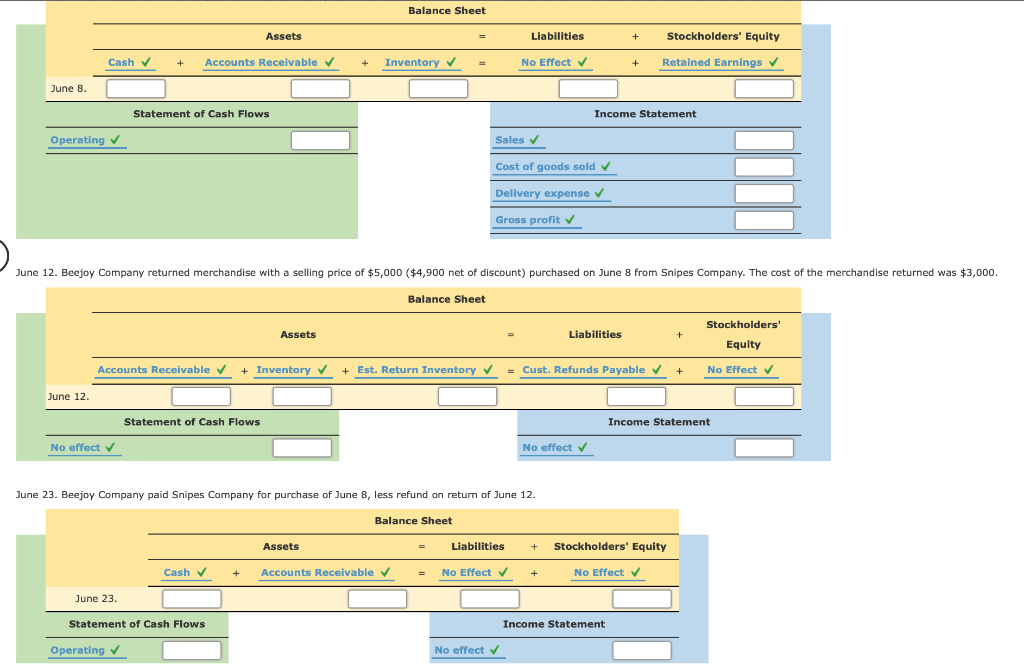

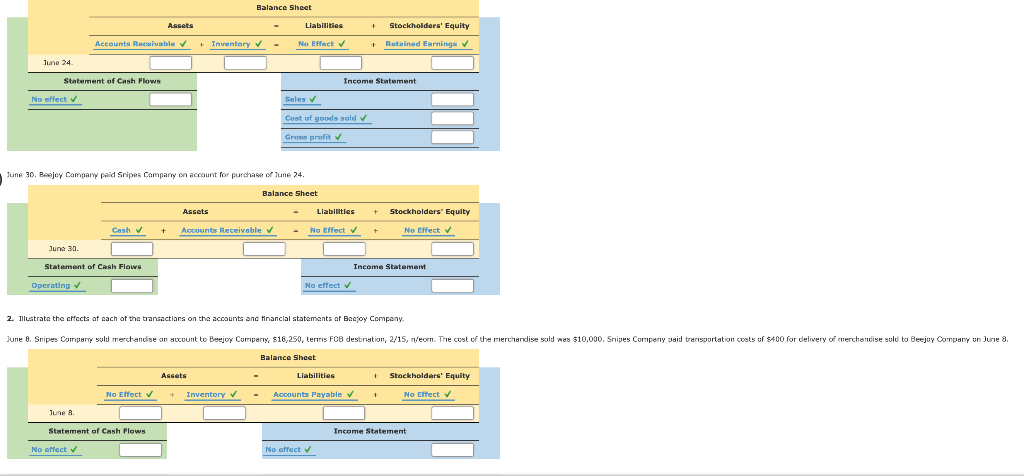

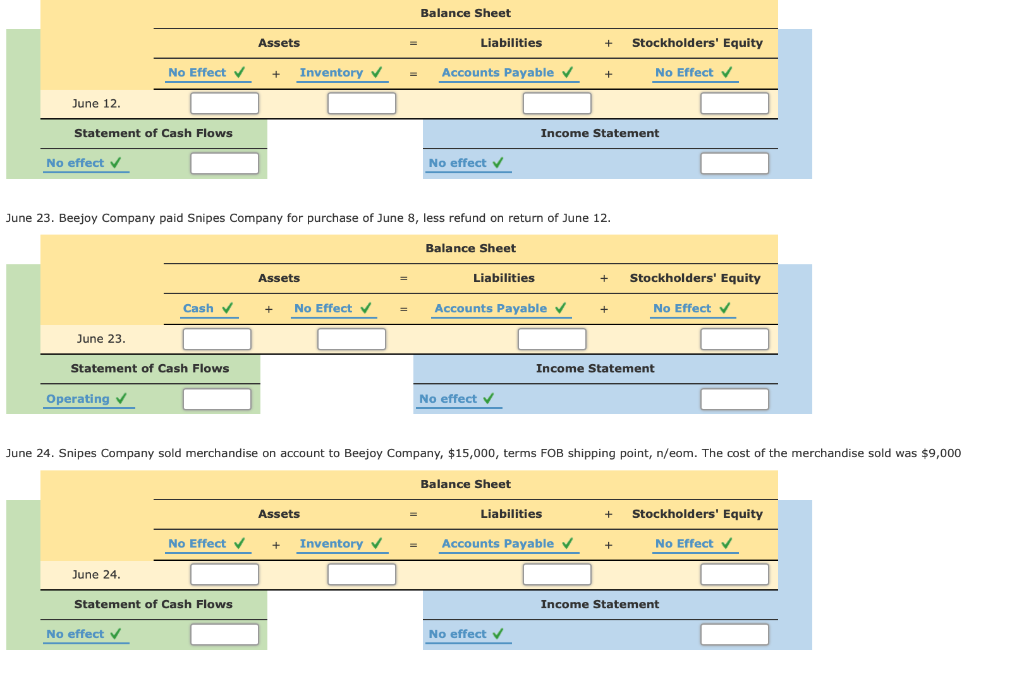

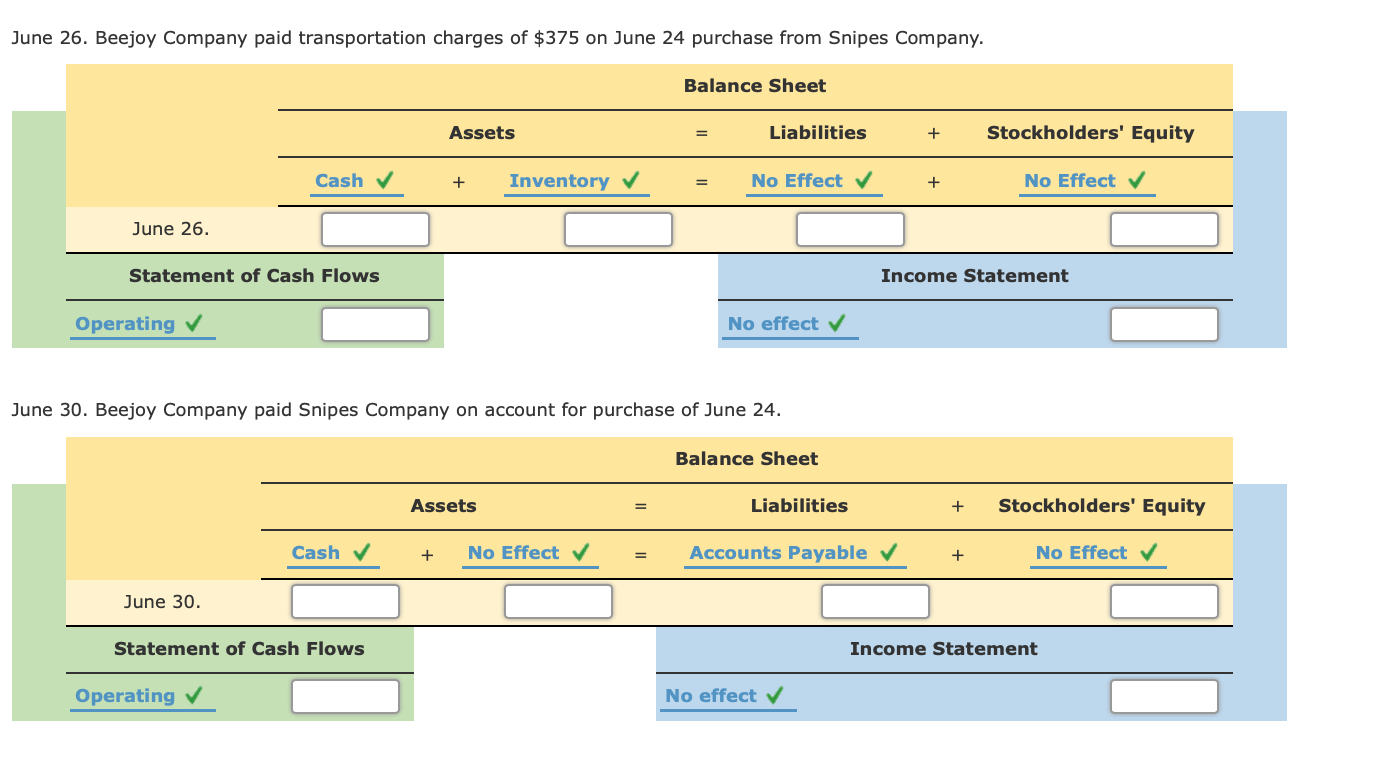

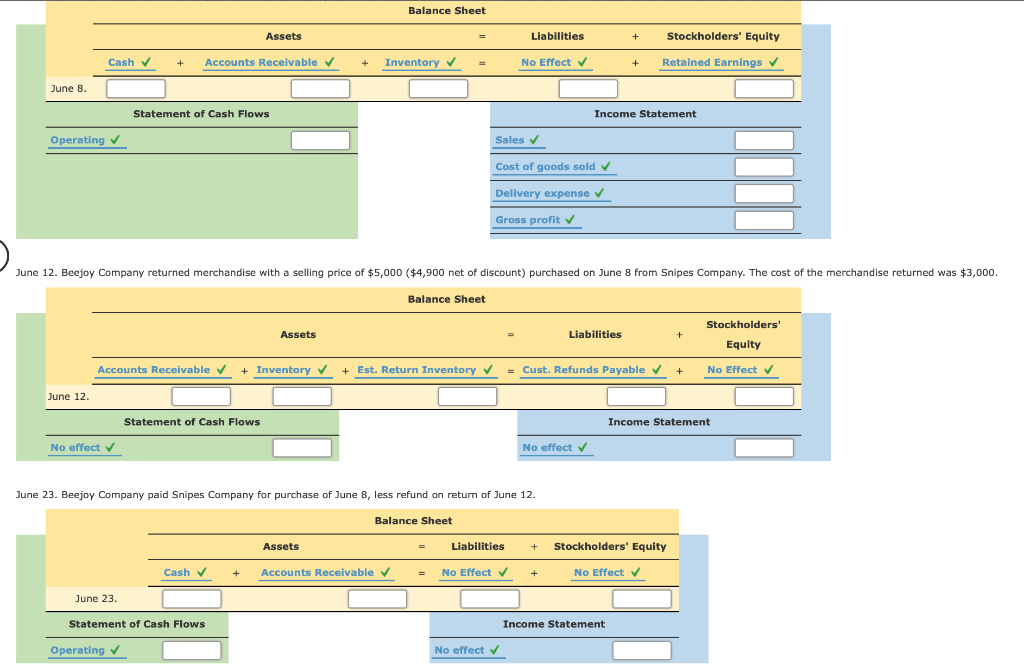

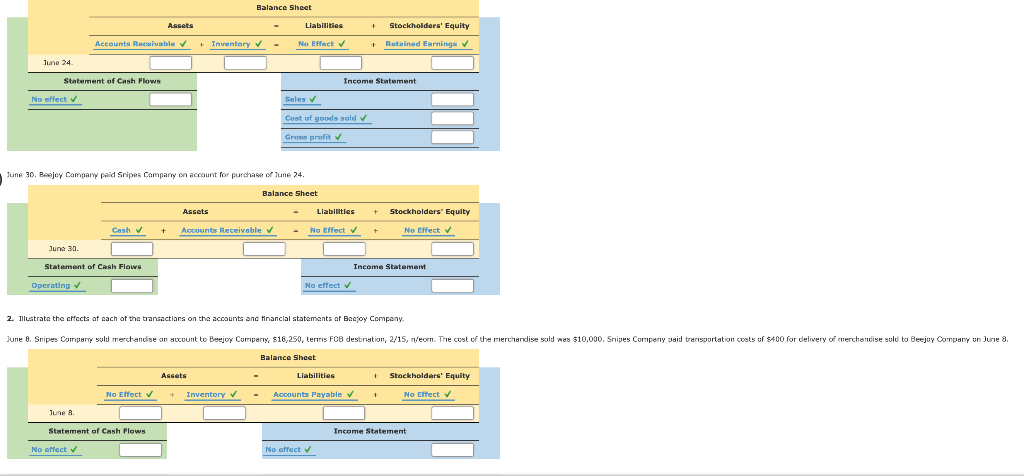

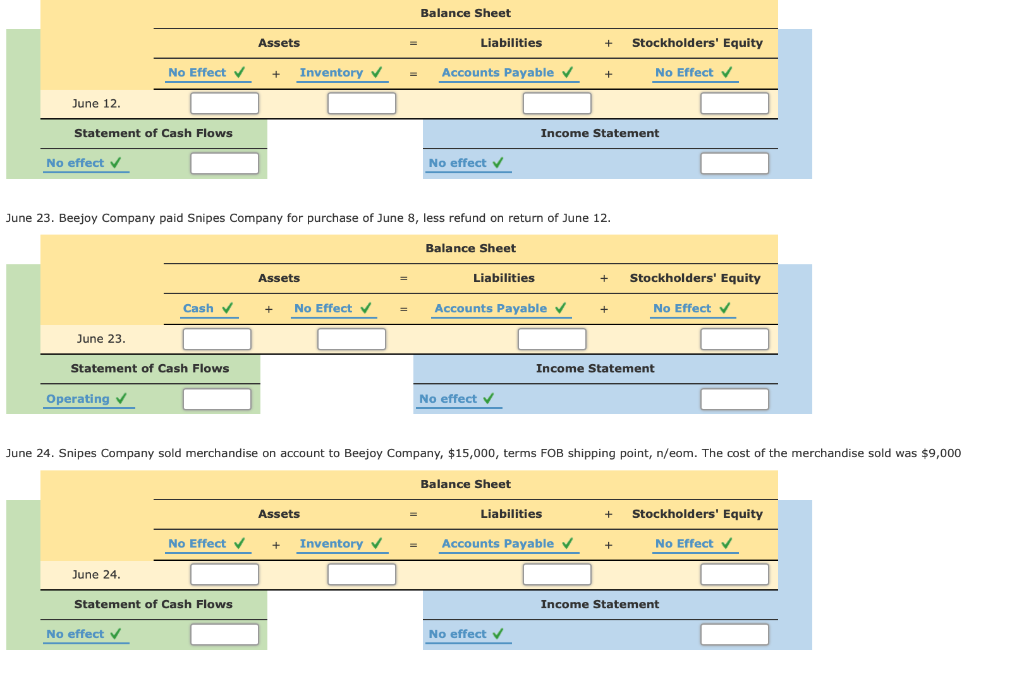

If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. Enter account decreases, cash outflows, and the income statement effects that reduce gross profit as negative amounts.

The following selected transactions were completed during June between Snipes Company and Beejoy Company:

Requirements:

1. Illustrate the effects of each of the transactions on the accounts and financial statements of Snipes Company.

June 8. Snipes Company sold merchandise on account to Beejoy Company, $18,250, terms FOB destination, 2/15, n/eom. The cost of the merchandise sold was $10,000. Snipes Company paid transportation costs of $400 for delivery of the merchandise.

June 24. Snipes Company sold merchandise on account to Beejoy Company, $15,000, terms FOB shipping point, n/eom. The cost of the merchandise sold was $9,000.

June 12. Beejoy Company returned merchandise with a selling price of $5,000 ($4,900 net of discount) purchased on June 8 from Snipes Company. The cost of the merchandise returned was $3,000.

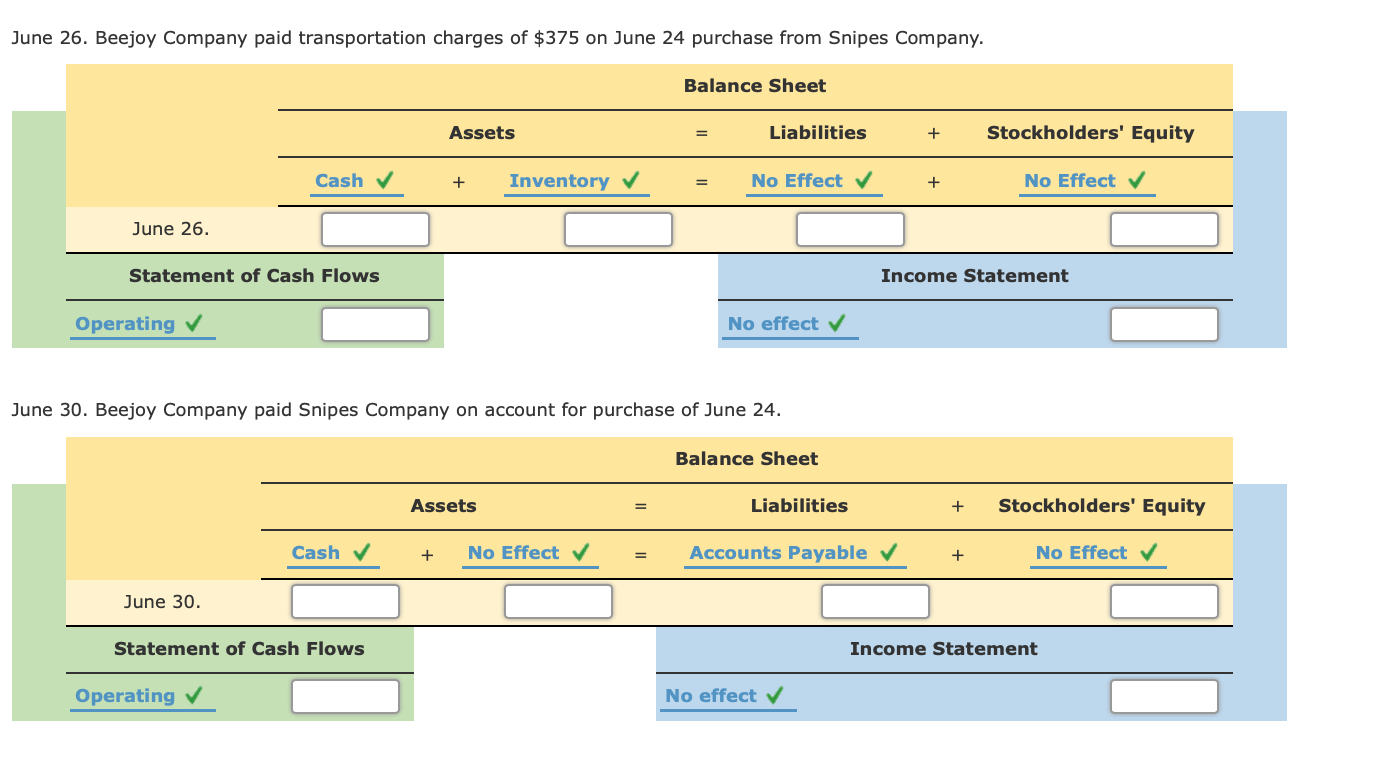

Balance Sheet Assets Liabilities + Stockholders' Equity Cash + Accounts Receivable Inventory No Effect + Retained Earnings June 8. Statement of Cash Flows Income Statement Operating Sales Cost of goods sold Delivery expense Gross profit June 12. Beejoy Company returned merchandise with a selling price of $5,000 ($4,900 net of discount) purchased on June 8 from Snipes Company. The cost of the merchandise returned was $3,000. Balance Sheet Assets Liabilities + Stockholders' Equity No Effect Accounts Receivable + Inventory + Est. Return Inventory = Cust. Refunds Payable + June 12. Statement of Cash Flows Income Statement No effect No effect June 23. Beejoy Company paid Snipes Company for purchase of June 8, less refund on return of June 12. Balance Sheet Assets Liabilities + Stockholders' Equity Cash + Accounts Receivable = No Effect + No Effect June 23. Statement of Cash Flows Income Statement Operating No effect Balance Sheet Assets Liabilities 1 Stockholders' Equity Accounts Receivable + Inventory - No Effect + Retained Earnings June 24 Statement of Cash Flows Income Statement No effect Sales Cost of goods sold Gross profit June 30. Bejoy Company paid Sripes Company on account for purchase of June 24. Balance Sheet Assets Llabilities + Stockholders' Equity Cash + Accounts Receivable No Effect + No Effect June 30. Statement of Cash Flowe Income Statement Operating No effect 2. Illustrate the ctfects of each of the transactions on the accounts and financial statements of Becoy Company June 8. Snipes Company sold merchandise on a count to Bejoy Company, $18,250, terms FOB destination, 2/15, nieom. The cost of the merchandise sold was $10,000. Snipes Company paid transportation costs of $400 for delivery of merchandise sold to Beejuy Company on June 8. Balance Sheet Assets Liabilities Stockholders' Equity No Effect + Inventory Accounts Payable + No Effect June 8. Statement of Cash Flows Income Statement No effect No effect Balance Sheet Assets Liabilities + Stockholders' Equity No Effect + Inventory Accounts Payable + No Effect June 12 Statement of Cash Flows Income Statement No effect No effect June 23. Beejoy Company paid Snipes Company for purchase of June 8, less refund on return of June 12. Balance Sheet Assets Liabilities + Stockholders' Equity Cash + No Effect Accounts Payable + No Effect June 23 Statement of Cash Flows Income Statement Operating No effect June 24. Snipes Company sold merchandise on account to Beejoy Company, $15,000, terms FOB shipping point, n/eom. The cost of the merchandise sold was $9,000 Balance Sheet Assets Liabilities + Stockholders' Equity No Effect + Inventory Accounts Payable + No Effect June 24. Statement of Cash Flows Income Statement No effect No effect June 26. Beejoy Company paid transportation charges of $375 on June 24 purchase from Snipes Company. Balance Sheet Assets Liabilities + Stockholders' Equity Cash + Inventory No Effect + No Effect June 26. Statement of Cash Flows Income Statement Operating No effect June 30. Beejoy Company paid Snipes Company on account for purchase of June 24. Balance Sheet Assets Liabilities + Stockholders' Equity Cash + No Effect Accounts Payable + No Effect June 30. Statement of Cash Flows Income Statement Operating No effect Balance Sheet Assets Liabilities + Stockholders' Equity Cash + Accounts Receivable Inventory No Effect + Retained Earnings June 8. Statement of Cash Flows Income Statement Operating Sales Cost of goods sold Delivery expense Gross profit June 12. Beejoy Company returned merchandise with a selling price of $5,000 ($4,900 net of discount) purchased on June 8 from Snipes Company. The cost of the merchandise returned was $3,000. Balance Sheet Assets Liabilities + Stockholders' Equity No Effect Accounts Receivable + Inventory + Est. Return Inventory = Cust. Refunds Payable + June 12. Statement of Cash Flows Income Statement No effect No effect June 23. Beejoy Company paid Snipes Company for purchase of June 8, less refund on return of June 12. Balance Sheet Assets Liabilities + Stockholders' Equity Cash + Accounts Receivable = No Effect + No Effect June 23. Statement of Cash Flows Income Statement Operating No effect Balance Sheet Assets Liabilities 1 Stockholders' Equity Accounts Receivable + Inventory - No Effect + Retained Earnings June 24 Statement of Cash Flows Income Statement No effect Sales Cost of goods sold Gross profit June 30. Bejoy Company paid Sripes Company on account for purchase of June 24. Balance Sheet Assets Llabilities + Stockholders' Equity Cash + Accounts Receivable No Effect + No Effect June 30. Statement of Cash Flowe Income Statement Operating No effect 2. Illustrate the ctfects of each of the transactions on the accounts and financial statements of Becoy Company June 8. Snipes Company sold merchandise on a count to Bejoy Company, $18,250, terms FOB destination, 2/15, nieom. The cost of the merchandise sold was $10,000. Snipes Company paid transportation costs of $400 for delivery of merchandise sold to Beejuy Company on June 8. Balance Sheet Assets Liabilities Stockholders' Equity No Effect + Inventory Accounts Payable + No Effect June 8. Statement of Cash Flows Income Statement No effect No effect Balance Sheet Assets Liabilities + Stockholders' Equity No Effect + Inventory Accounts Payable + No Effect June 12 Statement of Cash Flows Income Statement No effect No effect June 23. Beejoy Company paid Snipes Company for purchase of June 8, less refund on return of June 12. Balance Sheet Assets Liabilities + Stockholders' Equity Cash + No Effect Accounts Payable + No Effect June 23 Statement of Cash Flows Income Statement Operating No effect June 24. Snipes Company sold merchandise on account to Beejoy Company, $15,000, terms FOB shipping point, n/eom. The cost of the merchandise sold was $9,000 Balance Sheet Assets Liabilities + Stockholders' Equity No Effect + Inventory Accounts Payable + No Effect June 24. Statement of Cash Flows Income Statement No effect No effect June 26. Beejoy Company paid transportation charges of $375 on June 24 purchase from Snipes Company. Balance Sheet Assets Liabilities + Stockholders' Equity Cash + Inventory No Effect + No Effect June 26. Statement of Cash Flows Income Statement Operating No effect June 30. Beejoy Company paid Snipes Company on account for purchase of June 24. Balance Sheet Assets Liabilities + Stockholders' Equity Cash + No Effect Accounts Payable + No Effect June 30. Statement of Cash Flows Income Statement Operating No effect