Answered step by step

Verified Expert Solution

Question

1 Approved Answer

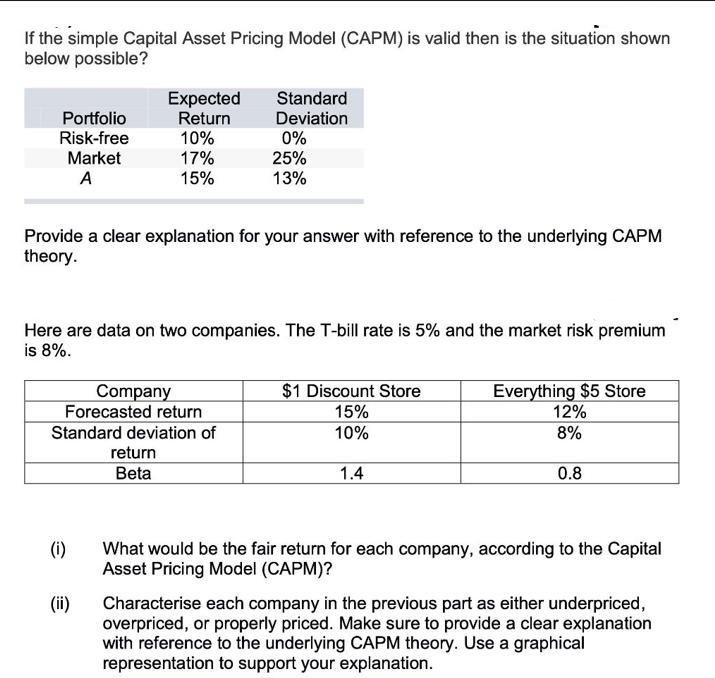

If the simple Capital Asset Pricing Model (CAPM) is valid then is the situation shown below possible? Portfolio Risk-free Market A Expected Return 10%

If the simple Capital Asset Pricing Model (CAPM) is valid then is the situation shown below possible? Portfolio Risk-free Market A Expected Return 10% 17% 15% Provide a clear explanation for your answer with reference to the underlying CAPM theory. Company Forecasted return Standard deviation of (i) Here are data on two companies. The T-bill rate is 5% and the market risk premium is 8%. (ii) Standard Deviation return Beta 0% 25% 13% $1 Discount Store 15% 10% 1.4 Everything $5 Store 12% 8% 0.8 What would be the fair return for each company, according to the Capital Asset Pricing Model (CAPM)? Characterise each company in the previous part as either underpriced, overpriced, or properly priced. Make sure to provide a clear explanation with reference to the underlying CAPM theory. Use a graphical representation to support your explanation.

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Evaluating the Possibility of the Given Situation The Capital Asset Pricing Model CAPM establishes a direct relationship between an assets expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started