Question

If Mr. Vavalu is a resident citizen, how much is his income tax due for the year 2023? If Mr. Vavalu is a resident alien,

If Mr. Vavalu is a resident citizen, how much is his income tax due for the year 2023?

If Mr. Vavalu is a resident alien, how much is his income tax due for the year 2023?

If Mr. Vavalu is a non-resident citizen, how availed optional standard deduction, how much is his income tax due for the year 2023?

If Mr. Vavalu is a resident citizen, opted to be taxed at 8% income tax rate, how much is his income tax due for the year 2023?

Compute for Mr. Vavalu's final tax due.

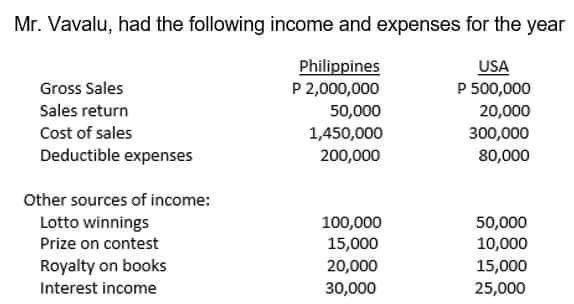

Mr. Vavalu, had the following income and expenses for the year Gross Sales Sales return Philippines P 2,000,000 50,000 1,450,000 USA P 500,000 20,000 300,000 Cost of sales Deductible expenses Other sources of income: Lotto winnings Prize on contest Royalty on books Interest income 200,000 80,000 100,000 50,000 15,000 10,000 20,000 15,000 30,000 25,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting

Authors: Barry Elliott, Jamie Elliott

18th edition

1292162406, 978-1292162409

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App