Answered step by step

Verified Expert Solution

Question

1 Approved Answer

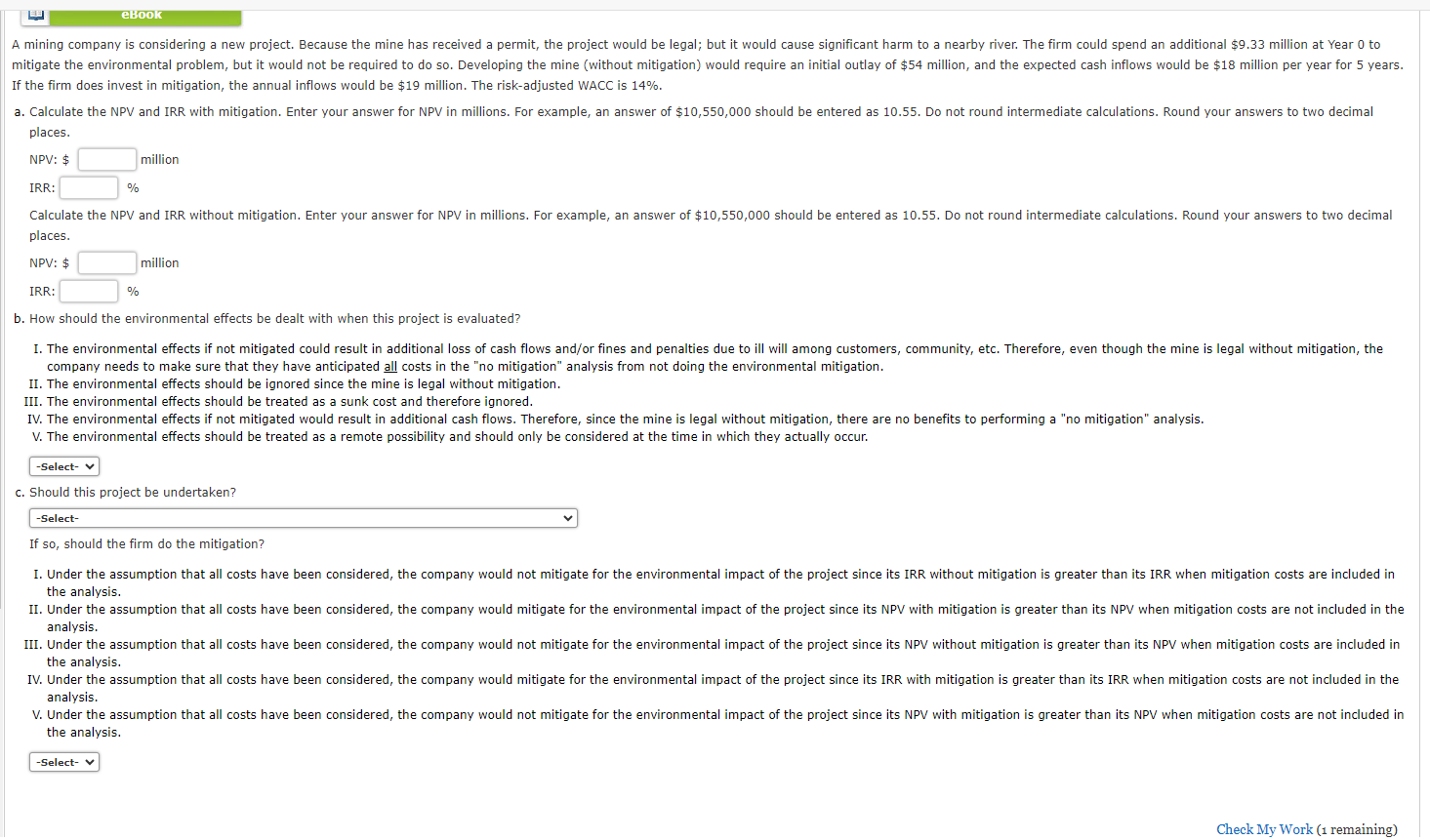

If the firm does invest in mitigation, the annual inflows would be $19 million. The risk-adjusted WACC is 14%. places. NPV: $ million IRR: %

If the firm does invest in mitigation, the annual inflows would be $19 million. The risk-adjusted WACC is 14%. places. NPV: $ million IRR: % places. NPV: $ million IRR: % b. How should the environmental effects be dealt with when this project is evaluated? company needs to make sure that they have anticipated all costs in the "no mitigation" analysis from not doing the environmental mitigation. II. The environmental effects should be ignored since the mine is legal without mitigation. III. The environmental effects should be treated as a sunk cost and therefore ignored. V. The environmental effects should be treated as a remote possibility and should only be considered at the time in which they actually occur. c. Should this project be undertaken? -Select- If so, should the firm do the mitigation? the analysis. analysis. the analysis. analysis. the analysis

If the firm does invest in mitigation, the annual inflows would be $19 million. The risk-adjusted WACC is 14%. places. NPV: $ million IRR: % places. NPV: $ million IRR: % b. How should the environmental effects be dealt with when this project is evaluated? company needs to make sure that they have anticipated all costs in the "no mitigation" analysis from not doing the environmental mitigation. II. The environmental effects should be ignored since the mine is legal without mitigation. III. The environmental effects should be treated as a sunk cost and therefore ignored. V. The environmental effects should be treated as a remote possibility and should only be considered at the time in which they actually occur. c. Should this project be undertaken? -Select- If so, should the firm do the mitigation? the analysis. analysis. the analysis. analysis. the analysis Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started