Answered step by step

Verified Expert Solution

Question

1 Approved Answer

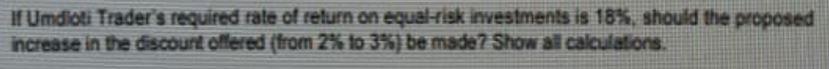

If Umdioti Trader's required rate of return on equal-risk investments is 18%, should the proposed increase in the discount offered (from 2% to 3%)

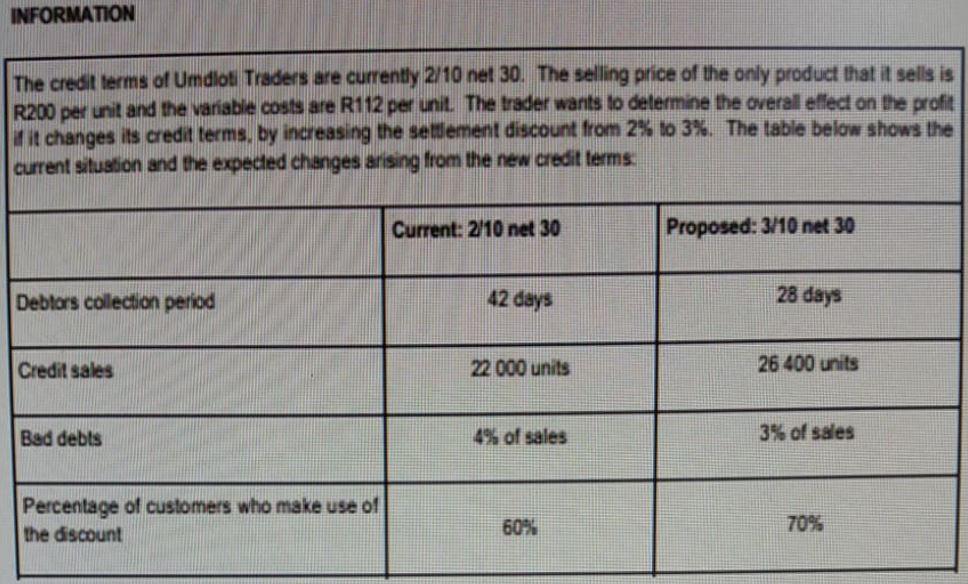

If Umdioti Trader's required rate of return on equal-risk investments is 18%, should the proposed increase in the discount offered (from 2% to 3%) be made? Show all calculations. INFORMATION The credit terms of Umdloti Traders are currently 2/10 net 30. The selling price of the only product that it sells is R200 per unit and the variable costs are R112 per unit. The trader wants to determine the overall effect on the profit if it changes its credit terms, by increasing the settlement discount from 2% to 3%. The table below shows the current situation and the expected changes arising from the new credit terms: Debtors collection period Credit sales Bad debts Percentage of customers who make use of the discount Current: 2/10 net 30 42 days 22 000 units 4% of sales 60% Proposed: 3/10 net 30 28 days 26 400 units 3% of sales 70%

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution A The Additional Profit Contribution from Additional Sales 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started