Question

Hamigo Berhad purchased a plant for RM8 million on 1 May 2018. The asset is depreciated over eight (8) years on the straight line

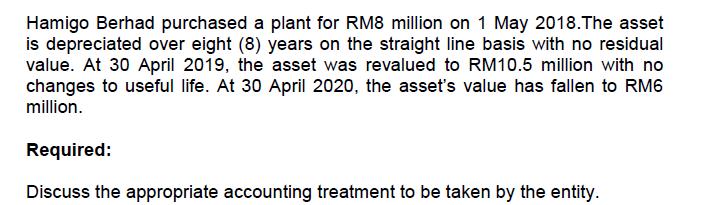

Hamigo Berhad purchased a plant for RM8 million on 1 May 2018. The asset is depreciated over eight (8) years on the straight line basis with no residual value. At 30 April 2019, the asset was revalued to RM10.5 million with no changes to useful life. At 30 April 2020, the asset's value has fallen to RM6 million. Required: Discuss the appropriate accounting treatment to be taken by the entity.

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Straightht line basis is a method of calculating depreciation and amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance An Integrated Planning Approach

Authors: Ralph R Frasca

8th edition

136063039, 978-0136063032

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App