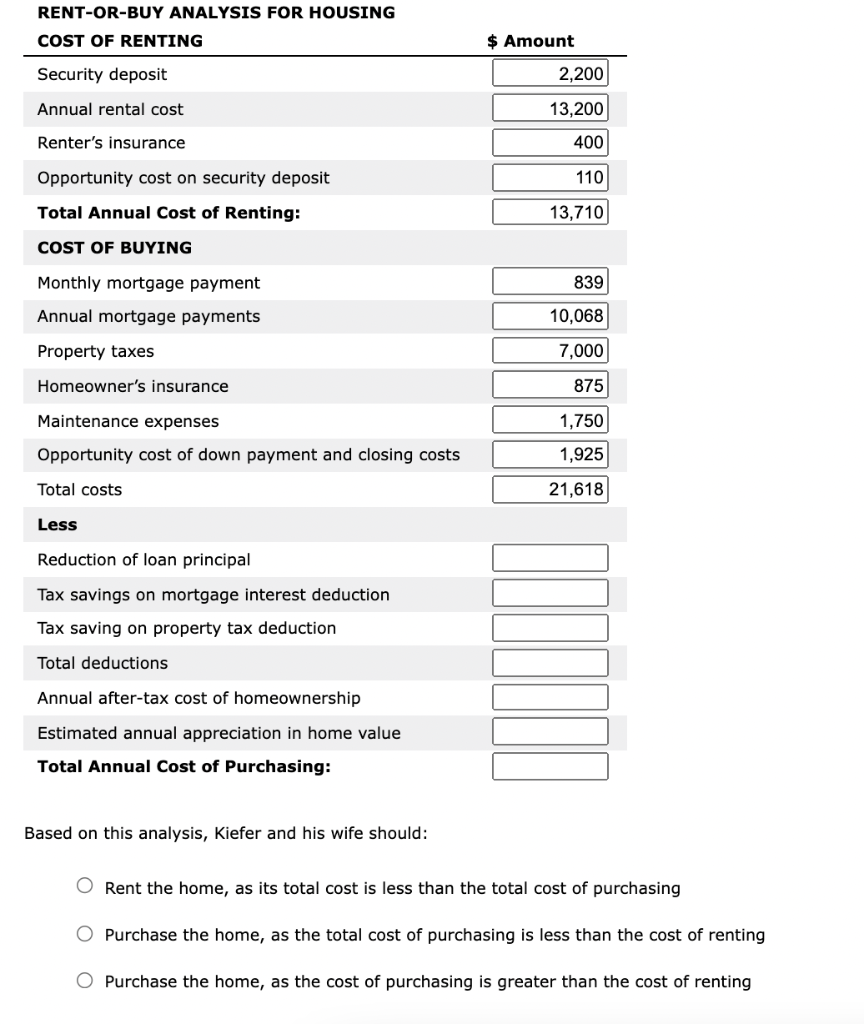

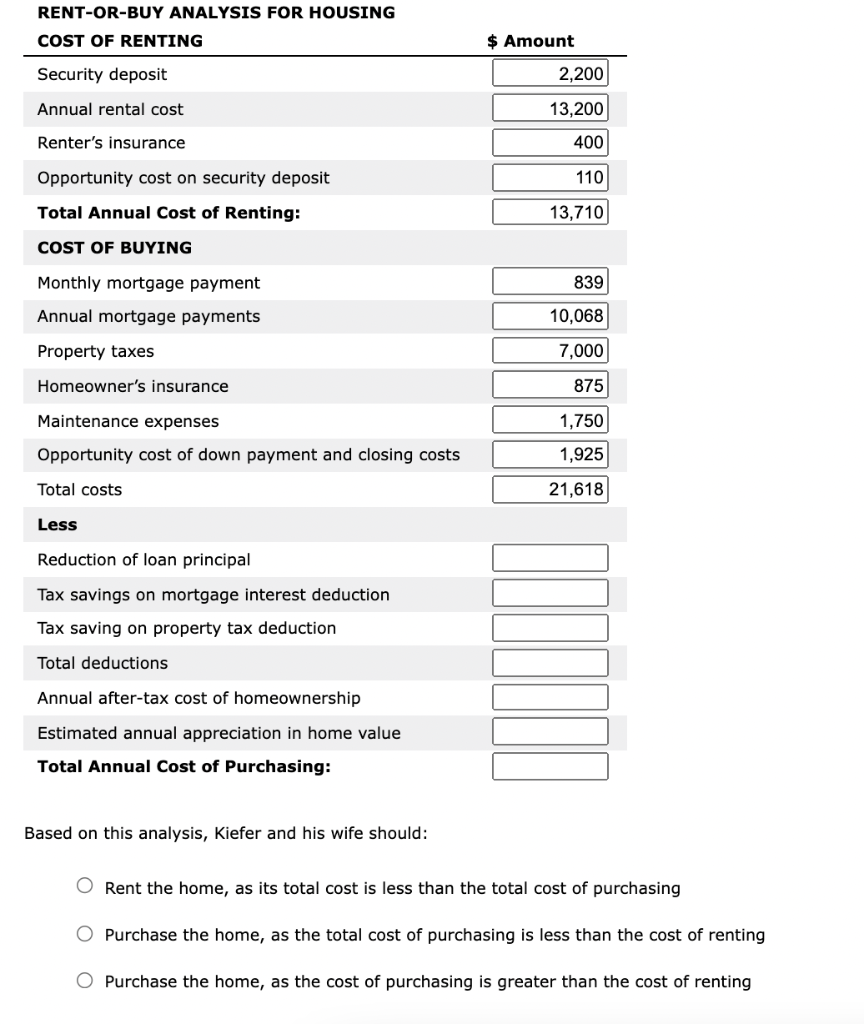

If they rent, the builder will require monthly rental payments of $1,100 and a security deposit equal to two months of rent. Since they want to be protected against the possible loss of their possessions, they will purchase a renters' policy of $200 every six months, while a more comprehensive homeowners' policy will cost 0.5% of the home's value per year. Money used to fund the unit's security deposit could otherwise be invested to earn 5% per year after taxes. Funds expended for a home's down payment and closing costs also incur an opportunity cost. If the unit is purchased, it will cost $175,000 and will require a 20% down payment. The loan will carry an interest rate of 6%, a term of 30 years, and monthly payments of $839. The closing costs associated with the unit's mortgage will be $3,500. The property taxes and the maintenance and repair expenses on the unit are estimated to be 4% and 1% of the unit's total price, respectively. Your ordinary income is taxed at the rate of 28%, and you'll be willing to itemize your tax deductions in the event that you purchase your new home. Financial publications report that home values are expected to increase by 3% this year due to inflation. Complete a rent-or-buy analysis worksheet to determine the total cost of renting and the total cost of purchasing Kiefer and his wife's prospective house and then recommend their best strategy. To complete the worksheet, enter the appropriate values in their corresponding blanks and round each value to the nearest whole dollar. RENT-OR-BUY ANALYSIS FOR HOUSING COST OF RENTING $ Amount Security deposit 2,200 Annual rental cost 13,200 Renter's insurance 400 Opportunity cost on security deposit 110 Total Annual Cost of Renting: 13,710 COST OF BUYING Monthly mortgage payment 839 Annual mortgage payments 10,068 Property taxes 7,000 Homeowner's insurance 875 Maintenance expenses 1,750 Opportunity cost of down payment and closing costs 1,925 Total costs 21,618 Less Reduction of loan principal Tax savings on mortgage interest deduction Tax saving on property tax deduction Total deductions Annual after-tax cost of homeownership Estimated annual appreciation in home value Total Annual Cost of Purchasing: Based on this analysis, Kiefer and his wife should: O Rent the home, as its total cost is less than the total cost of purchasing O Purchase the home, as the total cost of purchasing is less than the cost of renting O Purchase the home, as the cost of purchasing is greater than the cost of renting