Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If u don't know this.. Pls don't try it I have exam tomorrow A Dealer quotes All-in-Cost for a generic swap at 8% against six

If u don't know this.. Pls don't try it I have exam tomorrow

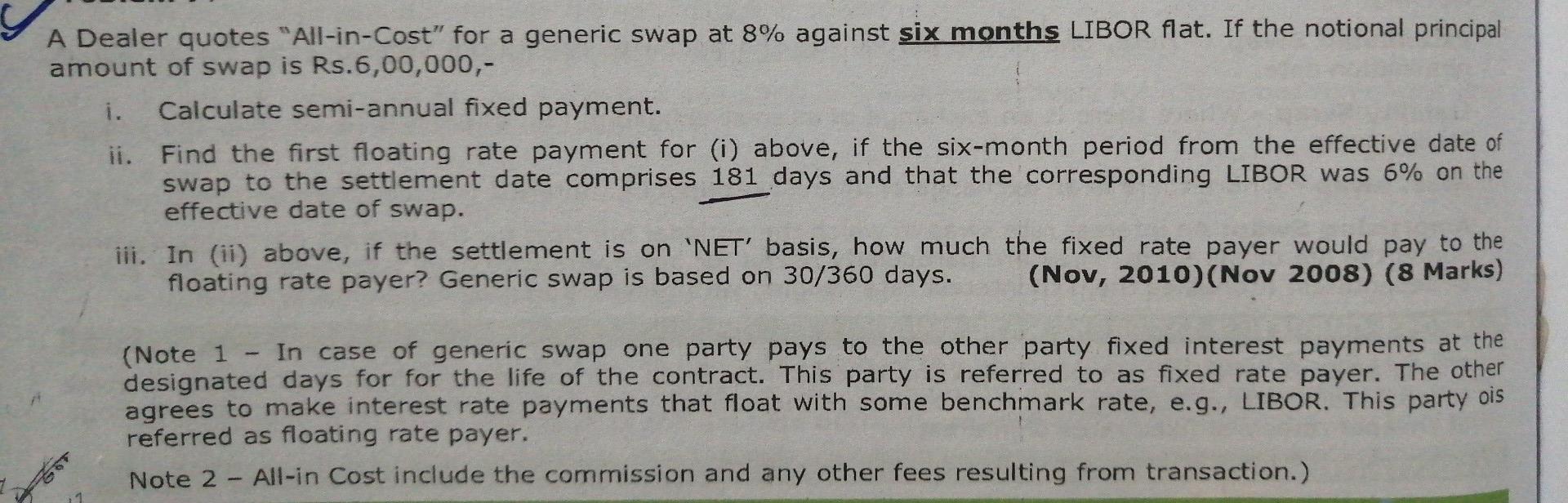

A Dealer quotes "All-in-Cost" for a generic swap at 8% against six months LIBOR flat. If the notional principal amount of swap is Rs.6,00,000,- i. Calculate semi-annual fixed payment. ii. Find the first floating rate payment for (i) above, if the six-month period from the effective date of swap to the settlement date comprises 181 days and that the corresponding LIBOR was 6% on the effective date of swap. iii. In (ii) above, if the settlement is on 'NET' basis, how much the fixed rate payer would pay to the floating rate payer? Generic swap is based on 30/360 days. (Nov, 2010) (Nov 2008) (8 Marks) (Note 1 In case of generic swap one party pays to the other party fixed interest payments at the designated days for for the life of the contract. This party is referred to as fixed rate payer. The other agrees to make interest rate payments that float with some benchmark rate, e.g., LIBOR. This party ois referred as floating rate payer. Note 2 - All-in Cost include the commission and any other fees resulting from transaction.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started