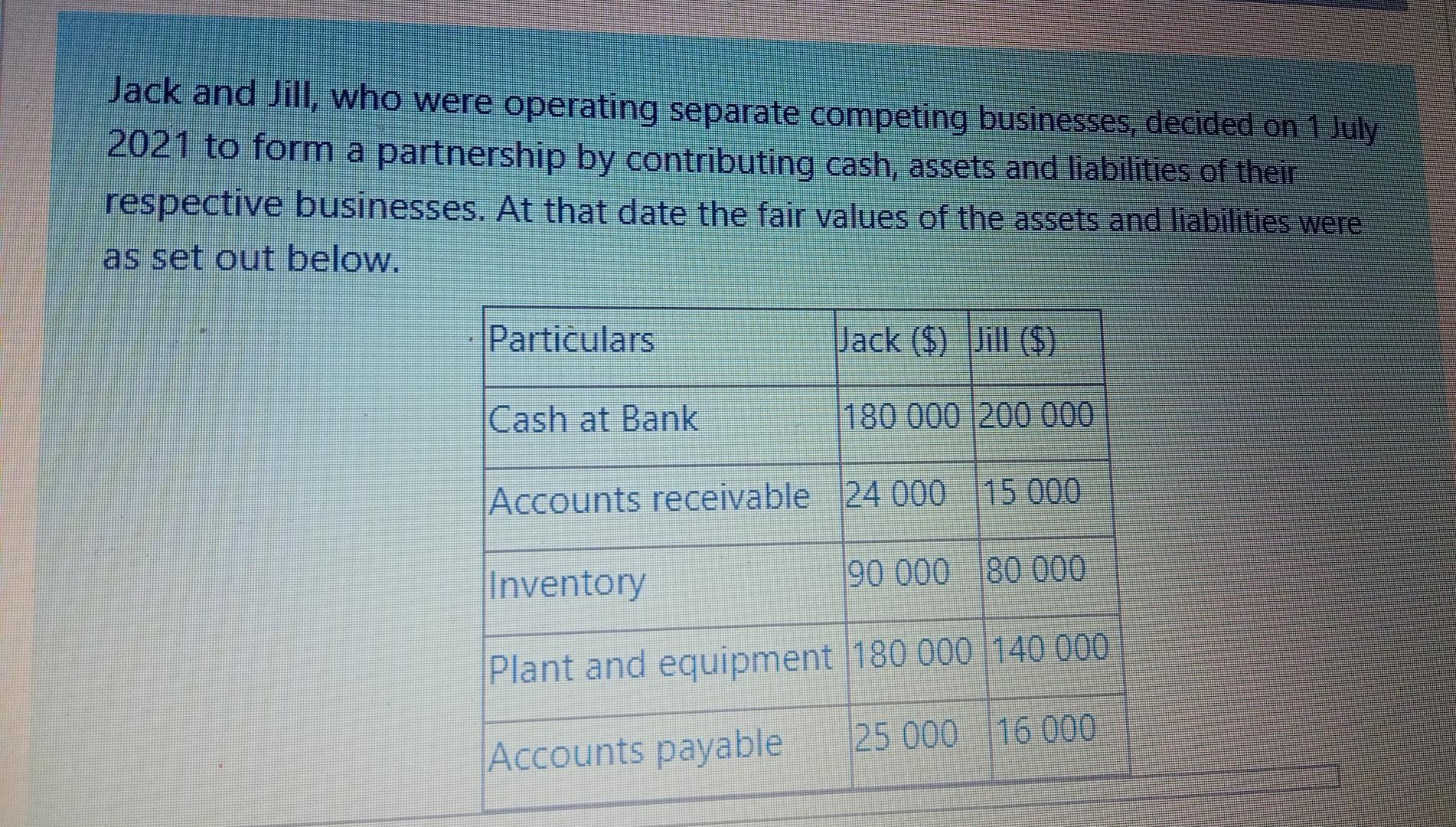

Jack and Jill, who were operating separate competing businesses, decided on 1 July 2021 to form a partnership by contributing cash, assets and liabilities of their respective businesses. At that date the fair values of the assets and liabilities were as set out below. Particulars Jack ($) Jill ($) Cash at Bank 180 000 200 000 Accounts receivable 24 000 15 000 Inventory 90 000 80 000 Plant and equipment 180 000 140 000 Accounts payable 25 000 16 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started