Question

The Permanent Income Hypothesis (PIH) is an economic theory attempting to describe how agents spread consumption over their lifetimes. First developed by Milton Friedman, it

The Permanent Income Hypothesis (PIH) is an economic theory attempting to describe how agents spread consumption over their lifetimes. First developed by Milton Friedman, it supposes that a person's consumption at a point in time is determined not just by their current income but also by their expected income in future years—their "permanent income". The Permanent Income Hypothesis is central to understanding the macroeconomic effects of fiscal and monetary policy.

In its simplest form, the hypothesis states that changes in permanent income, rather than changes in temporary income, are what drive the changes in a consumer's consumption patterns. Its predictions of consumption smoothing, where people spread out transitory changes in income over time, depart from the traditional Keynesian emphasis on the marginal propensity to consume. The PIH has had a profound effect on the study of consumer behavior, and provides an explanation for the failure of Keynesian demand management techniques.

The PIH makes a crucial distinction between programs which increase current income with the goal of increasing demand to end a recession. Traditionally, a transfer payment or a tax decrease that increases current income will increase the demand for goods and services because people's income increases. People become richer, they spend more. The PIH implies this is not always true and depends on peoples expectations about whether the transfer payment or tax decrease will be temporary or permanent.

The Marginal Propensity to Consume (MPC) measures how much of the increase in income is spent and how much is saved. A MPC of .5 means a person who receives a $100 transfer payment or a $100 tax reduction will spend $50 and save $50. Only the $50 spent will increase aggregate demand.

The PIH notes that the size of the increase in demand depends on peoples expectations about whether the increased income is temporary or permanent, i.e. MPC is not constant but depends on people's perception of what the government will do in the future. If an increase in income is expected to be a one-time temporary shot of money, MPC will be much lower than if the increase is expected to occur this year and every year in the foreseeable future.

If you buy a winning lottery ticket and get $5000 you will spend a little and save of lot because you know that the $5000 is one shot increase in income. If you get a raise at work that increases your salary by $5000 and you expect to get that higher salary into the foreseeable future, you will spend most of it knowing the increase in income is permanent. MPC for permanent increase in income are much higher than for temporary one time increases in income. The same $5000 increase in current income will have much larger demand effect if it perceived as temporary.

Consider 2 government programs implemented as a result of the pandemic. Assume the pandemic and these 2 programs take affect now.

- 1. A one-time stimulus payment today of $10,000 in response to the virus with no expectation of future payments.

- 2. The institution of an annual child tax credit of $10,000 that a person receives each year for each child until the child reaches age 18.

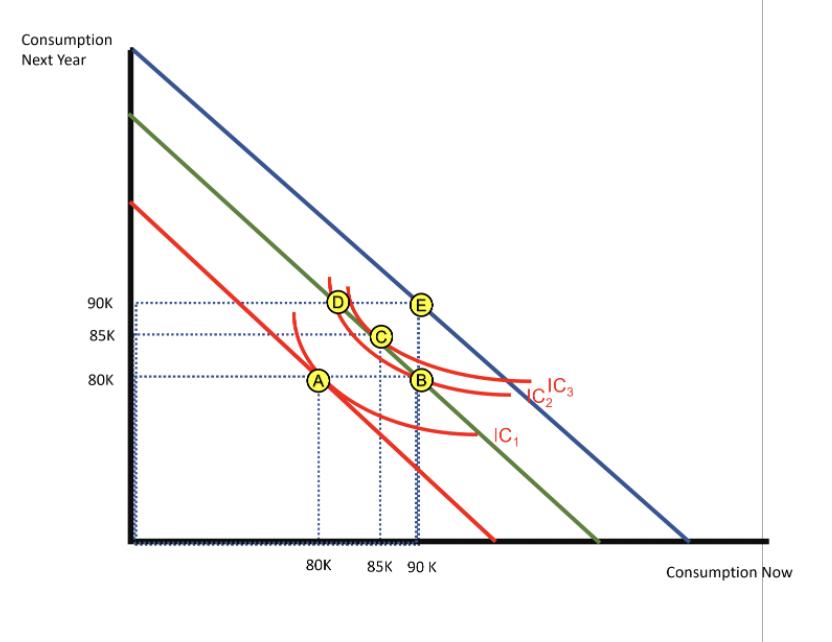

The graph below depicts a person with a permanent income of $80,000, i.e. he earns $80,000 today and expects to earn $80,000 next year.

The pandemic hits but he is able to work from home and his employment is unaffected by the virus.

Do an budget line/indifference curve analysis that compares and contrasts the 2 programs.

Specifically answer the following questions.

- 1. Which point, A-E, does the person start off at before the stimulus payment of the institution of the child tax credit?

- 2. Which point does each program move the person to? Answer for each program independently.

- 3. Which pattern of consumption will the person choose given the Permanent Income Hypothesis? Which point on the graph matches this pattern of consumption? Explain.

- 4. If the goal of the 2 programs is to increase the current demand for goods and services, Aggregate Demand in Macro-speak, to prevent a virus related recession, which program is better? Explain.

Consumption Next Year 90K 85K 80K 80K E B 85K 90 K IC IC3 C2 Consumption Now

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the two government programs and their effects on consumption and demand we will use a budget line and indifference curve analysis Assumptions Permanent income 80000 Price of goods and servi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started