Answered step by step

Verified Expert Solution

Question

1 Approved Answer

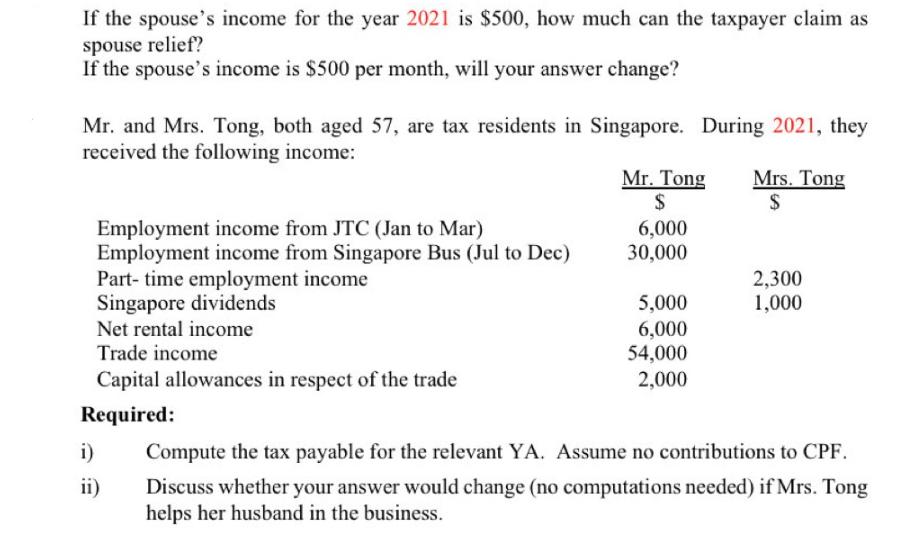

If the spouse's income for the year 2021 is $500, how much can the taxpayer claim as spouse relief? If the spouse's income is

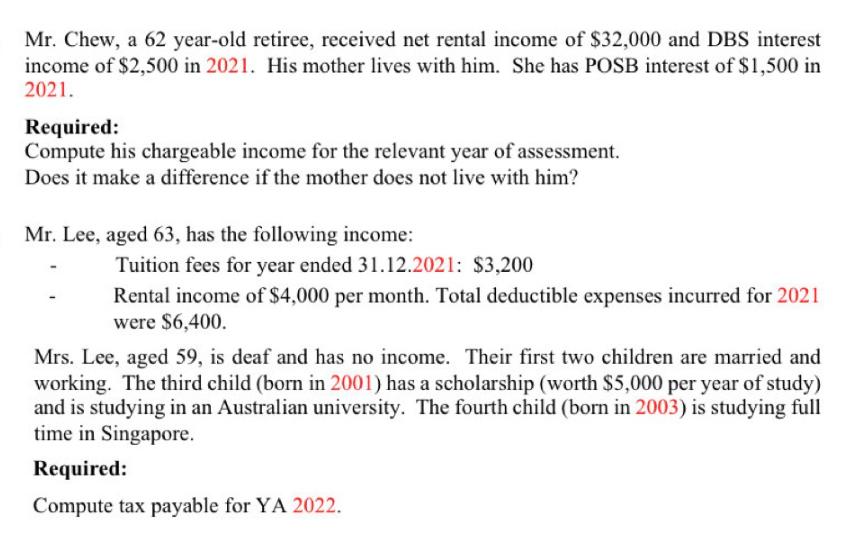

If the spouse's income for the year 2021 is $500, how much can the taxpayer claim as spouse relief? If the spouse's income is $500 per month, will your answer change? Mr. and Mrs. Tong, both aged 57, are tax residents in Singapore. During 2021, they received the following income: Employment income from JTC (Jan to Mar) Employment income from Singapore Bus (Jul to Dec) Part-time employment income Singapore dividends Net rental income Trade income Capital allowances in respect of the trade Required: i) Mr. Tong $ 6,000 30,000 5,000 6,000 54,000 2,000 Mrs. Tong $ 2,300 1,000 Compute the tax payable for the relevant YA. Assume no contributions to CPF. Discuss whether your answer would change (no computations needed) if Mrs. Tong helps her husband in the business. Mr. Chew, a 62 year-old retiree, received net rental income of $32,000 and DBS interest income of $2,500 in 2021. His mother lives with him. She has POSB interest of $1,500 in 2021. Required: Compute his chargeable income for the relevant year of assessment. Does it make a difference if the mother does not live with him? Mr. Lee, aged 63, has the following income: Tuition fees for year ended 31.12.2021: $3,200 Rental income of $4,000 per month. Total deductible expenses incurred for 2021 were $6,400. Mrs. Lee, aged 59, is deaf and has no income. Their first two children are married and working. The third child (born in 2001) has a scholarship (worth $5,000 per year of study) and is studying in an Australian university. The fourth child (born in 2003) is studying full time in Singapore. Required: Compute tax payable for YA 2022.

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To address the taxrelated queries and calculations For the Spouses Income of 500 1 Spouse Relief The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started