Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If Jordan Elliss predictions are correct, what will be the value per share of Encore stock if the firm maintains a constant annual 6% growth

If Jordan Elliss predictions are correct, what will be the value per share of Encore stock if the firm maintains a constant annual 6% growth rate in future dividends? (Note: Continue to use the new required of 6%.)

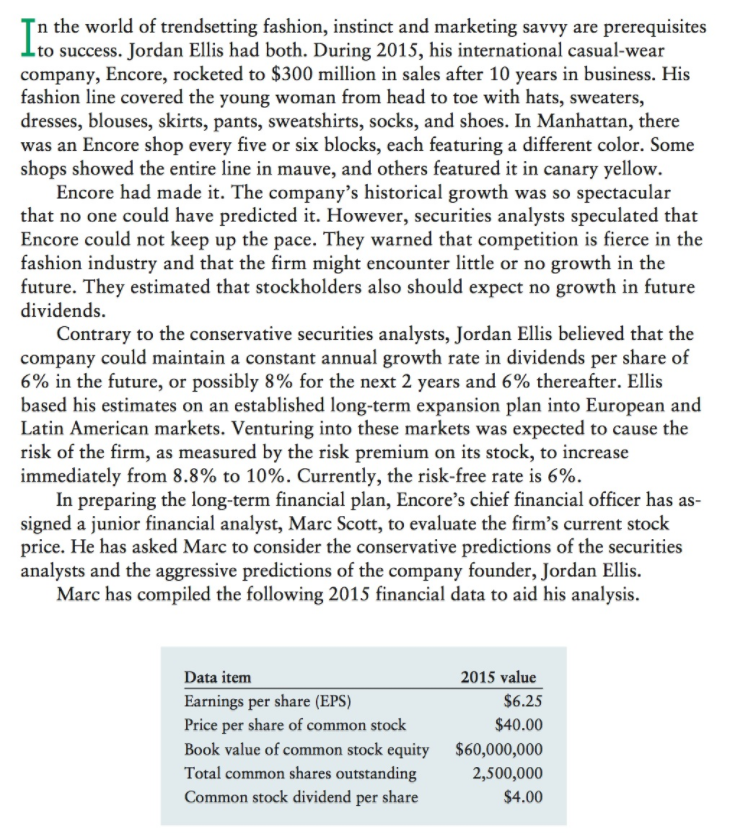

n the world of trendsetting fashion, instinct and marketing savvy are prerequisites to success. Jordan Ellis had both. During 2015, his international casual-wear company, Encore, rocketed to $300 million in sales after 10 years in business. His fashion line covered the young woman from head to toe with hats, sweaters, dresses, blouses, skirts, pants, sweatshirts, socks, and shoes. In Manhattan, there was an Encore shop every five or six blocks, each featuring a different color. Some shops showed the entire line in mauve, and others featured it in canary yellow. Encore had made it. The company's historical growth was so spectacular that no one could have predicted it. However, securities analysts speculated that Encore could not keep up the pace. They warned that competition is fierce in the fashion industry and that the firm might encounter little or no growth in the future. They estimated that stockholders also should expect no growth in future dividends Contrary to the conservative securities analysts, Jordan Ellis believed that the company could maintain a constant annual growth rate in dividends per share of 6% in the future, or possibly 8% for the next 2 years and 6% thereafter. Ellis based his estimates on an established long-term expansion plan into European and Latin American markets. Venturing into these markets was expected to cause the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 6%. In preparing the long-term financial plan, Encore's chief financial officer has as- signed a junior financial analyst, Marc Scott, to evaluate the firm's current stock price. He has asked Marc to consider the conservative predictions of the securities analysts and the aggressive predictions of the company founder, Jordan Ellis Marc has compiled the following 2015 financial data to aid his analysis. 2015 value Data item Earnings per share (EPS) Price per share of common stock Book value of common stock equity Total common shares outstanding Common stock dividend per share $6.25 $40.00 $60,000,000 2,500,000 $4.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started