Answered step by step

Verified Expert Solution

Question

1 Approved Answer

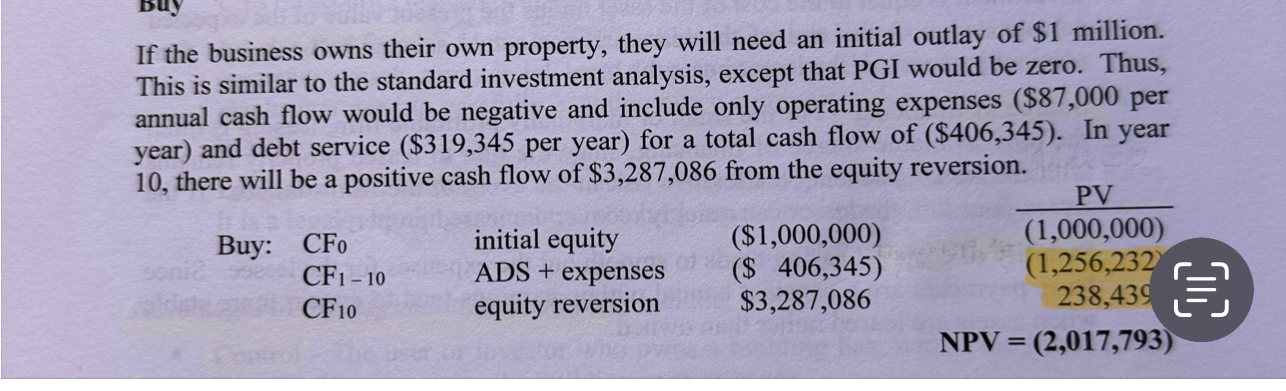

If the business owns their own property, they will need an initial outlay of $ 1 million. This is similar to the standard investment analysis,

If the business owns their own property, they will need an initial outlay of $ million. This is similar to the standard investment analysis, except that PGI would be zero. Thus, annual cash flow would be negative and include only operating expenses per year and debt service $ per year for a total cash flow of $ In year there will be a positive cash flow of $ from the equity reversion.

tablere win,,,Buy: initial equity,$

HOW WE GET THE PV NUMBERS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started