Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If Sandlands Vineyard decided to buy the building for 500,000, how would this income statement and balance sheet change? Exhibit 7 Typical Profitability and Cost

If Sandlands Vineyard decided to buy the building for 500,000, how would this income statement and balance sheet change?

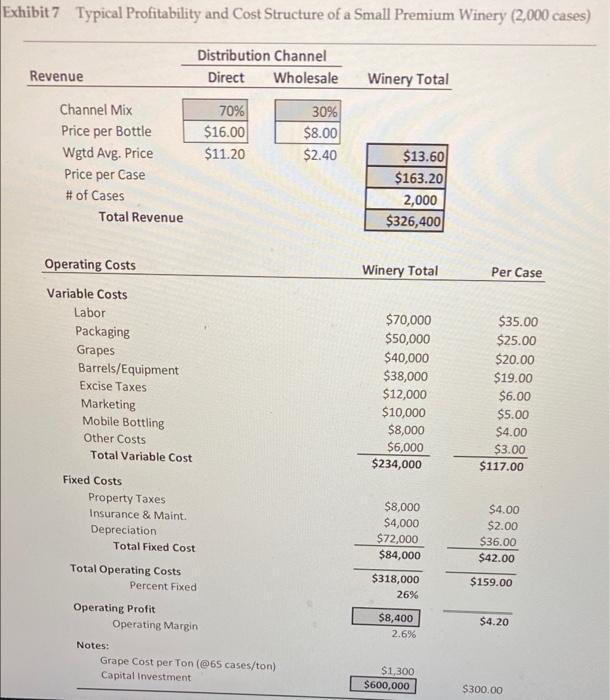

Exhibit 7 Typical Profitability and Cost Structure of a Small Premium Winery (2,000 cases) Distribution Channel Direct Wholesale Revenue Channel Mix Price per Bottle Wgtd Avg. Price Price per Case # of Cases Total Revenue Operating Costs Variable Costs Labor Packaging Grapes Barrels/Equipment Excise Taxes Marketing Mobile Bottling Other Costs Total Variable Cost Fixed Costs Property Taxes Insurance & Maint. Depreciation Total Fixed Cost Total Operating Costs Notes: Percent Fixed Operating Profit Operating Margin 70% $16.00 $11.20 Grape Cost per Ton (@65 cases/ton) Capital Investment 30% $8.00 $2.40 Winery Total $13.60 $163.20 2,000 $326,400 Winery Total $70,000 $50,000 $40,000 $38,000 $12,000 $10,000 $8,000 $6,000 $234,000 $8,000 $4,000 $72,000 $84,000 $318,000 26% $8,400 2.6% $1,300 $600,000 Per Case $35.00 $25.00 $20.00 $19.00 $6.00 $5.00 $4.00 $3.00 $117.00 $4.00 $2.00 $36.00 $42.00 $159.00 $4.20 $300.00

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

If sand lands Vinessed decided to buy building for 500000 how would ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started