Question

If Mrs. Little were a young woman looking to grow her wealth, which bond fund would be the most reasonable for her to buy? A.

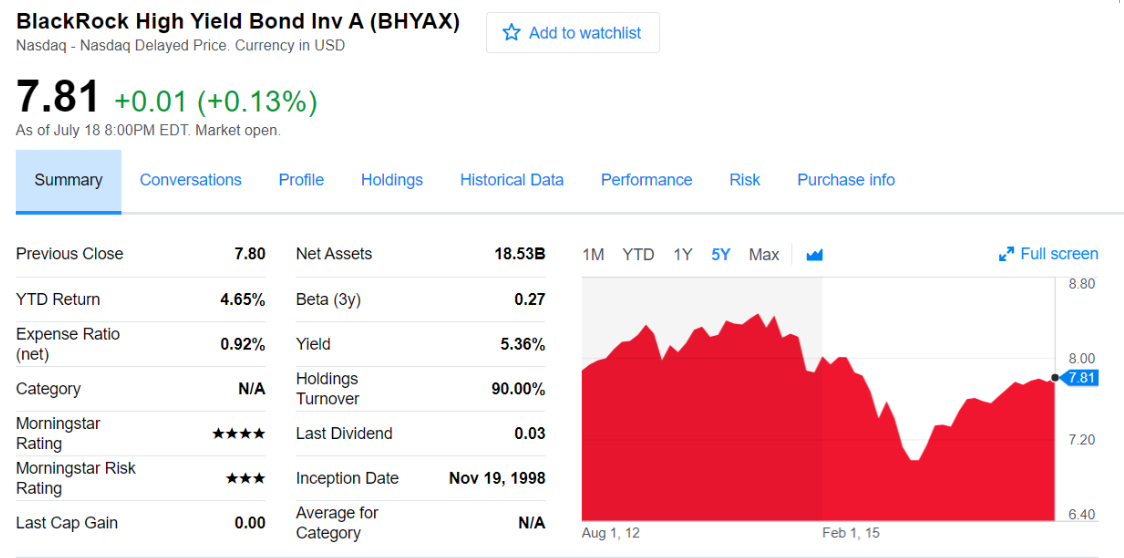

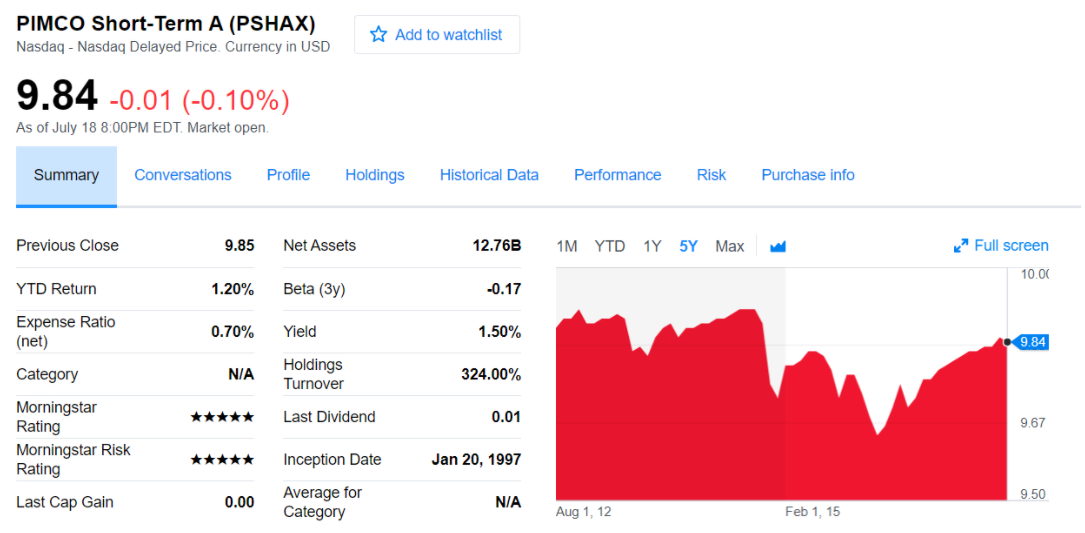

If Mrs. Little were a young woman looking to grow her wealth, which bond fund would be the most reasonable for her to buy?

A. PSHAX because the price per share is higher than the price per share of BHYAX, and thats an indication that its a fund of higher value.

B. PSHAX although the fund has a low yield, over the long-term time frame of the investor, the fund will have time to grow, and do better than the stock market while having lower risk.

C. BHYAX because the fund managers are likely to put a large percentage of the fund into high dividend yield stocks in order to boost both the dividend yield as well as the capital gains.

D. BHYAX because the fund seeks to maximize total returns, and despite the risk of being a junk bond fund, she has time to hold onto the fund if the market drops and wait for a recovery in the economy.

BlackRock High Yield Bond Inv A (BHYAX) Nasdaq - Nasdaq Delayed Price. Currency in USD Add to watchlist 7.81 +0.01 (+0.13%) As of July 18 8:00PM EDT, Market open. Summary Conversations Profile Holdings Historical Data Performance Risk Purchase info Previous Close 7.80 Net Assets 18.53B 1M YTD 1Y 5Y Max * Full screen 8.80 YTD Return 4.65% Beta (3) 0.27 Expense Ratio (net) 0.92% Yield 5.36% 8.00 7.81 Category N/A Holdings Turnover 90.00% **** Last Dividend 0.03 720 Morningstar Rating Morningstar Risk Rating *** Inception Date Nov 19, 1998 6.40 Last Cap Gain 0.00 Average for Category N/A Aug 1, 12 Feb 1, 15 PIMCO Short-Term A (PSHAX) Nasdaq - Nasdaq Delayed Price. Currency in USD Add to watchlist 9.84 -0.01 (-0.10%) As of July 18 8:00PM EDT. Market open. Summary Conversations Profile Holdings Historical Data Performance Risk Purchase info Previous Close 9.85 Net Assets 12.76B 1M YTD 14 5Y Max Full screen 10.00 YTD Return 1.20% Beta (3) -0.17 Expense Ratio (net) 0.70% Yield 1.50% 9.84 N/A Holdings Turnover 324.00% ***** Last Dividend 0.01 9.67 Category Morningstar Rating Morningstar Risk Rating Last Cap Gain ***** Inception Date Jan 20, 1997 9.50 0.00 Average for Category N/A Aug 1, 12 Feb 1, 15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started