Question: If managed effectively, Rearden Metal will have assets with a market value of $200 million. $300 million, or $400 million next year. with each outcome

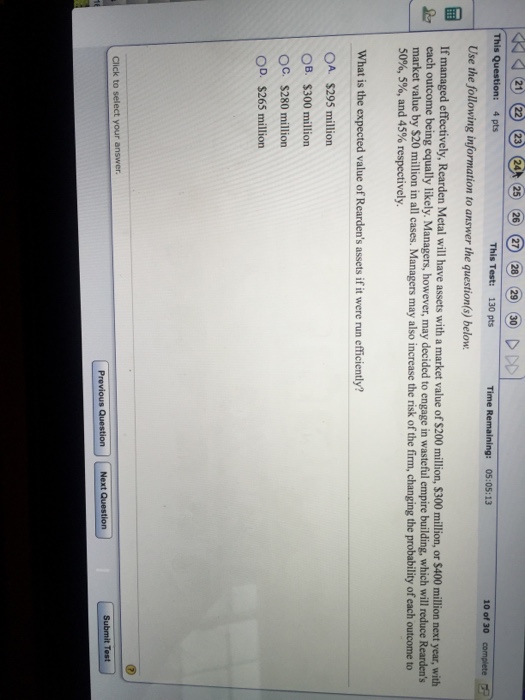

If managed effectively, Rearden Metal will have assets with a market value of $200 million. $300 million, or $400 million next year. with each outcome being equally likely. Managers, however, may decided to engage in wasteful empire building, which will reduce Rearden's market value by $20 million in all cases. Managers may also increase the risk of the firm, changing the probability of each outcome to 50%, 5%. and 45% respectively. What is the expected value of Rearden's assets if it were run efficiently? $295 million $300 million $280 million $265 million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock