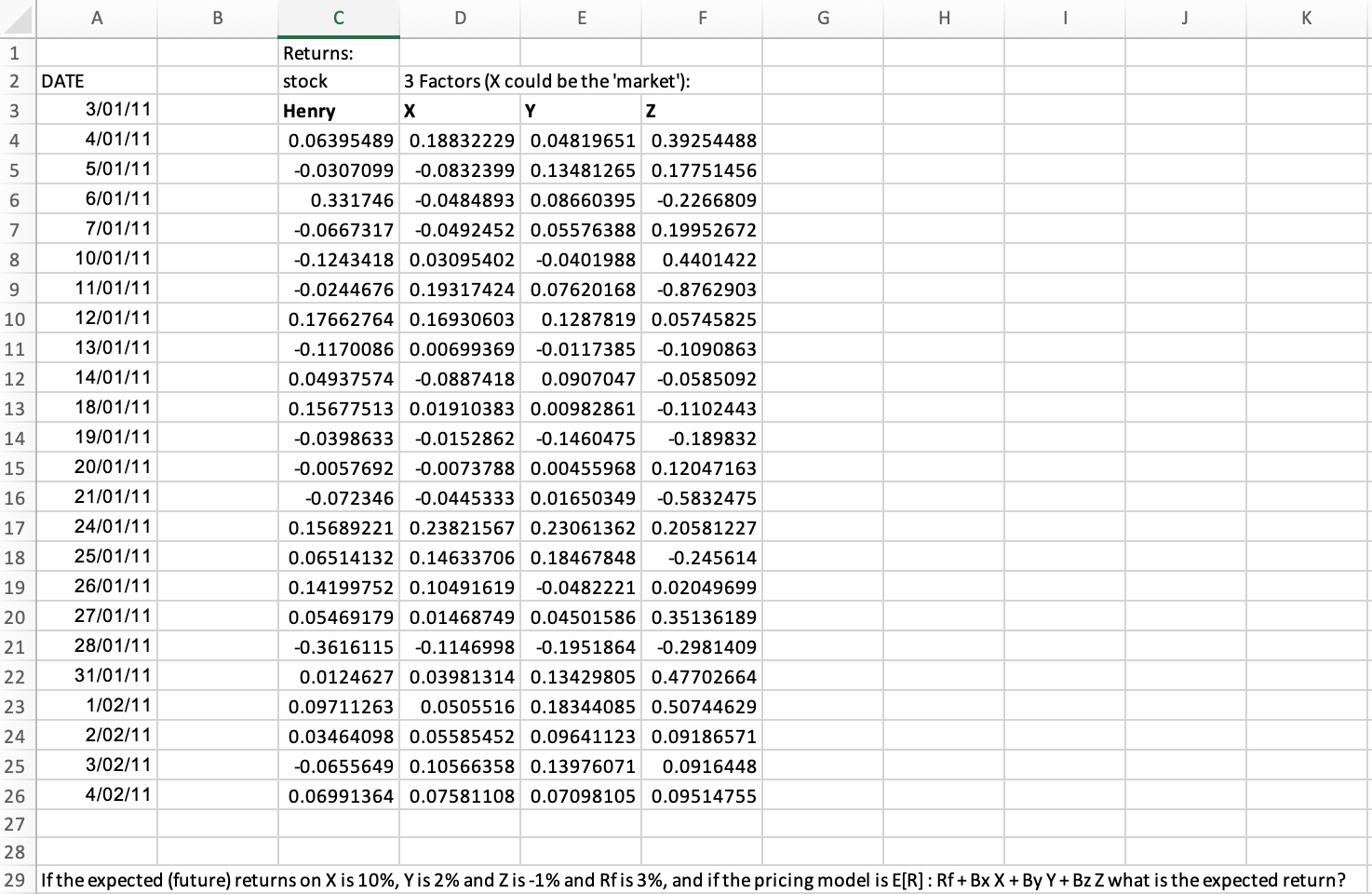

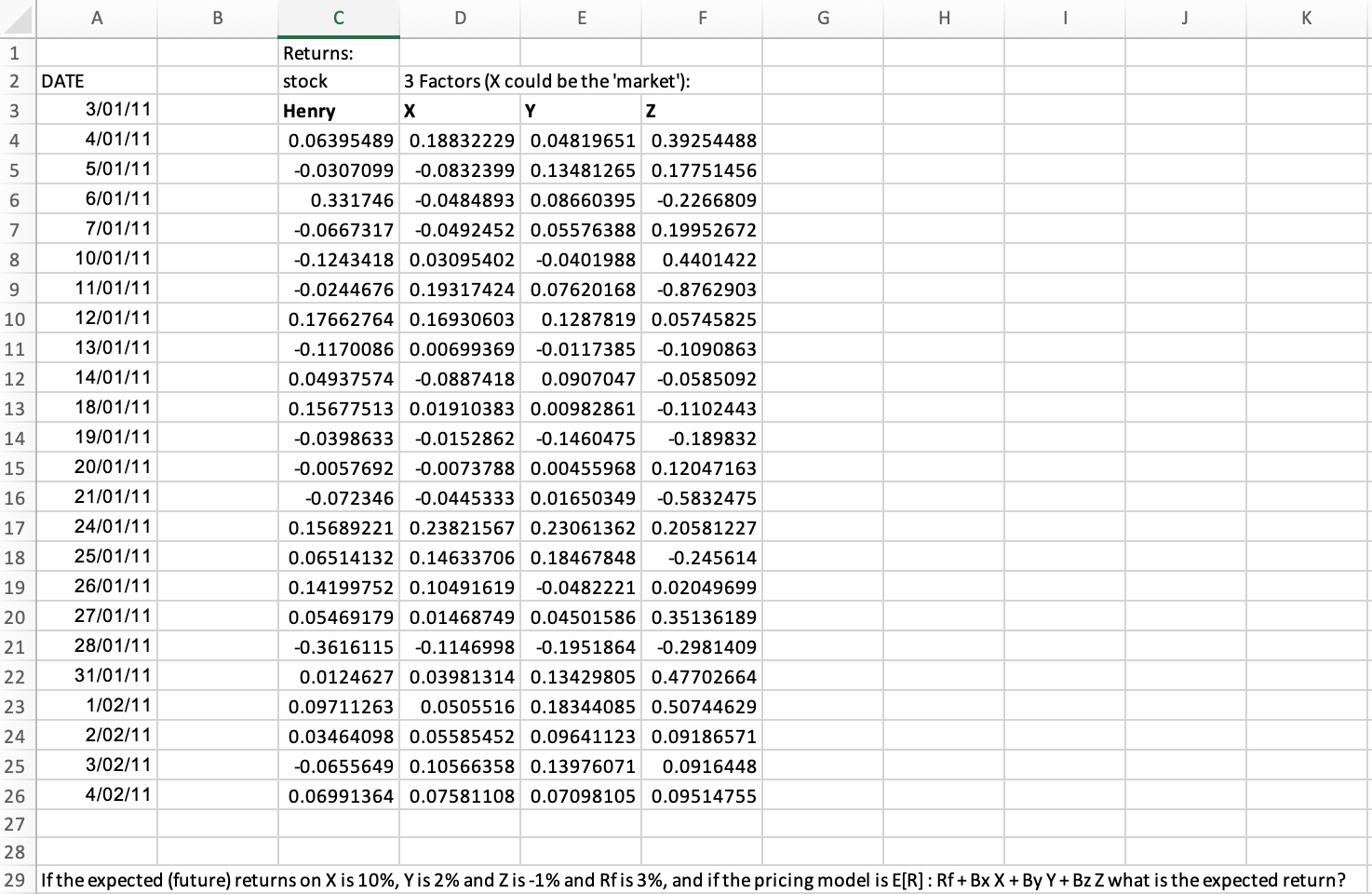

If the expected (future) returns on X is 10%, Y is 2% and Z is -1% and Rf is 3%, and if the pricing model is E[R] : Rf + Bx X + By Y + Bz Z what is the expected return?

C D E F J K 1 Returns: 2 DATE stock 3 Factors (X could be the 'market'): 3 3/01/11 Henry X Y Z 4 4/01/11 0.06395489 0.18832229 0.04819651 0.39254488 -0.0307099 -0.0832399 0.13481265 0.17751456 5 5/01/11 6/01/11 6 7 8 9 10 11 7/01/11 10/01/11 11/01/11 12/01/11 13/01/11 14/01/11 18/01/11 19/01/11 20/01/11 21/01/11 12 13 14 15 16 0.331746 -0.0484893 0.08660395 -0.2266809 -0.0667317 -0.0492452 0.05576388 0.19952672 -0.1243418 0.03095402 -0.0401988 0.4401422 -0.0244676 0.19317424 0.07620168 -0.8762903 0.17662764 0.16930603 0.1287819 0.05745825 -0.1170086 0.00699369 -0.0117385 -0.1090863 0.04937574 -0.0887418 0.0907047 -0.0585092 0.15677513 0.01910383 0.00982861 -0.1102443 -0.0398633 -0.0152862 -0.1460475 -0.189832 -0.0057692 -0.0073788 0.00455968 0.12047163 -0.072346 -0.0445333 0.01650349 -0.5832475 0.15689221 0.23821567 0.23061362 0.20581227 0.06514132 0.14633706 0.18467848 -0.245614 0.14199752 0.10491619 -0.0482221 0.02049699 0.05469179 0.01468749 0.04501586 0.35136189 -0.3616115 -0.1146998 -0.1951864 -0.2981409 0.0124627 0.03981314 0.13429805 0.47702664 0.09711263 0.0505516 0.18344085 0.50744629 0.03464098 0.05585452 0.09641123 0.09186571 -0.0655649 0.10566358 0.13976071 0.0916448 0.06991364 0.07581108 0.07098105 0.09514755 17 24/01/11 18 19 20 25/01/11 26/01/11 27/01/11 28/01/11 31/01/11 21 22 23 24 1/02/11 2/02/11 3/02/11 25 26 4/02/11 27 28 29 If the expected (future) returns on X is 10%, Y is 2% and Z is -1% and Rf is 3%, and if the pricing model is E[R]: Rf + Bx X + By Y+BzZ what is the expected return? A B G H I C D E F J K 1 Returns: 2 DATE stock 3 Factors (X could be the 'market'): 3 3/01/11 Henry X Y Z 4 4/01/11 0.06395489 0.18832229 0.04819651 0.39254488 -0.0307099 -0.0832399 0.13481265 0.17751456 5 5/01/11 6/01/11 6 7 8 9 10 11 7/01/11 10/01/11 11/01/11 12/01/11 13/01/11 14/01/11 18/01/11 19/01/11 20/01/11 21/01/11 12 13 14 15 16 0.331746 -0.0484893 0.08660395 -0.2266809 -0.0667317 -0.0492452 0.05576388 0.19952672 -0.1243418 0.03095402 -0.0401988 0.4401422 -0.0244676 0.19317424 0.07620168 -0.8762903 0.17662764 0.16930603 0.1287819 0.05745825 -0.1170086 0.00699369 -0.0117385 -0.1090863 0.04937574 -0.0887418 0.0907047 -0.0585092 0.15677513 0.01910383 0.00982861 -0.1102443 -0.0398633 -0.0152862 -0.1460475 -0.189832 -0.0057692 -0.0073788 0.00455968 0.12047163 -0.072346 -0.0445333 0.01650349 -0.5832475 0.15689221 0.23821567 0.23061362 0.20581227 0.06514132 0.14633706 0.18467848 -0.245614 0.14199752 0.10491619 -0.0482221 0.02049699 0.05469179 0.01468749 0.04501586 0.35136189 -0.3616115 -0.1146998 -0.1951864 -0.2981409 0.0124627 0.03981314 0.13429805 0.47702664 0.09711263 0.0505516 0.18344085 0.50744629 0.03464098 0.05585452 0.09641123 0.09186571 -0.0655649 0.10566358 0.13976071 0.0916448 0.06991364 0.07581108 0.07098105 0.09514755 17 24/01/11 18 19 20 25/01/11 26/01/11 27/01/11 28/01/11 31/01/11 21 22 23 24 1/02/11 2/02/11 3/02/11 25 26 4/02/11 27 28 29 If the expected (future) returns on X is 10%, Y is 2% and Z is -1% and Rf is 3%, and if the pricing model is E[R]: Rf + Bx X + By Y+BzZ what is the expected return? A B G H