if someone can please help me with the general journal and the T chart for the December transactions thank you!

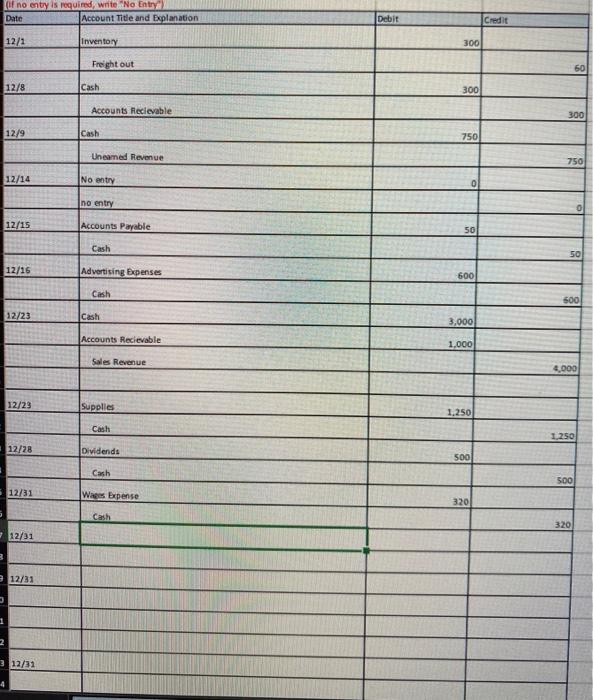

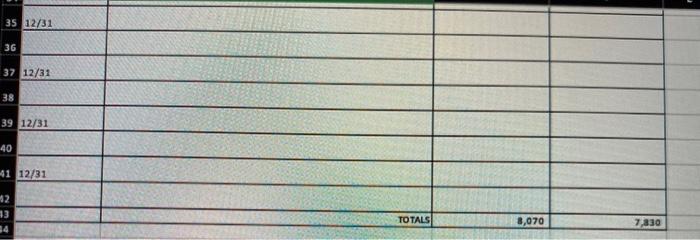

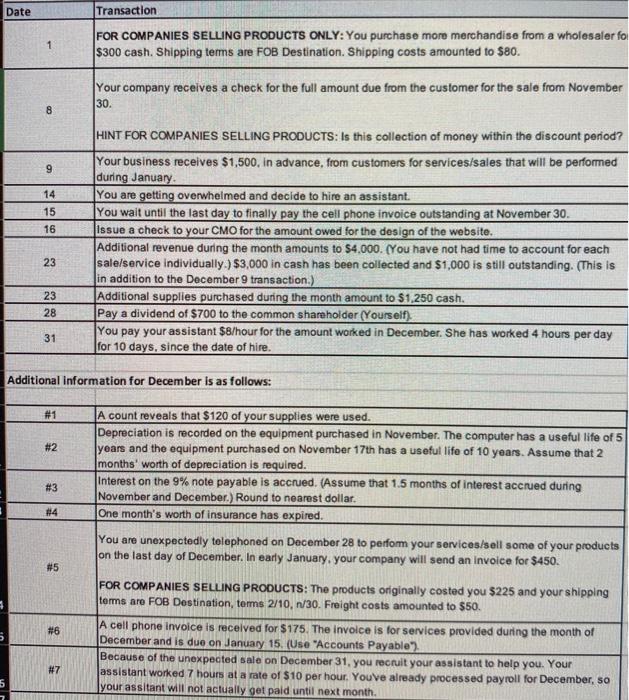

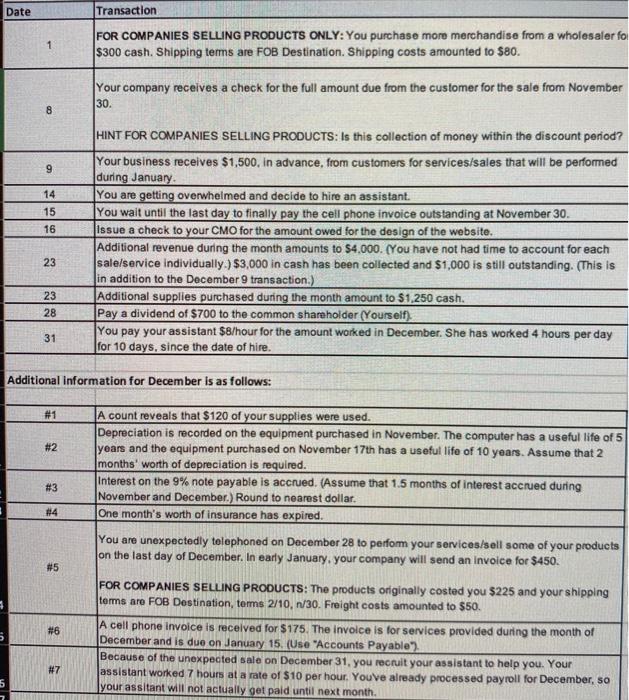

Date Transaction FOR COMPANIES SELLING PRODUCTS ONLY: You purchase more merchandise from a wholesaler for $300 cash. Shipping terms are FOB Destination. Shipping costs amounted to $80. 1 Your company receives a check for the full amount due from the customer for the sale from November 30. GO 9 14 15 16 HINT FOR COMPANIES SELLING PRODUCTS: Is this collection of money within the discount period? Your business receives $1,500, in advance, from customers for services/sales that will be performed during January You are getting overwhelmed and decide to hire an assistant You wait until the last day to finally pay the cell phone invoice outstanding at November 30. Issue a check to your CMO for the amount owed for the design of the website. Additional revenue during the month amounts to $4,000. (You have not had time to account for each sale/service individually.) $3,000 in cash has been collected and $1,000 is still outstanding. (This is in addition to the December 9 transaction.) Additional supplies purchased during the month amount to $1,250 cash. Pay a dividend of $700 to the common shareholder (Yourself). You pay your assistant $8/hour for the amount worked in December. She has worked 4 hours per day for 10 days, since the date of hire. 23 23 28 31 Additional information for December is as follows: #1 #2 #3 A count reveals that $120 of your supplies were used. Depreciation is recorded on the equipment purchased in November. The computer has a useful life of 5 years and the equipment purchased on November 17th has a useful life of 10 years. Assume that 2 months' worth of depreciation is required. Interest on the 9% note payable is accrued. (Assume that 1.5 months of interest accrued during November and December.) Round to nearest dollar. One month's worth of insurance has expired. You are unexpectedly telephoned on December 28 to perfom your services/sell some of your products on the last day of December. In early January, your company will send an invoice for $450. #4 #5 #6 FOR COMPANIES SELLING PRODUCTS: The products originally costed you $225 and your shipping terms are FOB Destination, terms 2/10, 1/30. Freight costs amounted to $50. A cell phone invoice is received for $175. The invoice is for services provided during the month of December and is due on January 15. (Use "Accounts Payable) Because of the unexpected sale on December 31, you recruit your assistant to help you. Your assistant worked 7 hours at a rate of $10 per hour. Youve already processed payroll for December, so your assitant will not actually get paid until next month. #7 no entry is required, write No Entry Date Account Title and Explanation Debit Credit 12/1 Inventory 300 Freight out 60 12/8 Cash 300 Accounts Recievable 300 12/9 Cash 750 Uneamed Revenue 750 12/14 No entry no entry 12/15 Accounts Payable 50 Cash 50 12/16 Advertising Expenses 600 Cash 500 12/23 Cash 3,000 Accounts Recievable 1.000 Sales Revenue 4,000 12/23 Supplies 1.250 Cash 1.250 12/28 Dividends 500 Cash 500 12/31 Wars Expense 320 Cash 320 12/31 12/31 1 2 3 12/31 4 35 12/31 36 37 12/31 38 39 12/31 40 41 12/31 12 TOTALS 8,070 7,830 Cam Inventory Det sed 6 7 te Robe 8 9 10 11 12 tance Notes Payable D tregance 13 14 15 16 17 Endance Unearned Revenue Supplies De brecht Endance Accounts Payable C Det Computer Det Credit Endance 18 Endance 19 20 21 Deg Delante 22 23 24 Endelence 25 26 27 segalance 28 29 Ende 30 31 32 tegalance 33 34 End balance 35 36 37 Dec le 38 39 Melence 40 Advertising Expense Equipment Det DAN be Common Stock Prepaid Insurance Credit De Ilince Cost of Goods Sold Accounts Receivable Erede Debit Service Revenue Credit Cell Phone Expense 12./23 De 42 MB 43 44 45 46 End Balance 47 48 49 Balance 50 51 52 End Balance 53 54 55 g Balance 56 Wages Expense Sede Freight-Out Credit EN Sunces Expense D E B Supplies Expense Dose Kredit De Balance Dividends De Credit End Balance 6 7 8 Endance 9 O 51 Bee Balance 2 3 54 End Bence 55 56 57 beg Balance 58 Depreciation Expense Crede Debt Leg Balance Accumulated Depreciation Equipment Debt End Balance Interest Expense Credit Debt Meg Balance Accumulated Depreciation Computer Debt ind Band Insurance Expense Credit Det 20 End Balance 21 22 73 Beg Bline 74 75 76 Endance 77 78 79 begance 80 81 De Bebe Interest Payable (both Credit Endance Wages Payable Debt cre 82 in ce 83 84 85 g 86 87 88 End Balance 89 90

if someone can please help me with the general journal and the T chart for the December transactions thank you!

if someone can please help me with the general journal and the T chart for the December transactions thank you!