Answered step by step

Verified Expert Solution

Question

1 Approved Answer

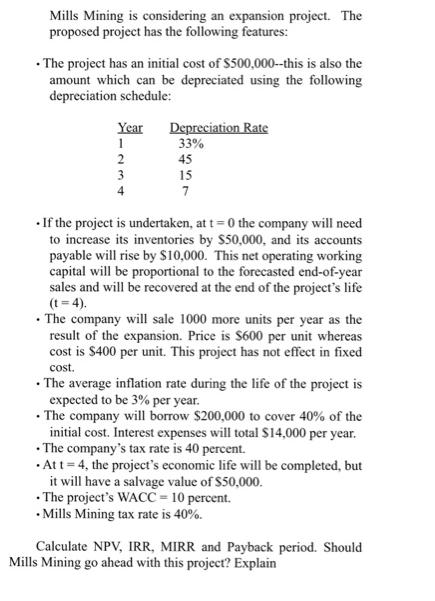

Mills Mining is considering an expansion project. The proposed project has the following features: . The project has an initial cost of $500,000--this is

Mills Mining is considering an expansion project. The proposed project has the following features: . The project has an initial cost of $500,000--this is also the amount which can be depreciated using the following depreciation schedule: Year 1 2 3 4 Depreciation Rate 33% 45 15 7 . If the project is undertaken, at t=0 the company will need to increase its inventories by $50,000, and its accounts payable will rise by $10,000. This net operating working capital will be proportional to the forecasted end-of-year sales and will be recovered at the end of the project's life (t = 4). . The company will sale 1000 more units per year as the result of the expansion. Price is $600 per unit whereas cost is $400 per unit. This project has not effect in fixed cost. The average inflation rate during the life of the project is expected to be 3% per year. The company will borrow $200,000 to cover 40% of the initial cost. Interest expenses will total $14,000 per year. The company's tax rate is 40 percent. . At t= 4, the project's economic life will be completed, but it will have a salvage value of $50,000. The project's WACC = 10 percent. Mills Mining tax rate is 40%. Calculate NPV, IRR, MIRR and Payback period. Should Mills Mining go ahead with this project? Explain

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

NPV The net present value NPV is a measure of the profitability of a project calculated by subtracting the present value of the projects future cash outflows from the present value of its future cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started