Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the WACC for Ritter Corp. is 12% and the expected perpetual annual growth rate in cash flow is 3%, estimate the total market value

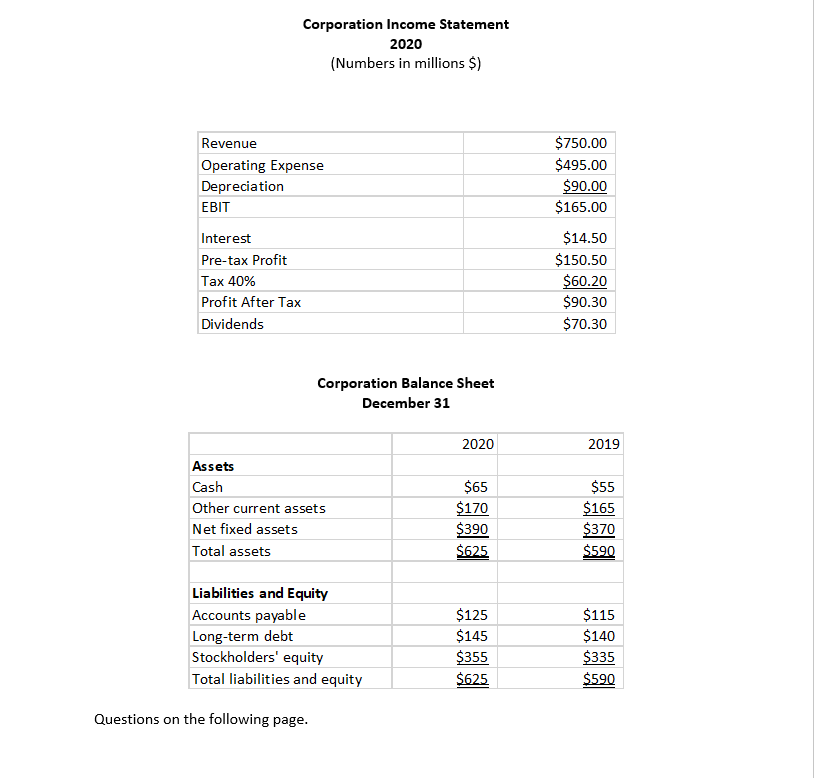

If the WACC for Ritter Corp. is 12% and the expected perpetual annual growth rate in cash flow is 3%, estimate the total market value of the firm at the end of 2020

Corporation Income Statement 2020 (Numbers in millions $) Revenue Operating Expense Depreciation EBIT $750.00 $495.00 $90.00 $165.00 Interest Pre-tax Profit Tax 40% Profit After Tax Dividends $14.50 $150.50 $60.20 $90.30 $70.30 Corporation Balance Sheet December 31 2020 2019 Assets Cash Other current assets Net fixed assets Total assets $65 $170 $390 $625 $55 $165 $370 $590 Liabilities and Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and equity $125 $145 $355 $625 $115 $140 $335 $590 Questions on the following pageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started