Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the stock of Staples is trading at $183 per share and its put option with strike (exercise price) of $185 per share and three

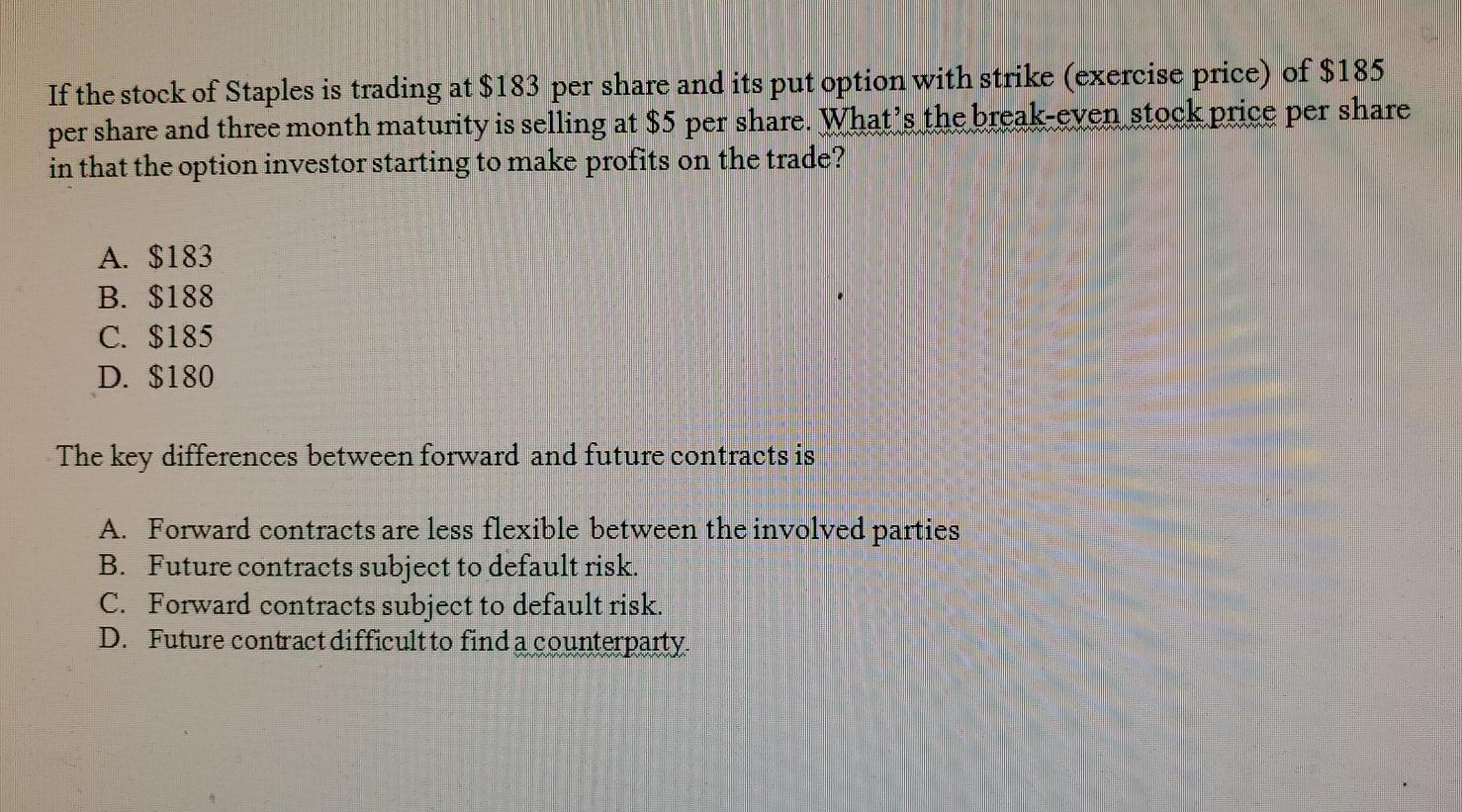

If the stock of Staples is trading at $183 per share and its put option with strike (exercise price) of $185 per share and three month maturity is selling at $5 per share. What's the break-even stock price per share in that the option investor starting to make profits on the trade? A. $183 B. $188 C. $185 D. $180 The key differences between forward and future contracts is A. Forward contracts are less flexible between the involved parties B. Future contracts subject to default risk. C. Forward contracts subject to default risk. D. Future contract difficult to find a counterparty

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started