Question

if The publisher is thinking of offering a buy-back contract to the book store. According to this contract, it will sell books to the book

if The publisher is thinking of offering a buy-back contract to the book store. According to this contract, it will sell books to the book store at a price of w per copy; but at the end of the season, it will buy back unsold copies at a price of b per copy. The publisher will dispose all unsold copies at 50% off the retail price.

When w = 25, what is the buy-back price b that the publisher should use to induce a critical ratio = 80%? What is the new optimal quantity Q that the book store should order now, to maximize his expected profits? Round up Q to integer if necessary.

Detail for question and answers to first two:

Purdue Book Store is trying to decide on how many copies of a book to purchase from the McGraw Hill publisher at the start of a selling season. The book retails at $28 per copy at the book store, and costs $15 for the book publisher to produce each copy. Purdue Book Store will dispose of all of the unsold copies of the book at 50% off the retail price at the end of the season.

It is estimated that demand for this book during the season is Normal with a mean of 1000 and a standard deviation of 250.

We consider the book publisher ("supplier") and the book store ("retailer") as a simple supply chain.

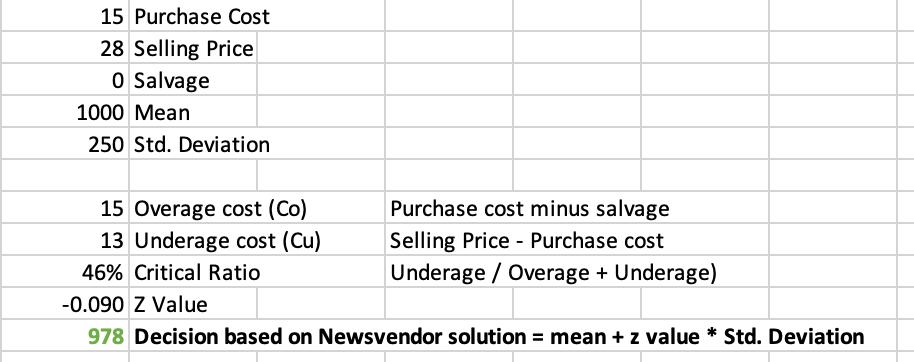

- First, consider the centralized case where the supplier and retailer belong to the same company. What is the optimal quantity Q that the book store should order from the publisher to maximize the total supply chain's profit? Round upQ to integer if necessary.

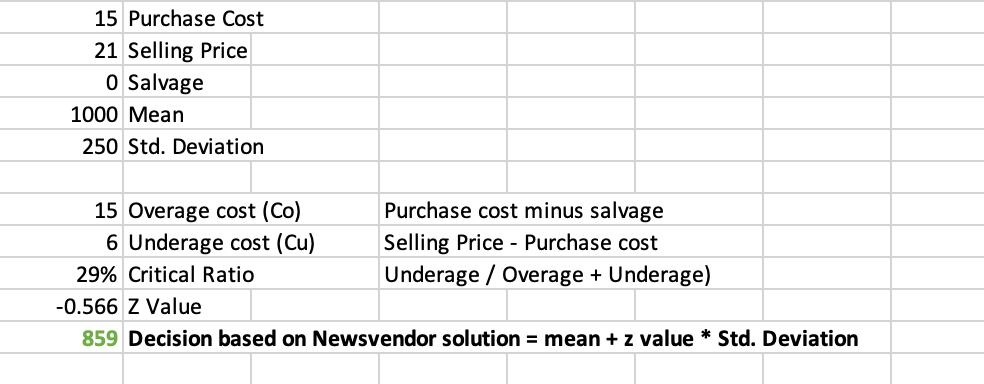

- Then, consider the decentralized case without any coordination. The publisher sells the book to the book store at $21 per copy. Now, what is the optimal quantity Q that the book store should order from the publisher to maximize his own expected profits? Round up Q to integer if necessary.

15 Purchase Cost 28 Selling Price O Salvage 1000 Mean 250 Std. Deviation 15 Overage cost (Co) 13 Underage cost (Cu) 46% Critical Ratio Purchase cost minus salvage Selling Price Purchase cost Underage / Overage + Underage) -0.090 Z Value 978 Decision based on Newsvendor solution = mean + z value * Std. Deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To find the optimal quantity Q that the book store should order from the publisher in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started