If there are 5 boxes for the account titles to go into, like for question b) and c) please use 5 account titles to answer the question I have included a screenshot of all of the possible title names that I can use

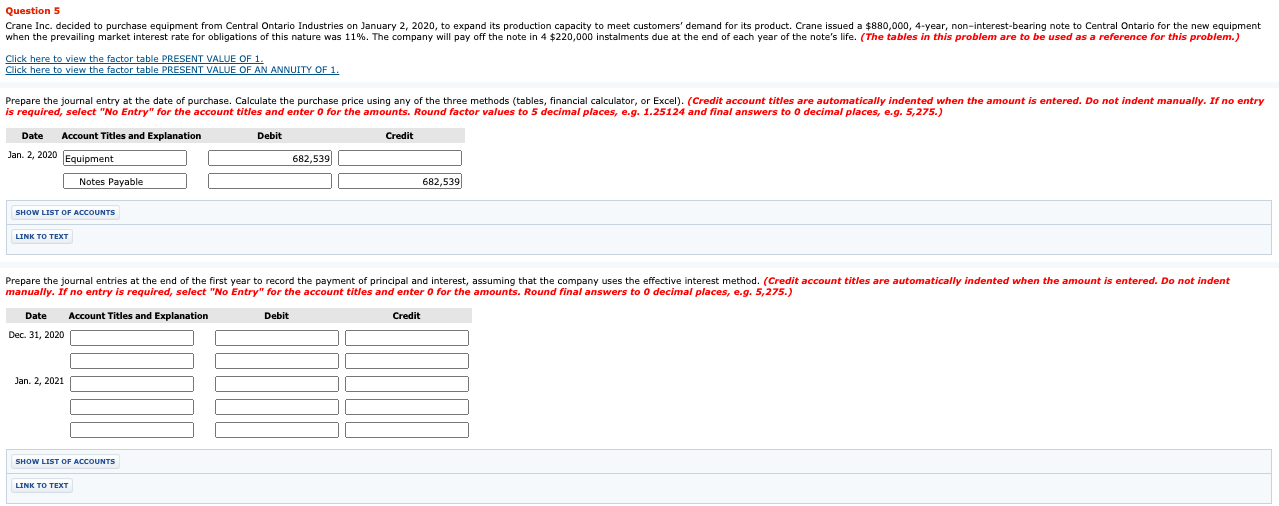

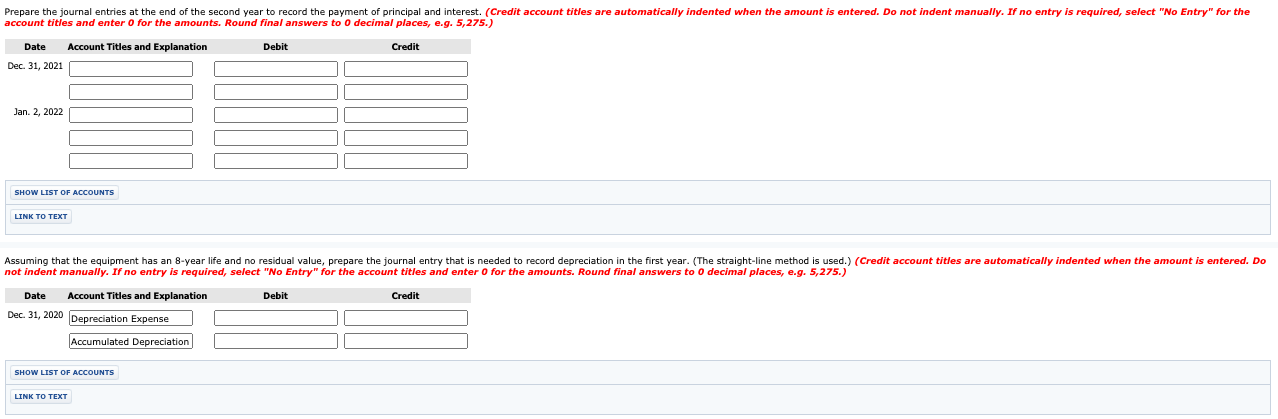

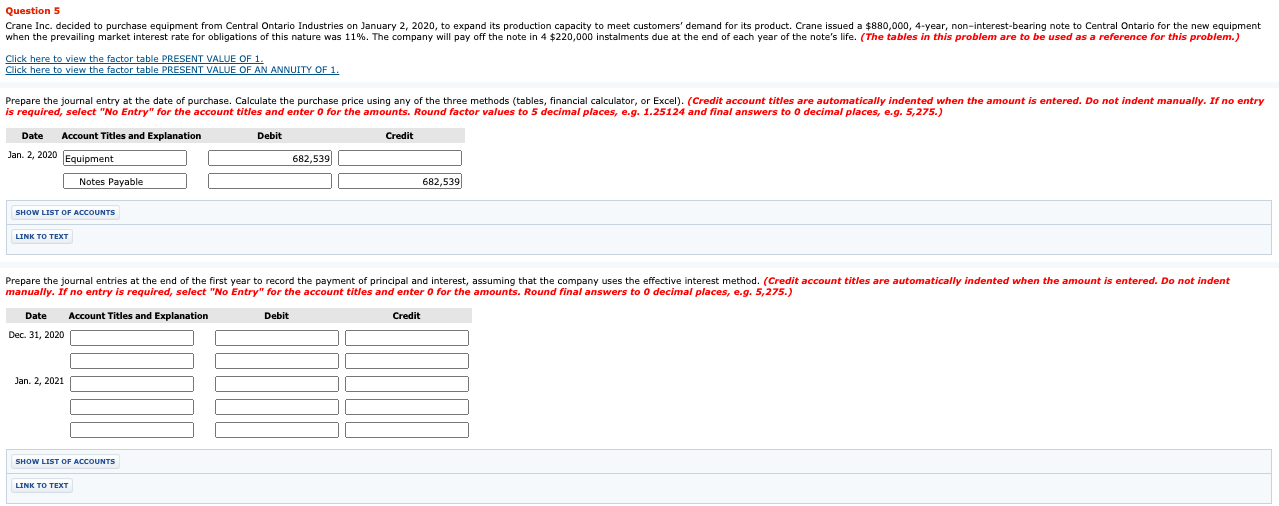

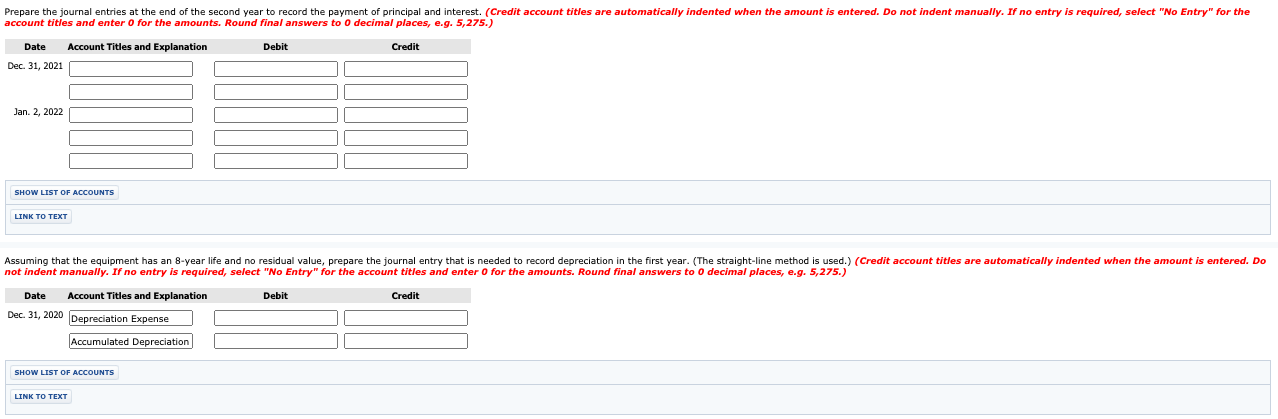

Question 5 Crane Inc. decided to purchase equipment from Central Ontario Industries on January 2, 2020, to expand its production capacity to meet customers' demand for its product. Crane issued a $880,000, 4-year, non-interest-bearing note to Central Ontario for the new equipment when the prevailing market interest rate for obligations of this nature was 11%. The company will pay off the note in 4 $220,000 instalments due at the end of each year of the note's life. (The tables in this problem are to be used as a reference for this problem.) Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. entered. Do not indent manually. If no entry Prepare the journal entry at the date of purchase. Calculate the purchase price using any of the three methods (tables, financial calculator, or Excel). (Credit account titles are automatically indented when the amount is required, select "No Entry" for the account titles and enter o for the amounts. Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275.) Debit Credit Date Account Titles and Explanation Jan. 2, 2020 Equipment Notes Payable 682.5391 682,539 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the journal entries at the end of the first year to record the payment of principal and interest, assuming that the company uses the effective interest method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round final answers to o decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Dec 31, 2020 Jan. 2, 2021 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the journal entries at the end of the second year to record the payment of principal and interest. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round final answers to O decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Dec 31, 2021 Jan. 2, 2022 SHOW LIST OF ACCOUNTS LINK TO TEXT Assuming that the equipment has an 8-year life and no residual value, prepare the journal entry that is needed to record depreciation in the first year. (The straight-line method is used.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round final answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Dec 31, 2020 Depreciation Expense Accumulated Depreciation SHOW LIST OF ACCOUNTS LINK TO TEXT Question 5 Accounts Payable Accounts Receivable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Leasehold Improvements Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Advertising Expense Asset Retirement Obligation Buildings Cash Common Shares Contributed Surplus Contributed Surplus - Donated Capital Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Donation Revenue Equipment Finance Expense Finance Revenue Gain or Loss in Value of Investment Property Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Machinery Gain on Disposal of Vehicles GST Payable GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Inventory Investment Property Land Land Improvements Loss on Disposal of Building Loss on Disposal of Equipment Loss on Disposal of Land Loss on Disposal of Machinery Loss on Disposal of Vehicles Machinery Repairs and Maintenance Expense Mineral Resources Mortgage Payable No Entry Notes Payable Notes Receivable Office Expense Owner's Drawings Prepaid Expenses Prepaid Insurance Profit on Construction Purchase Discounts Purchase Returns and Allowances Rent Expense Revaluation Gain or Loss Revaluation Surplus (OCI) Revenue - Government Grants Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Service Revenue Supplies Supplies Expense Tenant Deposits Liability Vehicles