Answered step by step

Verified Expert Solution

Question

1 Approved Answer

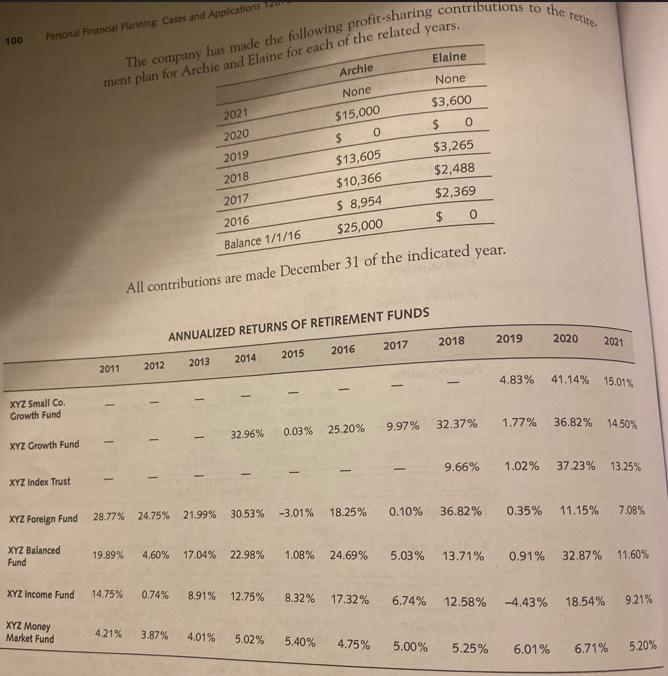

If the Peytons had earned an average return equal to that of the XYZ Balanced Fund (13.6%) on the ABC Company profit-sharing plan contributions to

If the Peytons had earned an average return equal to that of the XYZ Balanced Fund (13.6%) on the ABC Company profit-sharing plan contributions to the Peytons' plan accounts, how much better off would Archie's account be as of 2022 (answer in $ amount)?

If the Peytons had earned an average return equal to that of the XYZ Balanced Fund (13.6%) on the ABC Company profit-sharing plan contributions to the Peytons' plan accounts, how much better off would Archie's account be as of 2022 (answer in $ amount)?

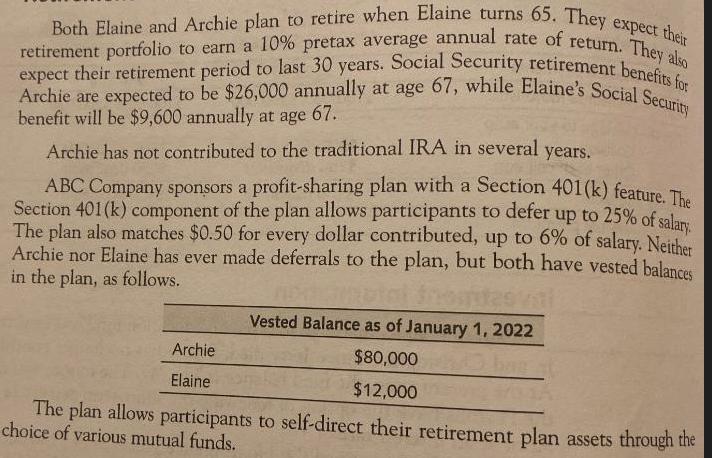

Both Elaine and Archie plan to retire when Elaine turns 65. They expect their retirement portfolio to earn a 10% pretax average annual rate of return. They also expect their retirement period to last 30 years. Social Security retirement benefits for Archie are expected to be $26,000 annually at age 67, while Elaine's Social Security benefit will be $9,600 annually at age 67. Archie has not contributed to the traditional IRA in several several years. ABC Company sponsors a profit-sharing plan with a Section 401(k) feature. The Section 401(k) component of the plan allows participants to defer up to 25% of salary. The plan also matches $0.50 for every dollar contributed, up to 6% of salary. Neither Archie nor Elaine has ever made deferrals to the plan, but both have vested balances in the plan, as follows. Vested Balance as of January 1, 2022 $80,000 $12,000 The plan allows participants to self-direct their retirement plan assets through the choice of various mutual funds. Archie Elaine

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine how much better off Archies account would be if it had earned an average return of 136 instead of the actual returns we need to calculate the difference between the actual account value a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started