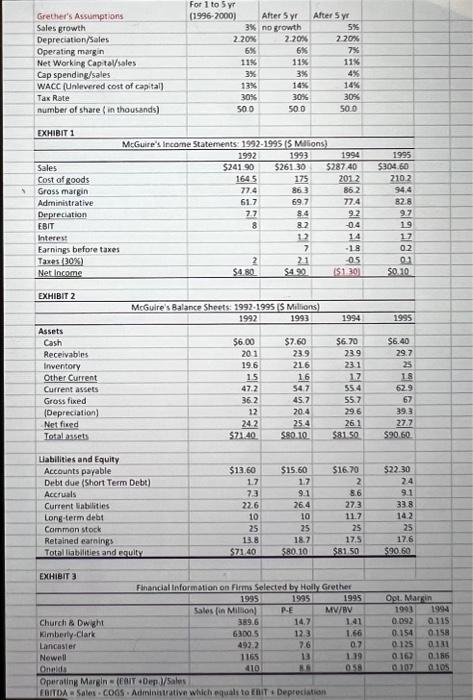

If the marketing estimation is correct, the spilt off of McGuire helps the company

achieve a fast growth after 5 years. Then use a DCF methodology (Discounted Free

Cash Flow Model) to estimate the equity value of McGuire assuming that the total

sales have a growth rate at 5% after five years (starting from 2000).

\begin{tabular}{|c|c|c|c|c|} \hline Grether's Assumptions & \begin{tabular}{l} For 1 to 5yr \\ (19962000) \end{tabular} & After 5yr & After 5yr & \\ \hline Sales growth & 3% & no growth & 5% & \\ \hline Depreciation/sales & 2206 & 2.2006 & 2206 & \\ \hline Operating margin & 6x & 6.5 & 7% & \\ \hline Net Working Capital/sales & 1116 & 11% & 11% & \\ \hline Cap spending/sales & 3% & 3\% & 4% & \\ \hline WACC (Unlewwered cost of capital] & 13% & 145 & 14% & \\ \hline Tax Rate & 30% & 30% & 30% & \\ \hline number of share (in thousands) & 500 & 500 & 50.0 & \\ \hline \multicolumn{5}{|l|}{ EXHIBIT 1} \\ \hline \multicolumn{5}{|c|}{ McGuire's income Statements: 19221995 (S Mulions) } \\ \hline & 1992 & 1993 & 1994 & 1995 \\ \hline Sales & $24190 & $26130 & 5287.40 & 5304.60 \\ \hline Cost of goods & 1645 & 175 & 2012 & 210.2 \\ \hline Gross margin & 77.4 & 863 & 86.2 & 94.4 \\ \hline Administrative & 61.7 & 69.7 & 77.4 & 82.8 \\ \hline Depreciation & 27 & 8.4 & 9.2 & 9.7 \\ \hline EBIT & 8 & 3.2 & -0.4 & 19 \\ \hline interes: & & 12 & 1.4 & 17 \\ \hline Earnings before taxes & & 7 & -18 & 0.2 \\ \hline Taxes(300S) & 2 & 21 & -05 & 01 \\ \hline Ner Income & 54.80 & 54.9 & & 50.10 \\ \hline \multicolumn{5}{|l|}{ EXHIBIT 2} \\ \hline \multicolumn{5}{|c|}{ MoGuire's Balance Shepts: 1992-1995 (S Miltions) } \\ \hline & 1992 & 1993 & 1994 & 1985 \\ \hline \multicolumn{5}{|l|}{ Assets } \\ \hline Cash & $6.00 & $7.60 & $6.70 & $6.40 \\ \hline Receivabies & 201 & 23.9 & 239 & 29.7 \\ \hline Inventory & 19.6 & 21.6 & 231 & 25 \\ \hline Other Current & 15 & 16 & 17 & 18 \\ \hline Current assets & 47.2 & 54.7 & 55.4 & 629 \\ \hline Gross fixed & 36.2 & 45.7 & 55.7 & 67 \\ \hline (Depreciation) & 12 & 20.4 & 29.6 & 39.3 \\ \hline Net fined & 24.2 & 25.4 & 261 & 277 \\ \hline Totalassets & 571.40 & 580.10 & $8150 & $90.60 \\ \hline \multicolumn{5}{|l|}{ Uabilities and Equity } \\ \hline Accounts parable & $13.60 & $15.60 & $16.70 & $22.30 \\ \hline Debu due (Short Term Debs) & 1.7 & 17 & 2 & 24 \\ \hline Accruals & 73 & 9.1 & 8.6 & 9.1 \\ \hline Current liablities & 22.6 & 26.4 & 27.3 & 33.8 \\ \hline Long-term debt & 10 & 10 & 11.7 & 14.2 \\ \hline Cornmon stock & 25 & 25 & 25 & 25 \\ \hline Retained earnings & 13.8 & 187 & 175 & 17.6 \\ \hline Totall liabilities and equity & 57140 & 580.10 & $8150 & 590.60 \\ \hline \end{tabular} ExHIEIT 3 \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Financial Informstion on Firms Selected by Holly Grether } \\ \hline & 1995 & 1995 & 1995 & Opt M & \\ \hline & Soles [in Milion) & P.E & MN/BV & 1903 & 1904 \\ \hline Church \& Dwight & 389.6 & 14.7 & 1.41 & 0.002 & 0.115 \\ \hline Bimberly-Clark & 63005 & 123 & 1.66 & 0.154 & 0.158 \\ \hline Lancaster & 4922 & 76 & 0.7 & 0.125 & 0.191 \\ \hline Newell & 1165 & 13 & 119 & 0.162 & 0.166 \\ \hline Onaide. & 410 & & 0.58 & 0102 & 0.108 \\ \hline \end{tabular}