Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the cost of capital is 8%, evaluate the proposed investment using the following techniques: a. Payback, b. Return on Investment, c. Net Present Value,

If the cost of capital is 8%, evaluate the proposed investment using the following techniques:

a. Payback,

b. Return on Investment,

c. Net Present Value,

d. Discounted Net Present Value,

e. Internal Rate of Return.

Please answer it properly with calculations.

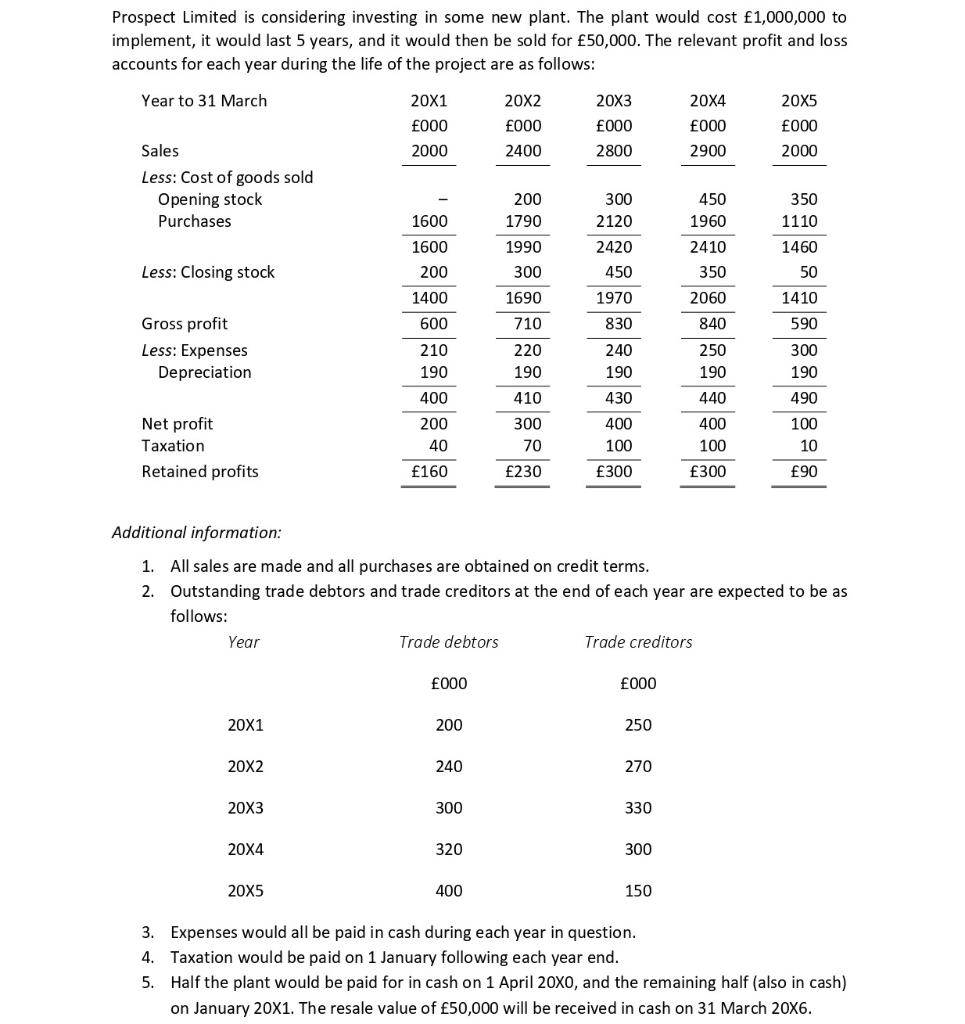

Prospect Limited is considering investing in some new plant. The plant would cost 1,000,000 to implement, it would last 5 years, and it would then be sold for 50,000. The relevant profit and loss accounts for each year during the life of the project are as follows: Additional information: 1. All sales are made and all purchases are obtained on credit terms. 2. Outstanding trade debtors and trade creditors at the end of each year are expected to be as follows: 3. Expenses would all be paid in cash during each year in question. 4. Taxation would be paid on 1 January following each year end. 5. Half the plant would be paid for in cash on 1 April 20X0, and the remaining half (also in cash) on January 201. The resale value of 50,000 will be received in cash on 31 March 206Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started