Question

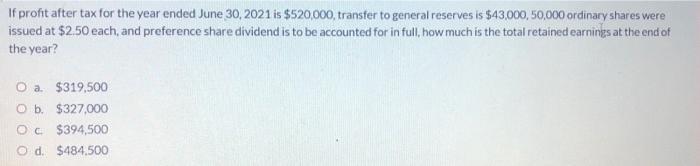

If profit after tax for the year ended June 30, 2021 is $520,000, transfer to general reserves is $43.000, 50,000 ordinary shares were issued

If profit after tax for the year ended June 30, 2021 is $520,000, transfer to general reserves is $43.000, 50,000 ordinary shares were issued at $2.50 each, and preference share dividend is to be accounted for in full, how muchis the total retained earnings at the end of the year? O a $319,500 O b. $327,000 Oc $394,500 O d. $484,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

After tax profit 520000 less General reseve 43000 less pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

2nd Edition

978-0470933268, 470933267, 470876441, 978-0470876442

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App