Question

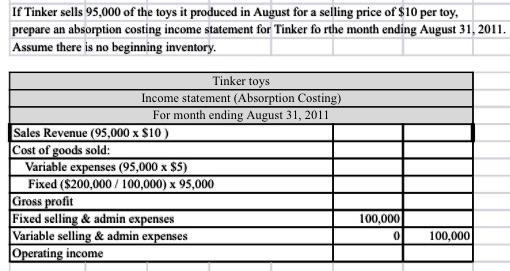

If Tinker sells 95,000 of the toys it produced in August for a selling price of $10 per toy, prepare an absorption costing income

If Tinker sells 95,000 of the toys it produced in August for a selling price of $10 per toy, prepare an absorption costing income statement for Tinker forthe month ending August 31, 2011. Assume there is no beginning inventory. Tinker toys Income statement (Absorption Costing) For month ending August 31, 2011 Sales Revenue (95,000 x $10) Cost of goods sold: Variable expenses (95,000 x $5) Fixed ($200,000/100,000) x 95,000 Gross profit Fixed selling & admin expenses Variable selling & admin expenses Operating income 100,000 0 100,000

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Heres the absorption costing income statement for Tinker for the month ending August 31 2011 Tinker ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management Measuring Monitoring And Motivating Performance

Authors: Leslie G. Eldenburg, Susan Wolcott, Liang Hsuan Chen, Gail Cook

2nd Canadian Edition

1118168879, 9781118168875

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App