Answered step by step

Verified Expert Solution

Question

1 Approved Answer

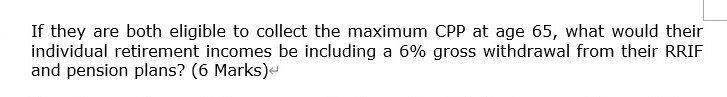

If they are both eligible to collect the maximum CPP at age 65, what would their individual retirement incomes be including a 6% gross

If they are both eligible to collect the maximum CPP at age 65, what would their individual retirement incomes be including a 6% gross withdrawal from their RRIF and pension plans? (6 Marks) Ron and Janice Mawson are now both 55 years old but Ron was disabled for eight years which resulted in excess medical costs so they had to refinance the house. The current mortgage is $150,000 and the house has a market value of $800,000. They also have two children aged 12 and 14 and they continue to work in their current positions. < They currently have no liabilities other than the mortgage and they continue to invest in their RRSPs on a monthly basis. Ron has grown his RRSP to $300,000 and Janice has $350,000 in her RRSP. They each contribute $800 per month to these plans and will continue to do so until their planned retirement at age 65. These registered plans are currently invested 30% income and 70% equity. < < Both Ron and Janice also have a defined benefit pension plan with their employer's which will pay 1.5% of their final salaries times their years of service. Ron and Janice will have final salaries of $125,000 and $80,000 respectively. Their years of service are 25 years for Ron and 30 years for Janice. < In addition, Janice has a non-registered portfolio worth $100,000 which is allocated 50% preferred dividend funds and 50% capital growth equity funds. This non registered fund currently has an unrealized capital gain of $30,000. She expects this fund to continue to grow by 8% per year with all of the growth relating to capital gains. Ron also has $80,000 invested in Canada Savings Bonds that are earning 3% interest and he plans on holding these bonds until retirement. Their house is held in joint tenancy and they have designated each other as beneficiary on their RRSP and Pension Plans. The non-registered accounts are held in their individual names and do not have beneficiary designations or rights of survivorship.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided here is a summary of Ron and Janice Mawsons financial situation 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started