The two employees of Silver Co. receive various fringe benefits. Silver Co. provides vacation at the rate of $315 per day. Each employee earns

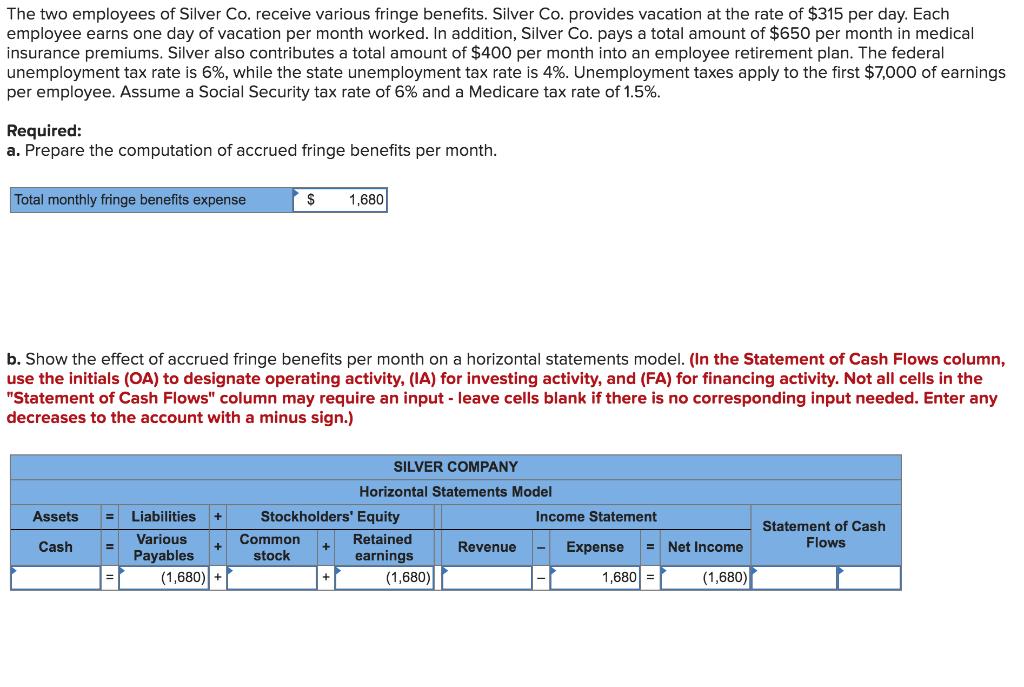

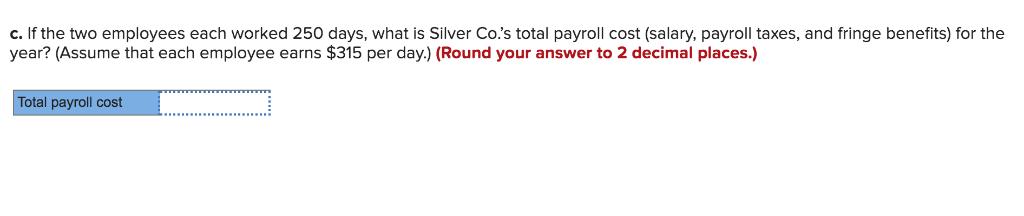

The two employees of Silver Co. receive various fringe benefits. Silver Co. provides vacation at the rate of $315 per day. Each employee earns one day of vacation per month worked. In addition, Silver Co. pays a total amount of $650 per month in medical insurance premiums. Silver also contributes a total amount of $400 per month into an employee retirement plan. The federal unemployment tax rate is 6%, while the state unemployment tax rate is 4%. Unemployment taxes apply to the first $7,000 of earnings per employee. Assume a Social Security tax rate of 6% and a Medicare tax rate of 1.5%. Required: a. Prepare the computation of accrued fringe benefits per month. Total monthly fringe benefits expense 1,680 b. Show the effect of accrued fringe benefits per month on a horizontal statements model. (In the Statement of Cash Flows column, use the initials (OA) to designate operating activity, (IA) for investing activity, and (FA) for financing activity. Not all cells in the "Statement of Cash Flows" column may require an input - leave cells blank if there is no corresponding input needed. Enter any decreases to the account with a minus sign.) SILVER COMPANY Horizontal Statements Model Assets Liabilities Stockholders' Equity Income Statement %3D Statement of Cash Various Common Retained Cash Revenue Expense = Net Income Flows earnings (1,680) Payables stock (1,680) 1,680 = (1,680) c. If the two employees each worked 250 days, what is Silver Co.'s total payroll cost (salary, payroll taxes, and fringe benefits) for the year? (Assume that each employee earns $315 per day.) (Round your answer to 2 decimal places.) Total payroll cost

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started